- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Should You Consider Cognex After Its 28% Jump and Industry AI Demand?

Reviewed by Bailey Pemberton

So, you’re looking at Cognex stock and wondering whether this is the right moment to jump in, hold, or move on. It’s understandable, given a year-to-date climb of 28.3% and a solid 1-year return of 15.0%. Cognex has definitely gotten investors’ attention recently. Even a slight dip this past week of -2.1% hasn't erased the positive momentum built over the past several months, especially as the market continues to reward technology and automation players like Cognex for staying ahead in rapidly changing industries.

Of course, not every story is one of uninterrupted growth. Zooming out, the 5-year return is still in negative territory at -29.4%, a reminder that volatility and shifting market sentiment have been in play. Some of these long-term moves reflect larger developments in industrial automation and the broader tech sector, which can quickly shift investor perceptions of risk and reward for stocks like Cognex.

But let’s get to the numbers that matter. Is Cognex objectively undervalued at current prices? According to a classic six-point valuation test, Cognex currently scores 0 out of 6, which means it doesn't look undervalued by any major metric based on widely used methods. Does that mean the investment case is closed? Not so fast. Let’s walk through the major valuation approaches in detail. Later, we’ll also cover a more nuanced way of thinking about Cognex’s value that you won’t want to miss.

Cognex scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cognex Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its expected future free cash flows and discounting them back to today’s dollar value. For Cognex, this approach is based on the most recent free cash flow figure, ongoing analyst projections, and extrapolations for the future.

Cognex’s latest reported Free Cash Flow stands at $172.9 Million. Analysts offer forecasts up to five years out, with 2028 projected FCF at $331 Million. After that, Simply Wall St extends these estimates out to 2035 using moderating growth rates. The model used here is a two-stage Free Cash Flow to Equity approach. Initial analyst estimates set the foundation, and longer-term growth is extrapolated from those figures.

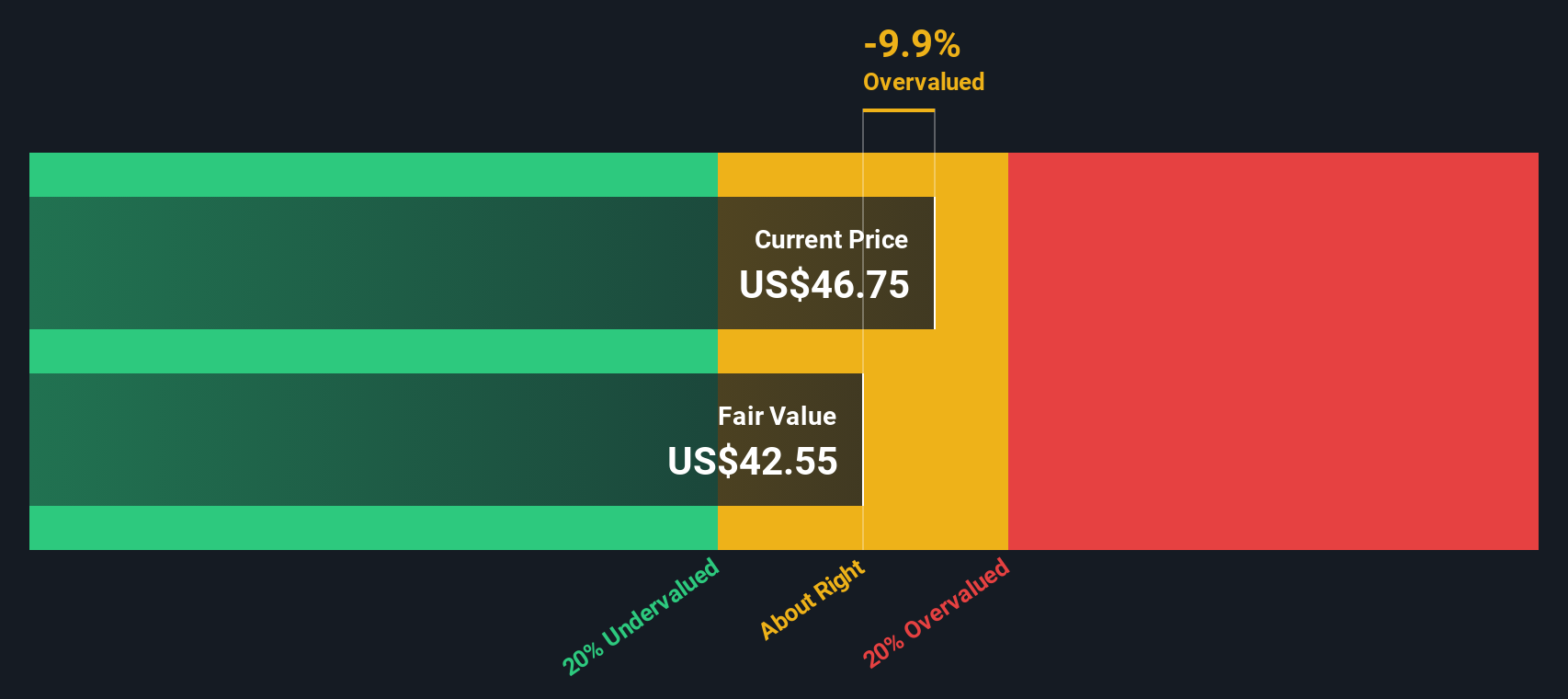

According to the DCF model, Cognex’s fair value is calculated at $42.53 per share. With an implied discount of 7.7%, the stock is currently trading slightly above this estimated intrinsic value, suggesting it may be somewhat overvalued but still within a reasonable range.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Cognex's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Cognex Price vs Earnings (PE Multiple)

The Price-to-Earnings, or PE, ratio is a popular way to value profitable companies because it directly ties a company’s price to its bottom-line earnings. For investors, the PE ratio offers a quick snapshot of how much the market is willing to pay for each dollar of earnings, making it a widely used benchmark for valuing tech firms like Cognex.

It’s important to remember that a “normal” or “fair” PE ratio isn’t the same for every company. High-growth companies tend to deserve a higher PE because future earnings are expected to be much bigger, while riskier or slower-growing companies see lower ratios.

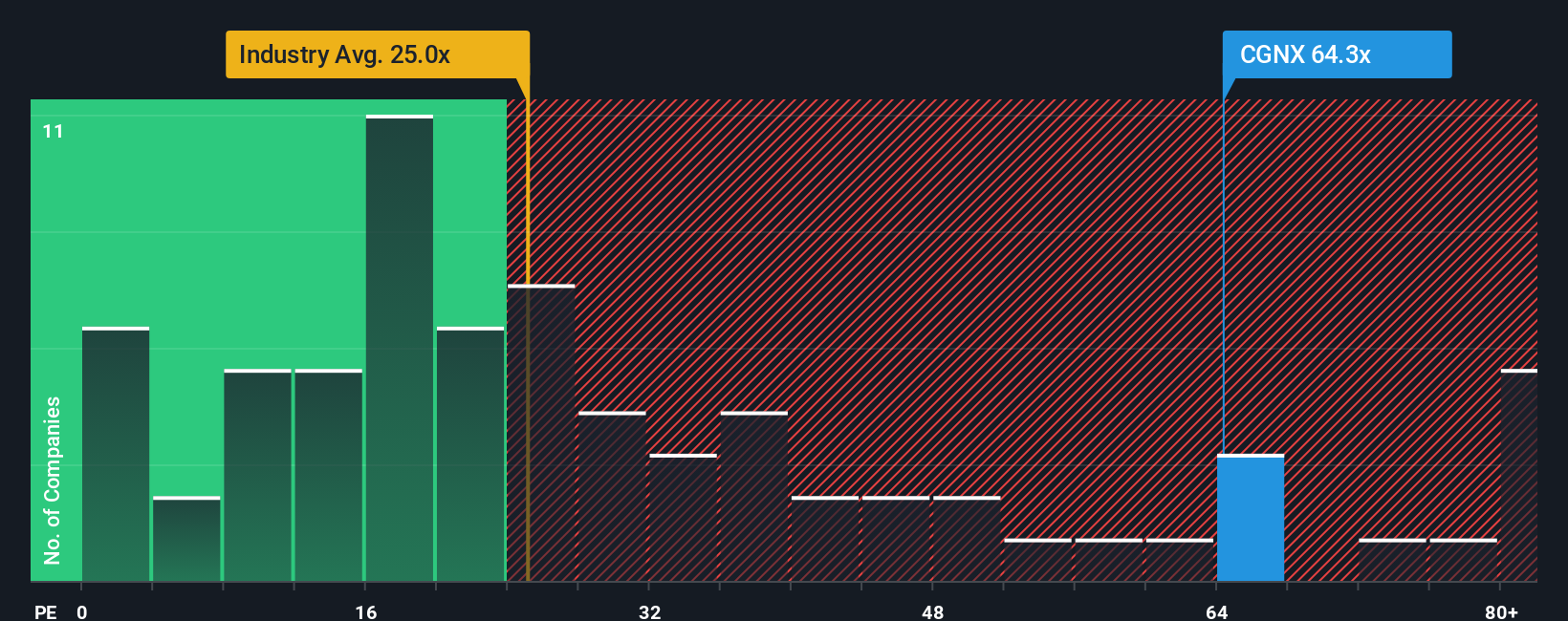

Right now, Cognex trades at 63x earnings. For context, this is significantly higher than the Electronic industry average of 26.1x as well as the peer average of 34.6x. At first glance, this might seem expensive. However, there is more to the story.

This is where Simply Wall St’s Fair Ratio comes in. Rather than just comparing Cognex with its industry or peers, the Fair Ratio aims to estimate what PE ratio Cognex should have given its earnings growth prospects, profit margins, industry, market cap, and risk profile. In this case, Cognex’s Fair Ratio is 33.7x, which is less than its current PE of 63x. That gap suggests the stock is trading notably above where a balanced valuation would place it.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cognex Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal, story-driven viewpoint about a company. It connects the “why” behind the numbers, letting you outline your expectations for Cognex’s future (like revenue, profit margins, product innovation, or emerging risks) and see how those assumptions translate into a fair value.

Narratives help bridge the gap between the facts and your perspective, linking what you believe about Cognex’s business. For instance, consider the impact of AI vision solutions or market reach and how these factors relate to a dynamic financial forecast and a calculated fair value. On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive tool to test their ideas and compare them with others.

Narratives make investing decisions easier because they update automatically with new news or earnings, helping you understand in real time whether the fair value (as you see it) is higher or lower than today’s share price. This enables you to decide if you would buy, hold, or sell.

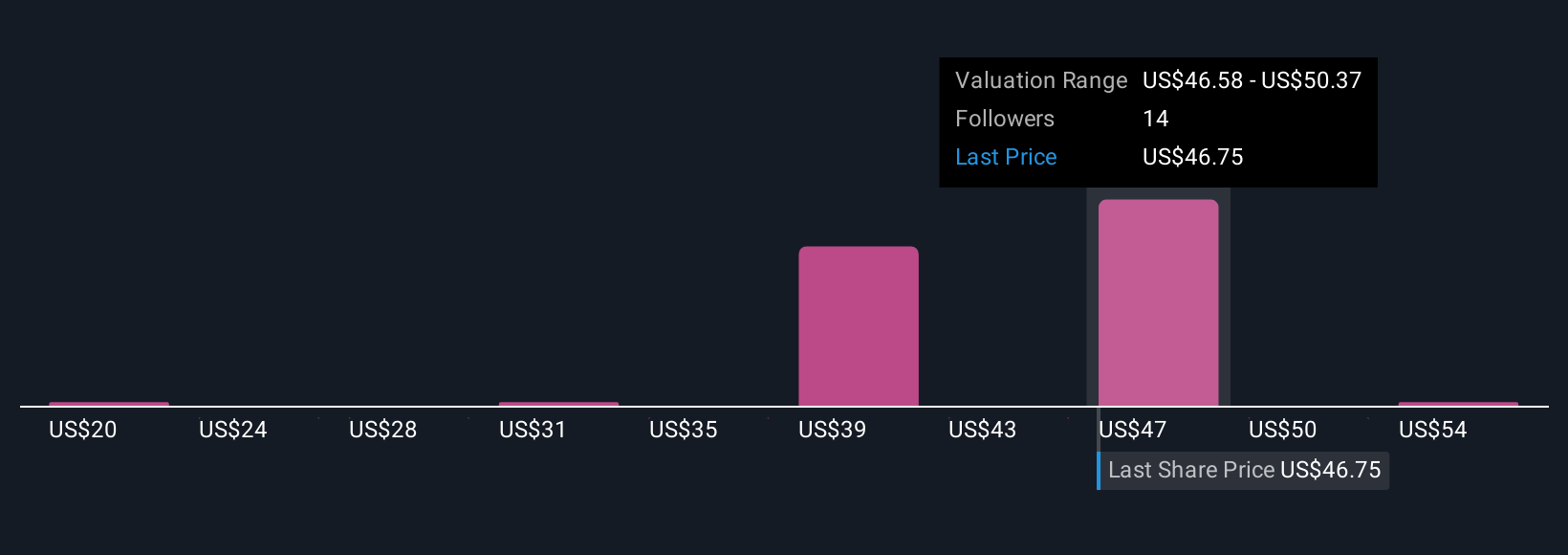

For example, bullish investors may see Cognex’s fair value at $58 per share based on robust AI-driven revenue growth, while more cautious users might value it at $35 per share due to margin pressure or industry risks.

Do you think there's more to the story for Cognex? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives