- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Should Shareholders Reconsider Cognex Corporation's (NASDAQ:CGNX) CEO Compensation Package?

Key Insights

- Cognex to hold its Annual General Meeting on 30th of April

- Salary of US$681.2k is part of CEO Rob Willett's total remuneration

- The total compensation is similar to the average for the industry

- Cognex's three-year loss to shareholders was 64% while its EPS was down 27% over the past three years

Shareholders will probably not be too impressed with the underwhelming results at Cognex Corporation (NASDAQ:CGNX) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 30th of April. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Cognex

How Does Total Compensation For Rob Willett Compare With Other Companies In The Industry?

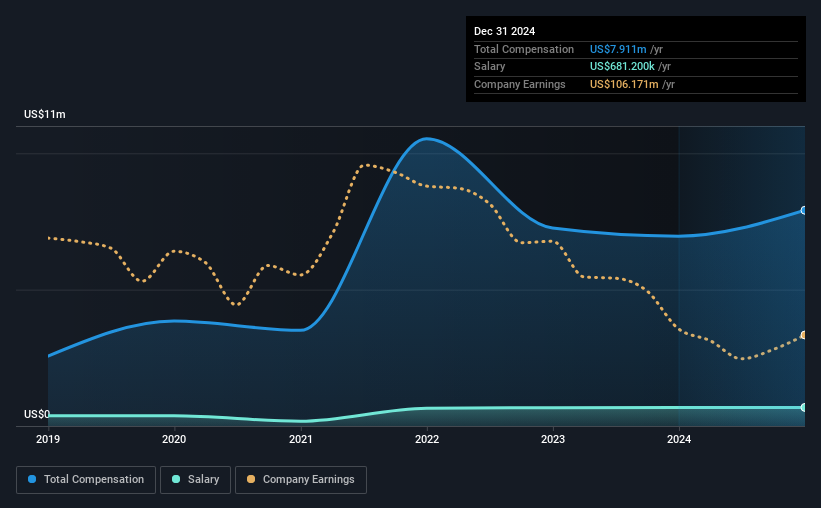

Our data indicates that Cognex Corporation has a market capitalization of US$4.1b, and total annual CEO compensation was reported as US$7.9m for the year to December 2024. That's a notable increase of 14% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$681k.

On comparing similar companies from the American Electronic industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$8.3m. From this we gather that Rob Willett is paid around the median for CEOs in the industry. Furthermore, Rob Willett directly owns US$382k worth of shares in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$681k | US$676k | 9% |

| Other | US$7.2m | US$6.3m | 91% |

| Total Compensation | US$7.9m | US$7.0m | 100% |

Talking in terms of the industry, salary represented approximately 23% of total compensation out of all the companies we analyzed, while other remuneration made up 77% of the pie. Cognex pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Cognex Corporation's Growth Numbers

Over the last three years, Cognex Corporation has shrunk its earnings per share by 27% per year. Its revenue is up 9.2% over the last year.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Cognex Corporation Been A Good Investment?

Few Cognex Corporation shareholders would feel satisfied with the return of -64% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

Whatever your view on compensation, you might want to check if insiders are buying or selling Cognex shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion