- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Cognex (CGNX): Rethinking Valuation After Goldman’s Rare Double Upgrade From Sell Directly to Buy

Reviewed by Simply Wall St

Cognex (CGNX) grabbed attention after Goldman Sachs issued a rare double upgrade, shifting its rating straight from Sell to Buy and sending the stock up about 5% in afternoon trading.

See our latest analysis for Cognex.

The 5.83% 1 day share price return to $36.83 stands out against a still cautious backdrop, with the 90 day share price return of minus 16.45% and 5 year total shareholder return of minus 52.82% suggesting sentiment may only just be turning.

If Cognex’s move has you rethinking opportunities in industrial tech, it might be worth scanning other high growth tech and automation names via high growth tech and AI stocks.

With earnings and revenue back on a growth path, a sizable discount to analyst targets, and a long term share price slide, is Cognex now a mispriced automation winner, or is the recent upgrade already baking in the next leg of growth?

Most Popular Narrative Narrative: 23.9% Undervalued

With Cognex closing at $36.83 versus a narrative fair value in the high $40s, the story frames today’s price as a sizable discount, hinged on sharp earnings expansion.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $241.2 million, and it would be trading on a PE ratio of 38.0x, assuming you use a discount rate of 8.2 percent.

Curious what justifies paying a premium style multiple for an industrial name, even after a pullback in the fair value estimate, while growth assumptions remain punchy and margins step up meaningfully? Dive into the narrative to see which specific revenue and profit milestones are doing the heavy lifting in this valuation roadmap.

Result: Fair Value of $48.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in commoditizing vision hardware and slower than hoped adoption of cloud based AI software could quickly undermine the bullish margin thesis.

Find out about the key risks to this Cognex narrative.

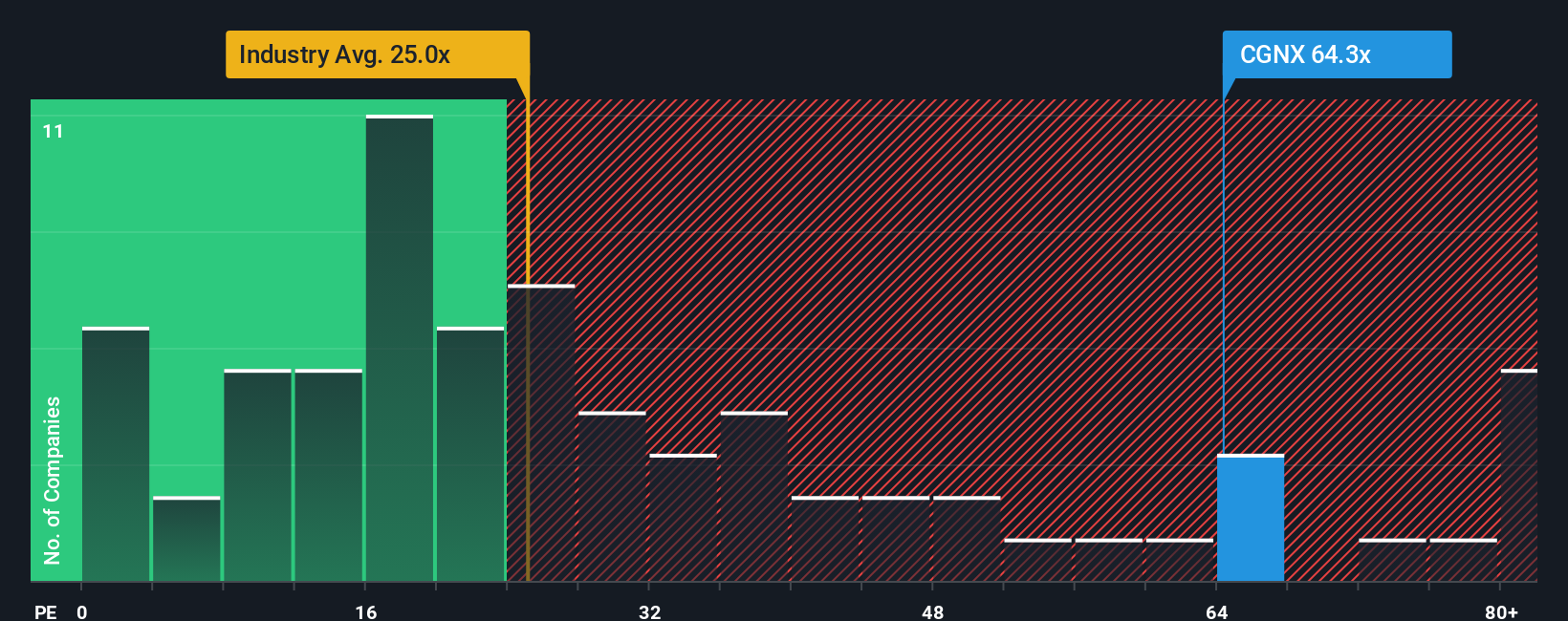

Another View, Earnings Multiple Sends a Different Signal

While the narrative fair value and our models point to Cognex trading at a discount, its current price to earnings ratio of 56x looks stretched versus a fair ratio of 31.8x, a 24.7x industry average and 43.9x for peers, raising real questions about valuation risk if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognex Narrative

If you see the outlook differently or want to test your own assumptions against the numbers, you can build a customized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cognex.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St Screener to spot fresh ideas that fit your strategy before the crowd catches on.

- Capture growth potential by scanning these 25 AI penny stocks that sit at the crossroads of automation, data and next generation software.

- Seek quality income opportunities with these 13 dividend stocks with yields > 3% that can help steady your portfolio through shifting markets.

- Explore emerging themes by reviewing these 80 cryptocurrency and blockchain stocks shaping the evolution of digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)