- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Cognex (CGNX): Exploring Valuation After Analyst Upgrades Spark Fresh Investor Attention

Reviewed by Kshitija Bhandaru

Cognex (CGNX) shares caught investors’ attention following an upgrade to Zacks Rank #2, which points to improving earnings estimates. Bernstein also maintained its buy rating, which signals consistent support from institutional analysts.

See our latest analysis for Cognex.

Buoyed by improved analyst sentiment and stable earnings forecasts, Cognex’s share price has picked up momentum lately, closing at $45.64 after a steady run. While its one-year total shareholder return sits just above flat, recent positive shifts in analyst outlook suggest the potential for renewed growth in the future.

If this pickup in analyst confidence has you searching for other intriguing opportunities, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares rallying alongside analyst enthusiasm, the key question is whether Cognex is trading at a bargain today or if the recent optimism means markets are already factoring in all future growth potential.

Most Popular Narrative: 3.3% Undervalued

With Cognex's fair value narrative set at $47.21 and the last close at $45.64, the market appears to be leaving a small margin for future upside. Investor focus is now centering on the critical drivers within this narrative, with much hinging on potential revenue expansion and operating leverage.

Accelerating adoption of AI-powered vision solutions (as seen with OneVision and the shift to cloud-based, scalable deployment) positions Cognex to upsell higher-value systems and increase average selling prices. This supports higher revenue and gross margin expansion.

Want to know what financial leap justifies this edge? The secret lies in bold forecasts for profit growth, next-generation tech, and a valuation outlook that defies industry norms. Curious to see what metrics set Cognex apart? Dive into the full narrative and uncover the numbers and assumptions powering this premium fair value.

Result: Fair Value of $47.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as ongoing price pressures from intense global competition and uncertainty around the adoption speed of Cognex’s next-generation AI software.

Find out about the key risks to this Cognex narrative.

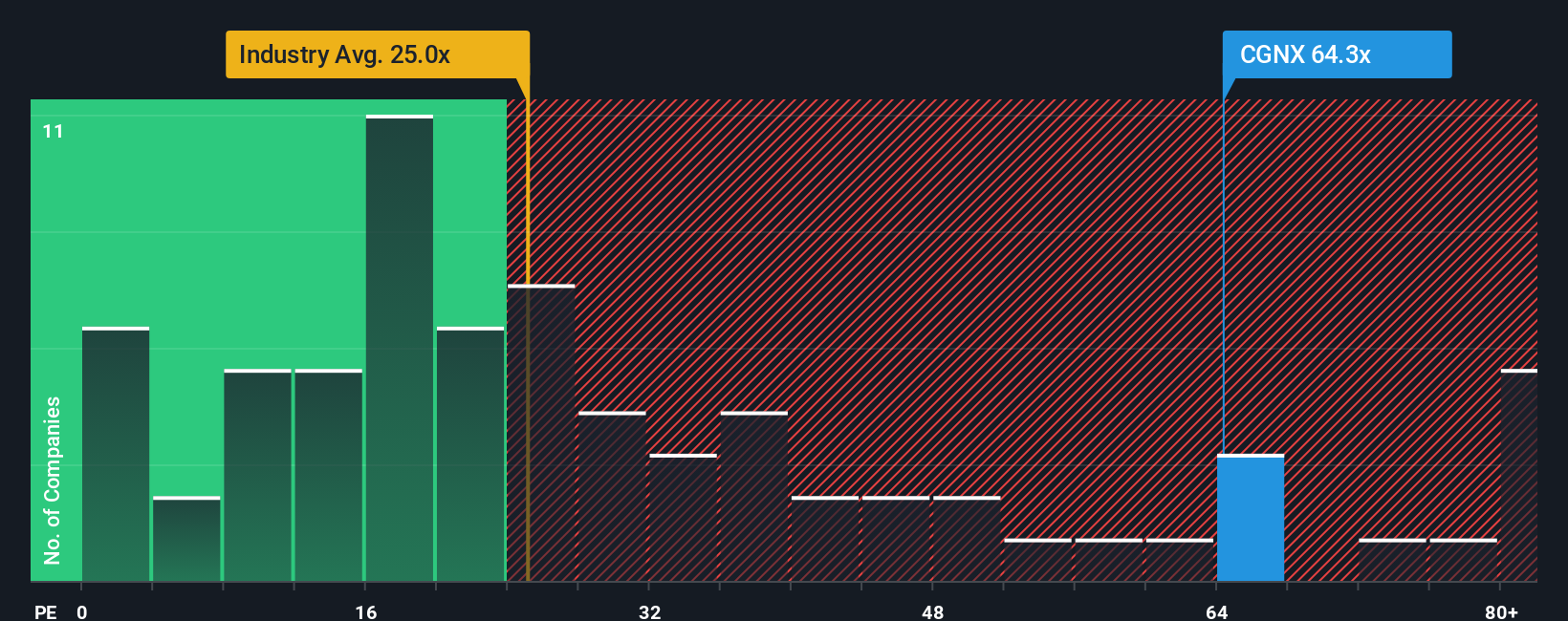

Another View: Price Ratios Flash a Warning

While analyst narratives suggest upside, the company's price-to-earnings ratio stands at 62.8x. This is much higher than both the peer average of 33.1x and the US Electronic industry at 24.3x. It is also well above the fair ratio of 33.4x, highlighting a significant valuation premium. Could this lofty multiple expose investors to more risk than they realize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognex Narrative

If you think the story looks different through your lens, take a few minutes to dig into the numbers and craft your own perspective. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cognex.

Looking for more investment ideas?

Expand your portfolio’s potential by acting now, not later. The Simply Wall Street Screener uncovers opportunities you might easily miss if you limit your search. Why not fuel your investing edge with proven strategies?

- Uncover high-yield options by targeting these 19 dividend stocks with yields > 3% that deliver solid returns and reliable payouts for income-focused investors.

- Get ahead of tomorrow’s breakthroughs by pinpointing top contenders among these 23 AI penny stocks that are pushing boundaries with world-changing automation and smart tech.

- Seize value plays fast by filtering for these 911 undervalued stocks based on cash flows that trade below their predicted worth, giving you a built-in margin of safety.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives