- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Cognex (CGNX): Assessing Valuation After Analyst Upgrades and Momentum in AI Vision Technology Adoption

Reviewed by Kshitija Bhandaru

Recent upgrades and optimistic commentary have put Cognex (CGNX) back on the radar. The company’s outlook is brightening as adoption of its AI-powered vision technologies expands. Investors are increasingly weighing the momentum against persistent competitive pressures.

See our latest analysis for Cognex.

Recent news has certainly brought Cognex some fresh attention, but it’s the share price momentum that stands out. The stock is up 35.6% in the past 90 days alone, with a year-to-date share price return of 30.5%. Over the longer haul, the total shareholder return paints a more modest picture, at 22% for the past year and just under 11% across three years. This reminds investors that this is still a recovery story in play.

If Cognex’s rebound has you thinking bigger, this is a great moment to discover See the full list for free..

But with the stock’s swift rally and analyst upgrades making headlines, the real question is whether Cognex remains undervalued at current levels or if the market has already priced in the company’s next phase of growth.

Most Popular Narrative: 3% Undervalued

The current narrative fair value estimate stands at $48 per share, modestly above the last close price of $46.57. Market watchers are weighing whether this projected upside is built to last amid evolving growth drivers.

Accelerating adoption of AI-powered vision solutions (as seen with OneVision and the shift to cloud-based, scalable deployment) positions Cognex to upsell higher-value systems and increase average selling prices, supporting higher revenue and gross margin expansion.

Want to know what’s powering this valuation? The secret lies in the narrative’s bold forecast for expanding margins and rapid profit growth. Curious how much faith is being placed in next-generation tech adoption and a tempting financial turnaround? Find out how high the ceiling could be. See what’s driving these analyst assumptions.

Result: Fair Value of $48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in core hardware products and uncertainty around Cognex’s transition to advanced AI software could still present challenges for its future earnings growth.

Find out about the key risks to this Cognex narrative.

Another View: Is the Market Overpricing Cognex?

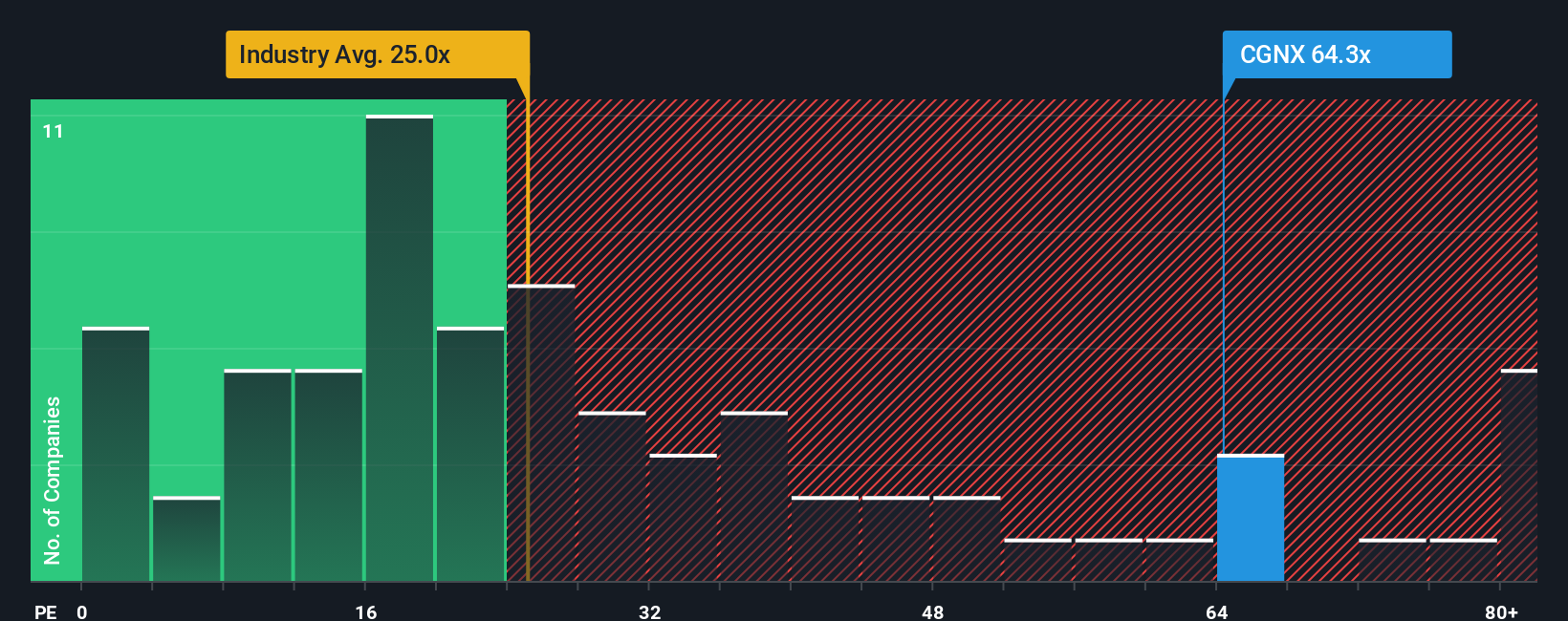

Stepping away from the narrative approach, the market’s main price-to-earnings ratio adds some caution. Cognex trades at 64.1x earnings, much higher than both its industry average (25.5x) and peer group (33.1x). Even compared to its fair ratio of just 33.4x, this elevated multiple suggests investors are paying a premium for anticipated growth. Is this optimism warranted, or could expectations be running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cognex Narrative

If you want to dig into the numbers yourself or take a different approach, it’s faster than ever to craft your own story and share your insights, all in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cognex.

Looking for More Investment Ideas?

Smart moves often start with fresh opportunities. Put yourself ahead of the curve by checking out unique companies poised for breakthroughs across trending sectors. Don’t let these opportunities slip by while others get ahead.

- Seize potential with these 888 undervalued stocks based on cash flows that are trading below their true worth before the market catches on.

- Unlock income streams by exploring these 18 dividend stocks with yields > 3% offering reliable yields over 3% for steady returns.

- Capture gains in emerging tech by targeting these 25 AI penny stocks shaping industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives