- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

The Bull Case For CDW (CDW) Could Change Following Asato AI Partnership Integration Learn Why

Reviewed by Simply Wall St

- Earlier this month, Asato Corporation announced a partnership with CDW Corporation to deliver AI-powered IT asset intelligence across enterprise, mid-market, and SMB customers, integrating the Asato platform into CDW's solutions lineup.

- This relationship aims to help CIOs unify fragmented IT data, drive efficient technology investments, and streamline IT operations, signaling a push into enterprise AI and business observability.

- We'll explore how the introduction of AI-driven IT asset intelligence through Asato could influence CDW's growth and margin expansion narrative.

CDW Investment Narrative Recap

If you’re a CDW shareholder, your conviction likely rests on the company’s ability to grow margins by expanding its AI and cloud-driven services, capturing higher-value business as digital transformation accelerates. The Asato partnership, which integrates AI-powered IT asset intelligence into CDW’s offerings, aligns with this focus but may not materially shift the most pressing short-term catalyst: maintaining revenue and margin growth amid tariff uncertainty. The core risk remains that infrastructure investments could slow if customers defer spending, putting pressure on near-term results.

Among recent announcements, CDW’s multi-year reseller deal with Smartsheet stands out for how it complements the Asato partnership. Together, these alliances aim to deepen CDW’s capability suite in automation, collaboration, and technology management, directly supporting the company’s strategy to expand high-margin service revenue streams and reinforce its value proposition in both enterprise and mid-market segments.

However, investors should be aware that, in contrast, shifts in customer spending driven by tariff policy could still...

Read the full narrative on CDW (it's free!)

CDW's outlook anticipates $23.1 billion in revenue and $1.3 billion in earnings by 2028. This scenario requires 3.3% annual revenue growth and a $0.2 billion increase in earnings from the current $1.1 billion.

Uncover how CDW's forecasts yield a $207.07 fair value, a 15% upside to its current price.

Exploring Other Perspectives

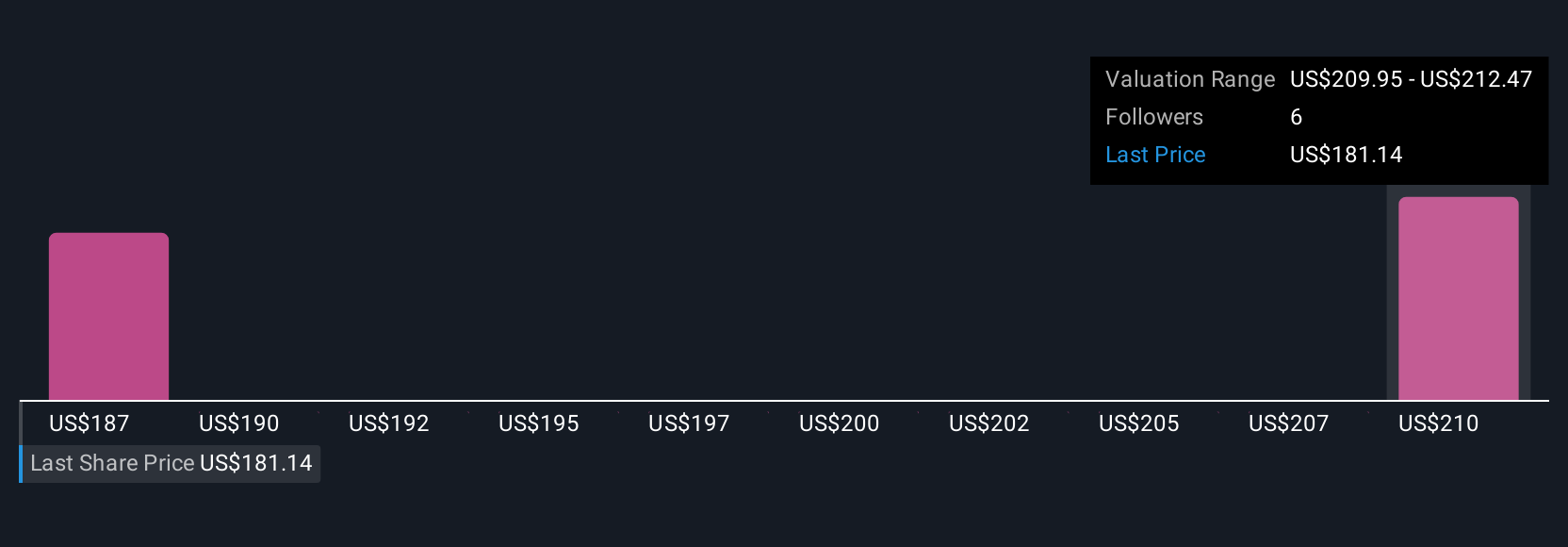

The Simply Wall St Community submitted two fair value estimates for CDW stock, ranging from US$204.05 to US$207.07 per share. While CDW’s expansion into AI services could act as a catalyst for margin improvement, these independent views remind you that opinions can differ widely so consider multiple viewpoints before making decisions.

Explore 2 other fair value estimates on CDW - why the stock might be worth just $204.05!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives