- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

Here's Why We Think CDW (NASDAQ:CDW) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in CDW (NASDAQ:CDW). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide CDW with the means to add long-term value to shareholders.

Check out our latest analysis for CDW

CDW's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, CDW has grown EPS by 17% per year. That's a good rate of growth, if it can be sustained.

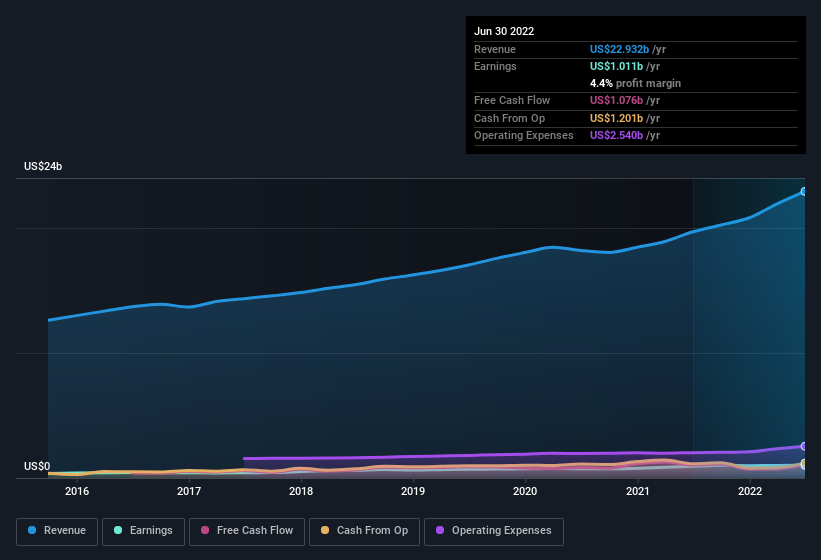

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note CDW achieved similar EBIT margins to last year, revenue grew by a solid 16% to US$23b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for CDW's future EPS 100% free.

Are CDW Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent US$1.5m buying CDW shares, over the last year, without reporting any share sales whatsoever. Knowing this, CDW will have have all eyes on them in anticipation for the what could happen in the near future. Zooming in, we can see that the biggest insider purchase was by President Christine Leahy for US$500k worth of shares, at about US$181 per share.

On top of the insider buying, it's good to see that CDW insiders have a valuable investment in the business. Holding US$78m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This should keep them focused on creating long term value for shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Chris Leahy, is paid less than the median for similar sized companies. For companies with market capitalisations over US$8.0b, like CDW, the median CEO pay is around US$13m.

The CDW CEO received US$8.9m in compensation for the year ending December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does CDW Deserve A Spot On Your Watchlist?

As previously touched on, CDW is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. We should say that we've discovered 1 warning sign for CDW that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, CDW isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives