- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

CDW (CDW) Is Down 8.9% After Trade Tensions and Government Shutdown Fuel Market Volatility – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early October 2025, renewed trade tensions arose after President Donald Trump threatened significant tariff increases on Chinese imports, leading to broad market volatility as the S&P 500 experienced its largest drop since August.

- This period of uncertainty was compounded by a U.S. government shutdown, which halted the release of key economic data and heightened unease for investors and policymakers, particularly affecting industries tied to global supply chains like IT solutions providers such as CDW.

- Given the recent reemergence of trade-related uncertainty, we'll examine how heightened macroeconomic risks could influence CDW's investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CDW Investment Narrative Recap

To be a shareholder in CDW, you typically need to believe in the expansion of IT services, including cloud, cybersecurity, and software, driven by demand for digital transformation and a resilient spread of customers across commercial, government, and healthcare sectors. While renewed tariff tensions and the government shutdown have increased near-term uncertainty for sectors with complex global supply chains, these latest developments have not produced any material shift in CDW’s most important short-term catalyst: the accelerating adoption of next-generation IT solutions. The biggest risk for the business still centers on persistent macro uncertainty and the potential for changing federal or education funding, both of which could weigh on sector demand and margins if conditions deteriorate further.

Amid this volatility, CDW’s most recent quarterly results (released August 6, 2025) showed higher sales year-on-year but lower net income and earnings per share, highlighting the impacts of margin pressure in a choppy operating environment. These data points remain central for investors keeping an eye on the balance between hardware-heavy, lower-margin deals and higher-value service offerings, a mix that could be further tested by external macro shocks or trade disruptions.

But with revenue growth still forecast below market levels, what should really grab investor attention is the effect persistent macro volatility could have on both pricing power and long-term profitability, especially if...

Read the full narrative on CDW (it's free!)

CDW's outlook anticipates $24.3 billion in revenue and $1.3 billion in earnings by 2028. This relies on a projected 3.5% annual revenue growth and a $0.2 billion increase in earnings from the current $1.1 billion.

Uncover how CDW's forecasts yield a $206.80 fair value, a 43% upside to its current price.

Exploring Other Perspectives

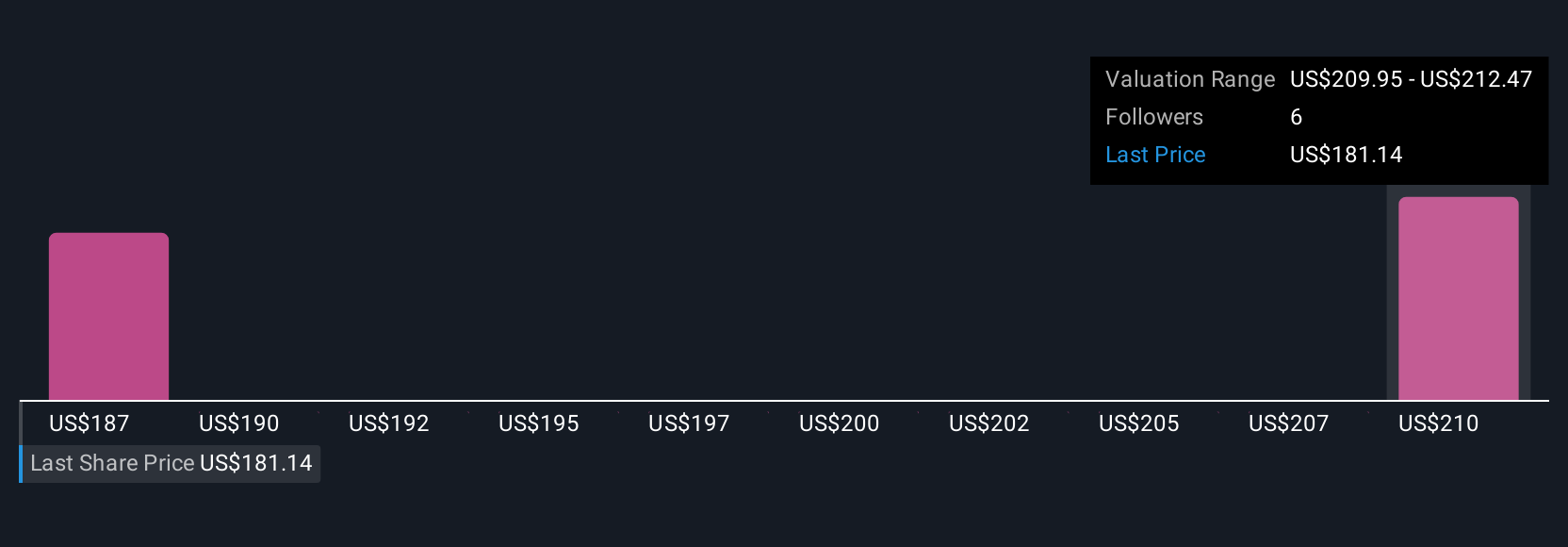

Three Simply Wall St Community fair value estimates for CDW range from US$196.24 to US$234.14 per share. Even as market participants' expectations diverge, the persistent risk of shifting federal or education funding continues to shape how performance may unfold, explore the full spectrum of insights.

Explore 3 other fair value estimates on CDW - why the stock might be worth just $196.24!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

No Opportunity In CDW?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives