- United States

- /

- Tech Hardware

- /

- NasdaqGM:CAN

The Market Lifts Canaan Inc. (NASDAQ:CAN) Shares 26% But It Can Do More

Canaan Inc. (NASDAQ:CAN) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 42% in the last twelve months.

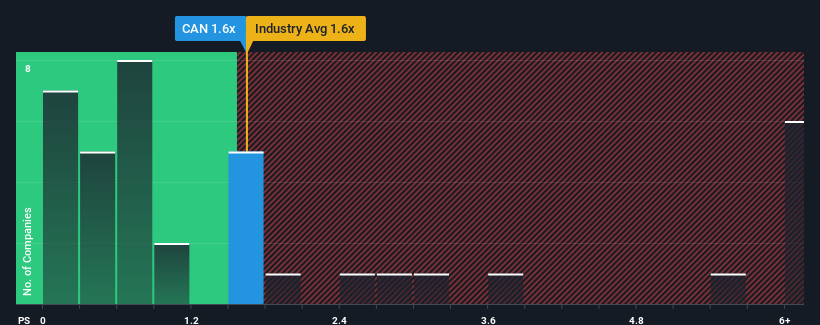

Although its price has surged higher, there still wouldn't be many who think Canaan's price-to-sales (or "P/S") ratio of 1.6x is worth a mention when it essentially matches the median P/S in the United States' Tech industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Canaan

What Does Canaan's P/S Mean For Shareholders?

Canaan could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Canaan will help you uncover what's on the horizon.How Is Canaan's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Canaan's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 48%. This means it has also seen a slide in revenue over the longer-term as revenue is down 27% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 56% over the next year. With the industry only predicted to deliver 7.9%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Canaan's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Canaan's P/S?

Its shares have lifted substantially and now Canaan's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Canaan's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Canaan (of which 2 are a bit concerning!) you should know about.

If you're unsure about the strength of Canaan's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CAN

Canaan

Engages in the research and development, design, and sale of integrated circuits (IC), and lease of final mining equipment by integrating IC products for bitcoin mining and related components in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026