- United States

- /

- Tech Hardware

- /

- NasdaqGM:CAN

Canaan (NasdaqGM:CAN) Valuation Check After Steep 12‑Month Share Price and TSR Declines

Reviewed by Simply Wall St

Canaan (NasdaqGM:CAN) has been quietly grinding through a tough stretch, with the stock down sharply this year even as annual revenue and net income growth have swung higher off a low base.

See our latest analysis for Canaan.

Still, the 1 year to date share price return of negative 64.23 percent and 1 year total shareholder return of negative 73.27 percent show that sentiment has been deteriorating rather than stabilising, as investors continue to price in execution and crypto cycle risks.

If Canaan’s volatility has you rethinking concentration risk, it might be worth scanning for other high growth names with strong insider alignment using our fast growing stocks with high insider ownership.

With the shares now trading below one dollar and sitting at a steep discount to analyst targets despite sharp revenue and profit growth, is Canaan an overlooked deep value play or is the market correctly discounting its future?

Most Popular Narrative Narrative: 72.5% Undervalued

With Canaan last closing at $0.79 against a narrative fair value near $2.89, the implied upside rests on aggressive growth and profitability improvements.

Persistent investment in next generation ASIC chip development (e.g., imminent A 16 launch), along with broadening cooling options, enables product differentiation and pricing power amid hardware refresh cycles, which should drive improved gross and net margins as mining efficiency demands rise.

Want to see what kind of revenue surge and margin shift would support this bold upside case, and which future earnings multiple ties it all together? Dive in.

Result: Fair Value of $2.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on Bitcoin mining hardware and intensifying competition could quickly erode Canaan’s margins and undermine the upbeat growth narrative.

Find out about the key risks to this Canaan narrative.

Another Take On Value

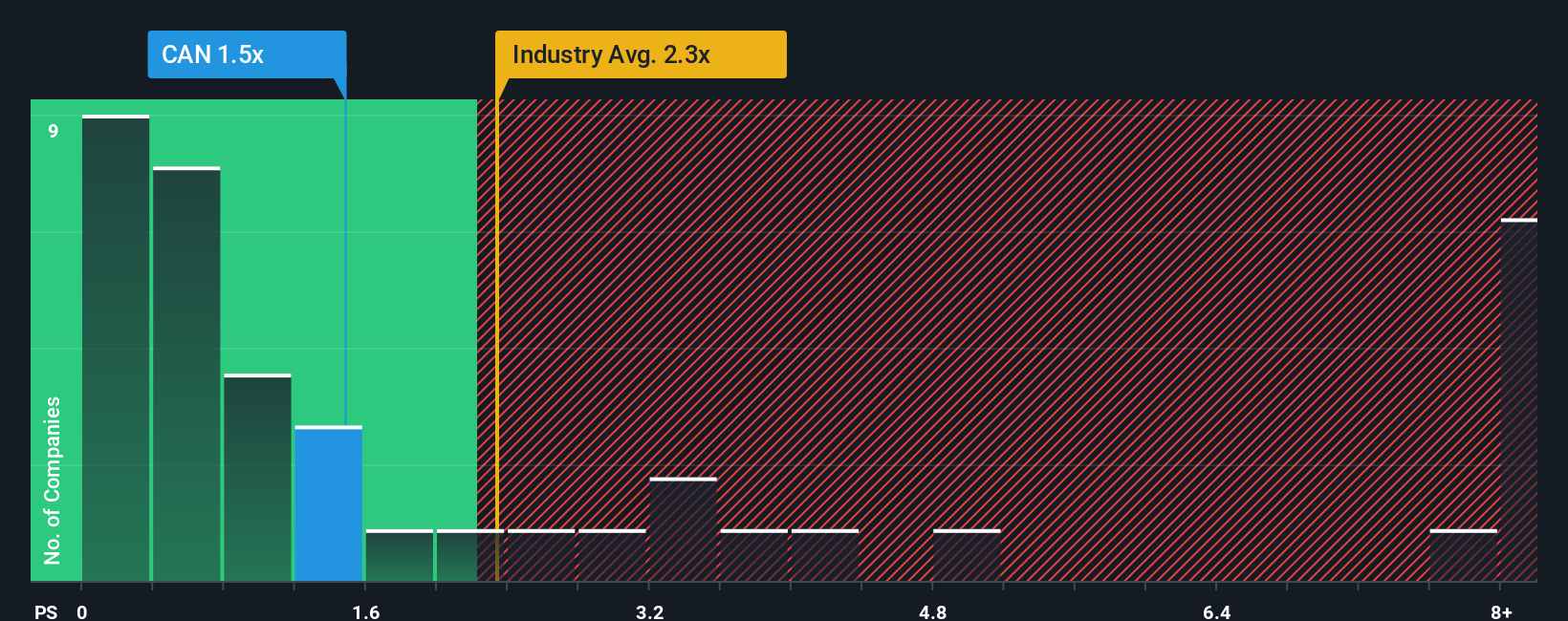

Step away from future earnings and Canaan looks far less of a bargain. Its price to sales ratio sits around 1.2 times, slightly richer than a fair ratio near 1.1 times and only modestly cheaper than US tech at 1.9 times. This hints at a limited margin of safety if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canaan Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalised Canaan thesis in just minutes: Do it your way.

A great starting point for your Canaan research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider building a broader watchlist of quality opportunities using our powerful screeners designed to surface overlooked and high potential stocks.

- Target stable income potential by reviewing these 13 dividend stocks with yields > 3% to help anchor a portfolio with reliable cash flows.

- Explore the next wave of innovation with these 26 AI penny stocks that are reshaping industries through real world artificial intelligence adoption.

- Search for potential mispriced opportunities using these 914 undervalued stocks based on cash flows which screens for businesses trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CAN

Canaan

Engages in the research and development, design, and sale of integrated circuits (IC), and lease of final mining equipment by integrating IC products for bitcoin mining and related components in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion