- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:AIOT

Revenues Tell The Story For PowerFleet, Inc. (NASDAQ:AIOT) As Its Stock Soars 38%

PowerFleet, Inc. (NASDAQ:AIOT) shares have continued their recent momentum with a 38% gain in the last month alone. The last month tops off a massive increase of 143% in the last year.

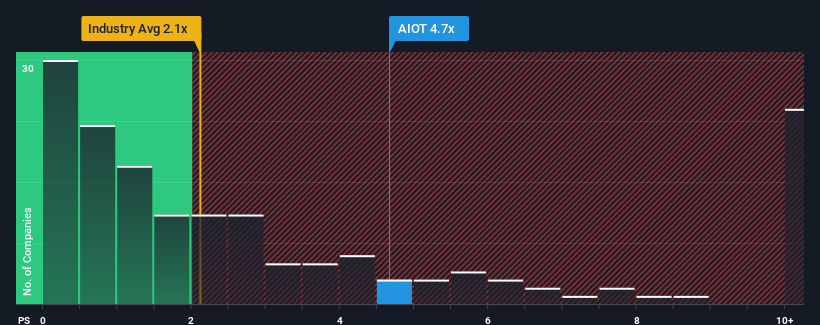

Since its price has surged higher, given around half the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider PowerFleet as a stock to avoid entirely with its 4.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for PowerFleet

How Has PowerFleet Performed Recently?

With revenue growth that's superior to most other companies of late, PowerFleet has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on PowerFleet will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like PowerFleet's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 67% last year. The latest three year period has also seen an excellent 82% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 81% over the next year. With the industry only predicted to deliver 10%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why PowerFleet's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From PowerFleet's P/S?

PowerFleet's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that PowerFleet maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 4 warning signs for PowerFleet (2 don't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on PowerFleet, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AIOT

PowerFleet

Provides artificial intelligence-of-things (AIoT) solutions in North America, Israel, Africa, Europe, the Middle East, Australia, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026