- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEIS

A Look at Advanced Energy Industries (AEIS) Valuation After Its Ultra-Efficient Converter Launch for AI and Industrial Markets

Reviewed by Simply Wall St

Most Popular Narrative: 2.5% Overvalued

According to the most widely followed narrative, Advanced Energy Industries currently trades roughly in line with what analysts estimate as its fair value. The company’s growth prospects and the trajectory of its profit margins are fueling optimism, yet expectations may already be baked into the price.

Sustained expansion in data center and cloud computing infrastructure, especially driven by AI workloads, is fueling robust demand for Advanced Energy's next-generation high-power density solutions. Strong design win momentum and customer forecasts suggest revenue growth in this segment will remain above historical averages into 2026 and beyond, providing significant top-line upside.

Curious what’s driving this high-stakes analyst narrative? There’s a forecast at play that’s rewriting the company’s earnings roadmap and calls for a profit margin leap, along with a valuation multiple that could turn heads in any tech sector debate. Want to see how bulls square lofty financial targets with today’s price? Dive into the full narrative that’s sparking real debate among investors.

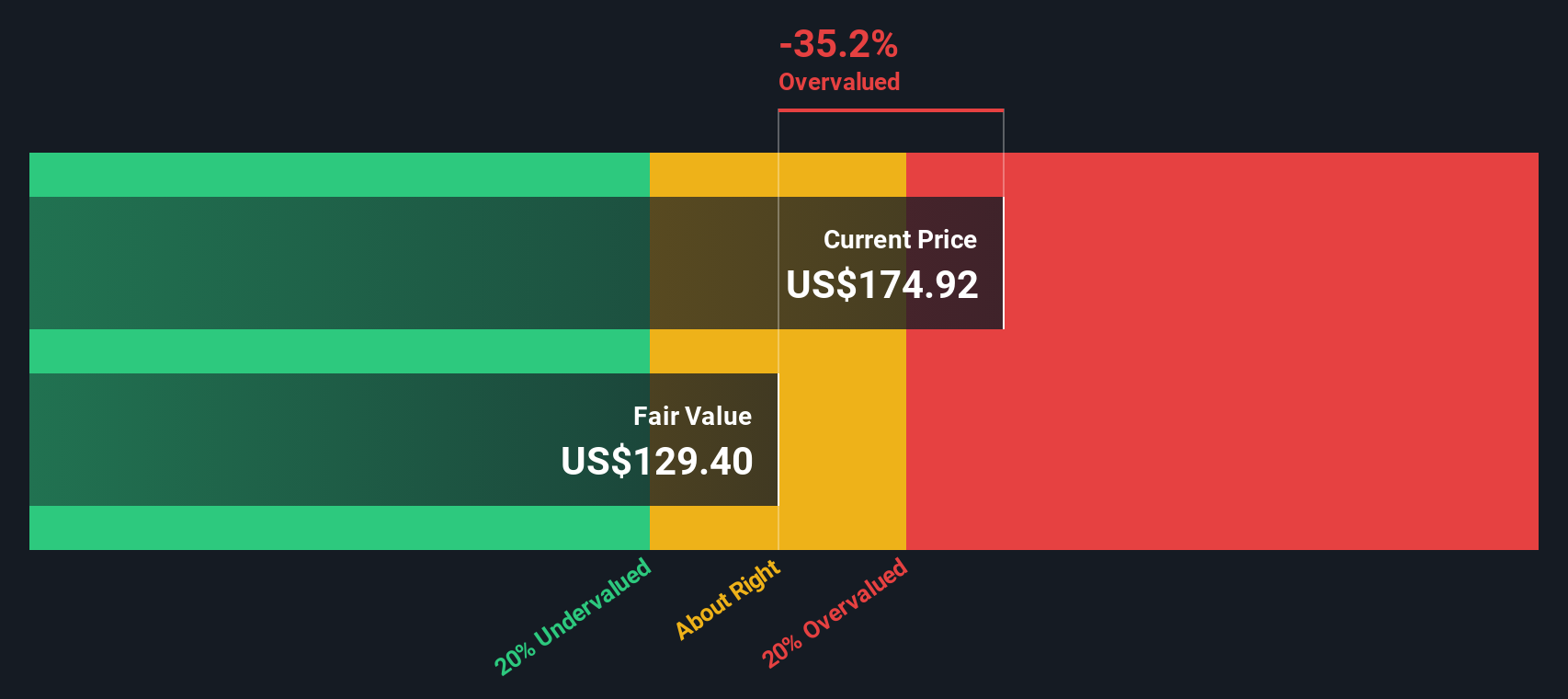

Result: Fair Value of $150.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the story could quickly change if key data center customers reduce spending, or if semiconductor demand slows further due to tariffs and global headwinds.

Find out about the key risks to this Advanced Energy Industries narrative.Another View: Discounted Cash Flow Model

Taking a different approach, the SWS DCF model arrives at a valuation that suggests Advanced Energy Industries might be priced a bit above what its future cash flows imply. Could this long-term view reveal overlooked risks, or does it miss near-term momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advanced Energy Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advanced Energy Industries Narrative

If you want a different perspective or like to dig into the numbers firsthand, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Advanced Energy Industries research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

The right investment can be game-changing, but savvy investors never settle for just one promising stock. Recharge your watchlist by targeting different sectors, trends, and strategies using powerful screeners made for forward-thinkers. Don’t risk missing a great opportunity when smarter choices are just a click away.

- Tap into tomorrow’s innovation by finding AI penny stocks that power breakthroughs in artificial intelligence, automation, and next-gen tech.

- Capture reliable returns and experience less volatility through dividend stocks with yields > 3% designed to spotlight companies with impressive yields and stability.

- Uncover unrealized potential with undervalued stocks based on cash flows which zero in on stocks trading below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:AEIS

Advanced Energy Industries

Provides precision power conversion, measurement, and control solutions in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)