- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Apple (AAPL) Valuation in Focus After Recent Share Price Dip

Reviewed by Simply Wall St

Apple (AAPL) rarely sits out of the headlines, but this week’s move in its shares has caught investor attention for a different reason. With no blockbuster news or product reveals to pin the action on, Apple’s stock ticked a bit lower, closing at $239.69 yesterday. For seasoned Apple watchers, such movements often spark questions. Are markets reading between the lines, or is this just part of the usual ebb and flow?

Even with the recent dip, it is worth zooming out on Apple’s momentum. Over the past month, shares have advanced by 4%, and in the past three months, they have surged 18%. These gains offset a modest year-to-date slide and reflect the company’s solid long-term run, boasting a 9% total return in the past year and nearly 49% over three years. As Apple continues to deliver steady revenue and net income growth, the big picture remains a blend of proven success and ongoing recalibration by the market.

After a stretch of impressive gains and the latest cooling-off, is the current price a rare buying window for Apple? Or does the market already reflect all the growth that lies ahead?

Most Popular Narrative: 35% Overvalued

According to a widely discussed narrative on Apple, the stock currently appears to be priced well above its fair value. The argument raises concerns that Apple’s current valuation may not reflect the challenges ahead for the company.

Apple’s P/E ratio currently exceeds 28x, far surpassing the broader market’s average of around 20x. For a company that is no longer experiencing explosive growth, such a high P/E ratio seems unsustainable. The market is pricing in continued rapid growth, but this assumption is increasingly unrealistic as Apple's product lines mature and market saturation sets in.

Think Apple’s rally is unstoppable? This narrative questions everything. Its valuation leans on big growth projections, a mature product portfolio, and some assumptions you will not expect. What numbers does this perspective use as the backbone for its caution? The answers might surprise even seasoned investors.

Result: Fair Value of $177.34 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, surging demand for new product categories or unexpected innovation could quickly challenge this cautious outlook. This could also fuel renewed optimism for Apple’s shares.

Find out about the key risks to this Apple narrative.Another View: Our DCF Model Steps In

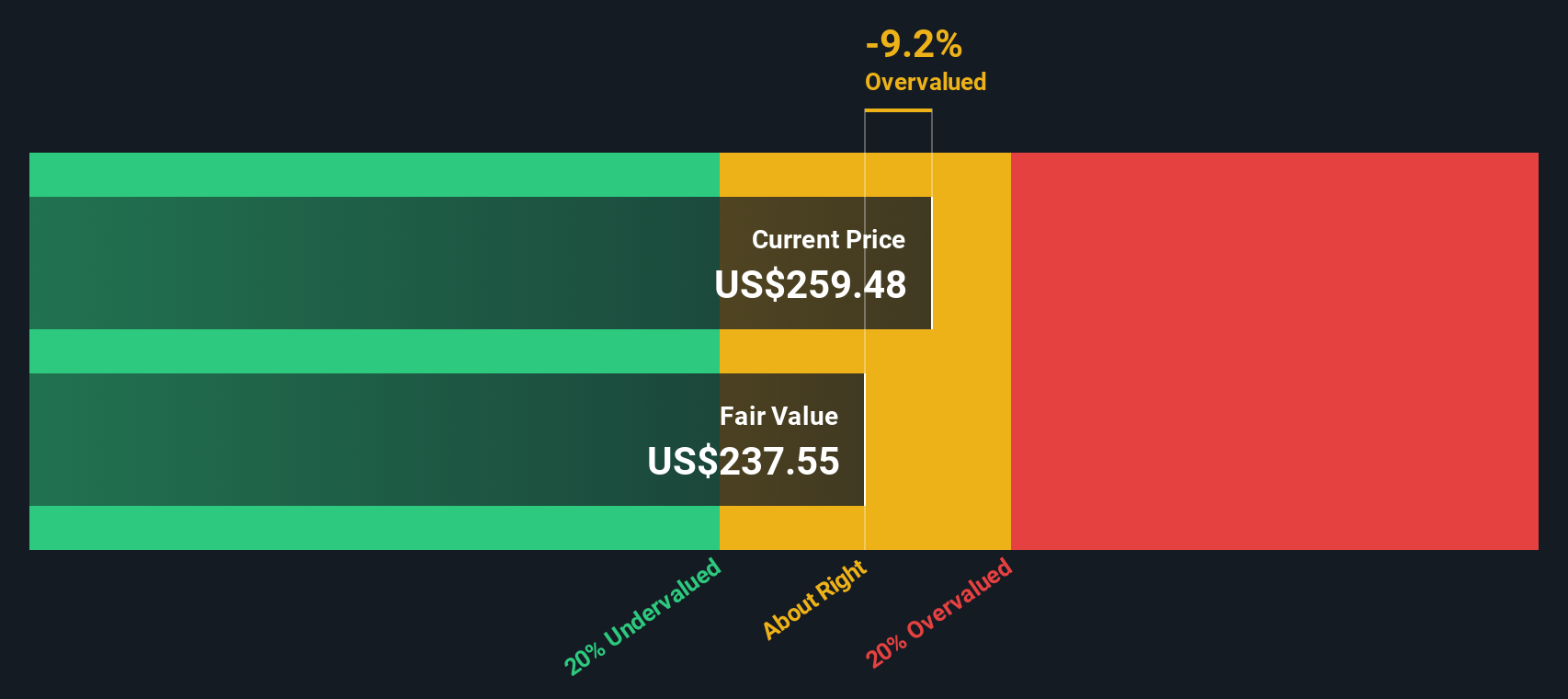

While some argue Apple is overvalued based on what investors pay per dollar of profit, our DCF model offers a different perspective. It suggests Apple's share price may actually be trading below its fair value. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Apple for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Apple Narrative

Of course, if you would rather draw your own conclusions or take a closer look at the numbers, you can build your own view in just a few minutes as well. Do it your way: Do it your way.

A great starting point for your Apple research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. With the right tools, you can spot promising companies others overlook and stay ahead of the market’s next big moves.

- Uncover hidden gems that could be tomorrow’s success stories with penny stocks with strong financials before they hit everyone’s radar.

- Capture the momentum in artificial intelligence by browsing AI penny stocks, which are transforming industries and setting new standards in tech innovation.

- Target pure value plays and unlock strong investment potential by seeking out undervalued stocks based on cash flows. These may be trading for less than they're truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)