- United States

- /

- Software

- /

- NYSEAM:BMNR

Why BitMine Immersion Technologies (BMNR) Is Up 6.4% After Amassing 2.65M ETH and $11.6B Holdings

Reviewed by Sasha Jovanovic

- BitMine Immersion Technologies recently disclosed that its total cash and crypto holdings have surpassed US$11.6 billion, with over 2.65 million ETH in its treasury and an aim to secure 5% of the total Ethereum supply.

- This transformation has drawn considerable institutional attention, positioning BitMine as the world’s largest corporate Ethereum holder and a central participant in the broader push for institutional adoption of Ethereum.

- We'll explore how BitMine's shift toward aggressive Ethereum accumulation influences its investment narrative and signals growing institutional engagement in crypto.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Bitmine Immersion Technologies' Investment Narrative?

For investors considering Bitmine Immersion Technologies, the thesis now turns squarely on the belief in Ethereum’s future prominence and the company’s ability to leverage its massive crypto treasury. The recent disclosure of over US$11.6 billion in cash and crypto, paired with an ambition to control 5% of the entire Ethereum supply, is a dramatic escalation in its commitment to Ethereum. This move supercharges Bitmine’s investment narrative and appears to be driving renewed institutional interest, especially following the latest direct equity offering. These catalysts have overshadowed past concerns about unprofitability, dilution, or negative margins, at least in the near term, as evidenced by strong price momentum since the news. Still, Bitmine’s severe operating losses, high leverage, and the very real risk of Ethereum price or regulatory shocks could materially impact its story. Recent momentum suggests the catalysts may now outweigh the immediate financial risks, but volatility and future dilution remain key issues for shareholders.

However, investors should not overlook Bitmine’s substantial history of shareholder dilution and lingering financial risks.

Exploring Other Perspectives

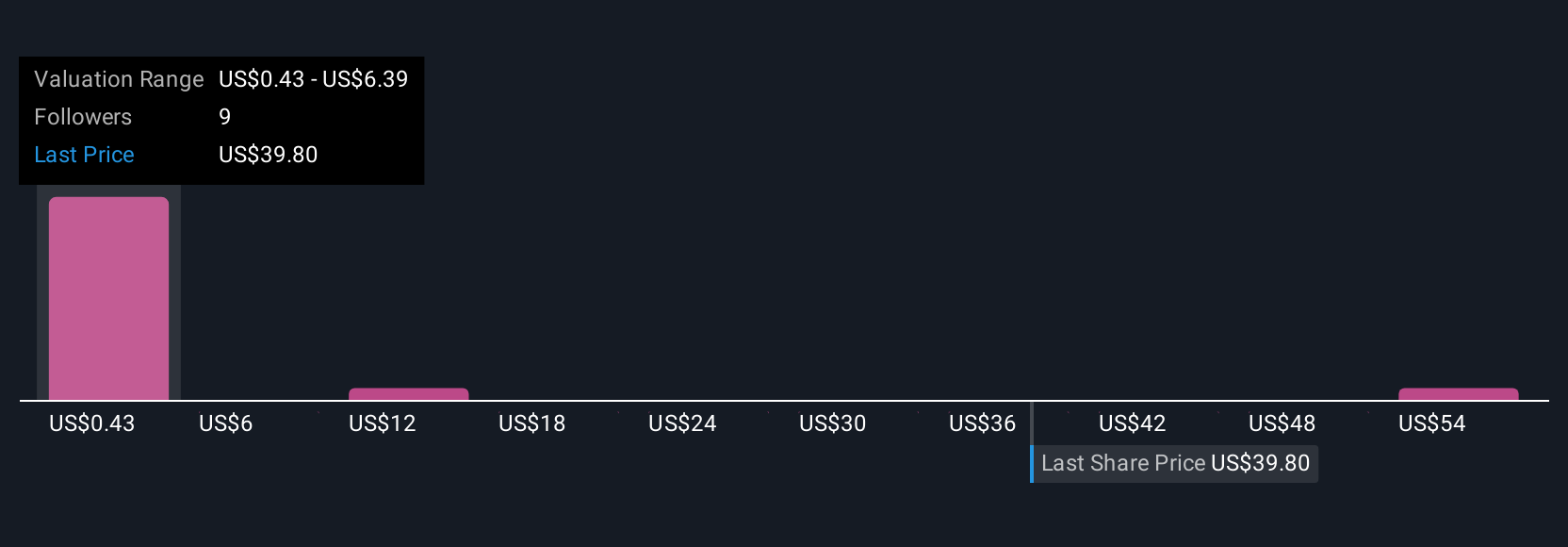

Explore 25 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives