- United States

- /

- Software

- /

- NYSEAM:BMNR

Does Bitmine’s 1,900% Rally Still Make Sense After Recent Crypto Regulation Headlines?

Reviewed by Bailey Pemberton

Thinking about what to do with Bitmine Immersion Technologies stock? You are not alone. After a meteoric rise of 1,935.4% over the past year and a 656.0% surge year-to-date, investors are watching closely for signs of what comes next. While the past week saw a pullback of -10.6%, and the last month logged a modest dip of -3.9%, these shifts are small compared to the significant long-term growth Bitmine has posted. Long-term holders have seen returns of 182.2% over three years and 71.8% over five years, numbers that are nearly unheard of in most sectors.

What drove these outsized gains? A big part of the story can be traced back to broad market developments in the crypto mining industry, where demand for efficient, high-output technology hit new highs. Investors have responded enthusiastically, not just to sector momentum, but to Bitmine’s reputation as an innovator in immersion cooling solutions for mining rigs. At the same time, the volatility seen in the stock price underscores new perceptions of risk, especially as regulatory and environmental questions surround the industry.

Given these dramatic moves, it is only natural to ask: is Bitmine Immersion Technologies undervalued, fairly valued, or overpriced at these levels? On a conventional value scorecard, Bitmine checks the box for undervaluation in zero out of six categories, leaving it with a valuation score of 0. However, those standard metrics may not tell the whole story. Up next, let us dig into the core approaches analysts use to value a company, followed by a fresh perspective on how to gauge what Bitmine may be worth.

Bitmine Immersion Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

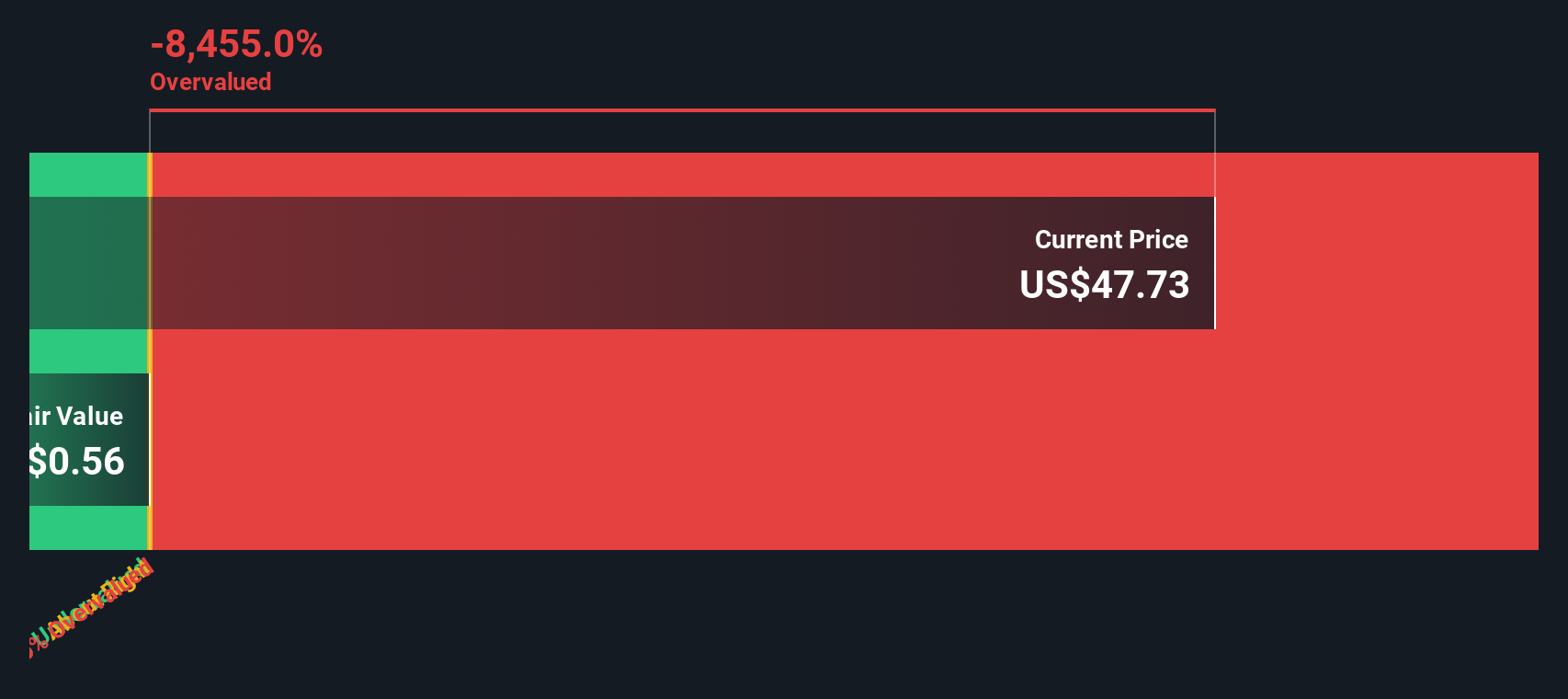

Approach 1: Bitmine Immersion Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to today, reflecting what those future dollars are worth in present terms. For Bitmine Immersion Technologies, the DCF model used here is the 2 Stage Free Cash Flow to Equity approach, focusing on the company’s ability to generate cash for its shareholders.

Currently, Bitmine reports free cash flow (FCF) of $0.84 million. Looking ahead, analysts forecast aggressive growth. Estimated FCF reaches $1.47 million in 2026 and rises annually to a projected $7.75 million by 2035. While analyst estimates typically extend five years, subsequent projections are extrapolated based on recent growth trends and broader market factors influencing the crypto mining sector.

Despite these optimistic projections, the DCF calculation arrives at an estimated intrinsic value of $0.34 per share. When compared to the current share price, this means Bitmine stock is trading at a 15,594.4% premium to its calculated fair value, making it extremely overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bitmine Immersion Technologies may be overvalued by 15594.4%. Find undervalued stocks or create your own screener to find better value opportunities.

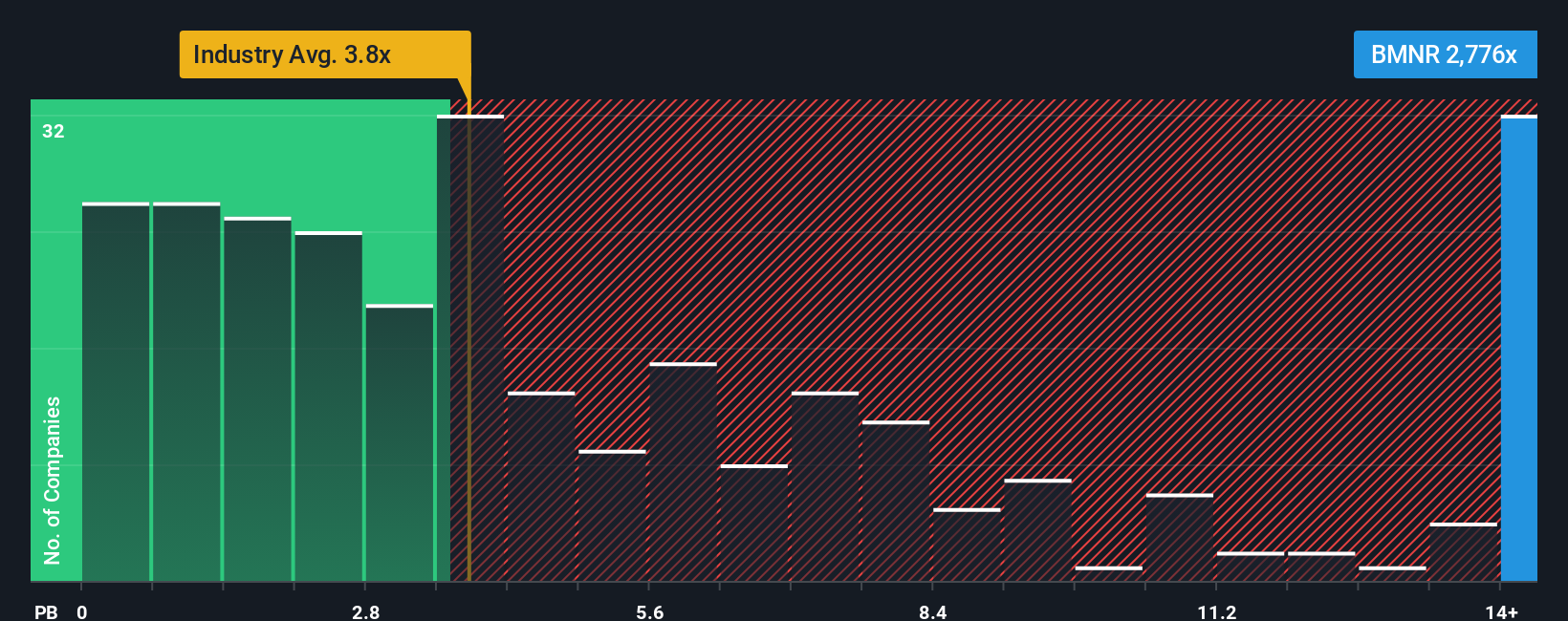

Approach 2: Bitmine Immersion Technologies Price vs Book

The price-to-book (P/B) ratio is often preferred for analyzing companies like Bitmine Immersion Technologies that may not have a consistent earnings track record, but do have meaningful book value on their balance sheet. This multiple is especially useful in industries using tangible assets or where profits can fluctuate, as it compares a company’s market price to its net asset value.

Growth expectations and risk levels play a key role in determining what counts as a “normal” or “fair” P/B ratio. Rapidly growing or safer companies tend to justify higher ratios, while mature or riskier businesses typically command lower ones.

Currently, Bitmine trades at a P/B ratio of 5,235.94x, far above the software industry average of 4.09x and its peer group average of 15.33x. These staggering numbers clearly place it in a unique league, but whether it is overvalued depends on deeper context.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike a simple comparison with sector or peer averages, the Fair Ratio looks at factors such as earnings growth, business risks, profit margins, market cap, and more to determine what a reasonable multiple should be for the stock in question. It provides a more comprehensive and tailored sense of value.

With Bitmine’s actual P/B ratio so far removed from what would be deemed standard by any reasonable measure, and no evidence that the Fair Ratio closes this enormous gap, the stock is best described as significantly overvalued by this metric as well.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

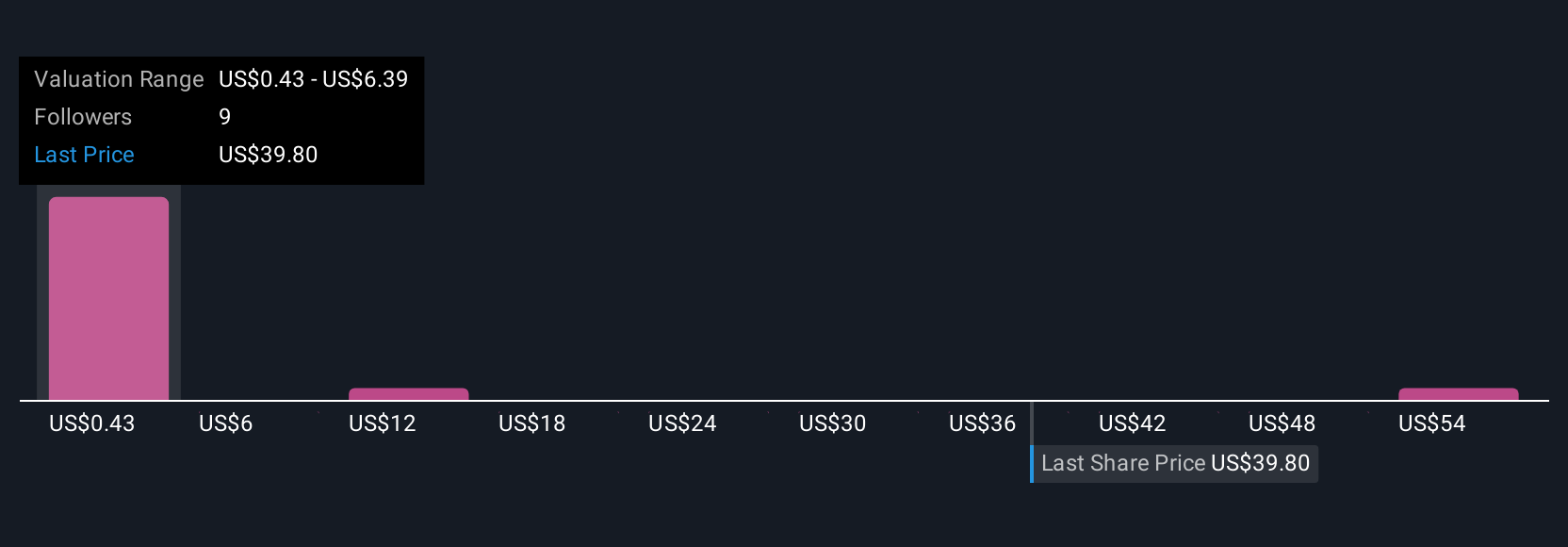

Upgrade Your Decision Making: Choose your Bitmine Immersion Technologies Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a tool that allows you to craft a story behind the numbers by linking your view of a company’s future, its fair value, expected revenues, earnings, and profit margins, to your investment decision. With Narratives, you can move beyond pure financial ratios and see how a company’s unique story translates into financial outcomes and a real-world valuation.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy and accessible way to express their beliefs and compare them with others in just a few clicks. Narratives highlight how your assumptions about Bitmine Immersion Technologies, such as continued innovation or market headwinds, connect directly to a fair value calculation, making it easier to decide when to buy or sell by comparing that fair value to the current price. Best of all, Narratives update dynamically when fresh news or earnings data arrives, keeping your investment thesis in sync with reality. For example, some investors see Bitmine’s disruptive tech leading to fair values as high as $6.00 per share, while others adopt caution with estimates as low as $0.22 per share, and both views have their place on the platform.

Do you think there's more to the story for Bitmine Immersion Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives