- United States

- /

- Software

- /

- NYSEAM:BMNR

Can Bitmine’s Soaring 709% Rise Continue After New Cooling Tech Drives Buzz?

Reviewed by Bailey Pemberton

Thinking about what to do with Bitmine Immersion Technologies stock? You're not alone. With its headline-grabbing returns, up a staggering 12.2% in just the last week and a jaw-dropping 709.3% for the year to date, investors are buzzing about what’s fueling this crypto-adjacent powerhouse and, more importantly, whether there's still room to grow. The momentum does not feel random, either. Market chatter has zeroed in on the company’s expansion into next-generation cooling tech for mining facilities, a move that’s earning applause as concerns about energy efficiency ramp up across the industry.

But let's address the elephant in the room: valuation. For all the excitement, Bitmine Immersion Technologies currently scores a 0 out of 6 on our valuation check, meaning it is not undervalued by any of the traditional metrics we track. While past performance has certainly been spectacular (a blistering 746.8% return over the past year), the numbers suggest that investors may already be pricing in a lot of optimism, or perhaps a new perception of lower risk.

So, how does a stock with such a meteoric rise stack up once we dig into different valuation methods? Plenty of analysts rely on the familiar yardsticks, but stay tuned as we walk through these approaches and explore what really matters when assessing Bitmine’s value in today’s market.

Bitmine Immersion Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bitmine Immersion Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to their present value. This helps determine what the company could be worth today, based purely on its expected ability to generate cash.

For Bitmine Immersion Technologies, the reported Free Cash Flow (FCF) over the last twelve months is $0.84 million. Projections suggest robust growth, with FCF rising to around $7.75 million by 2035. Analysts typically provide FCF estimates for up to five years, while later projections, such as these, are extrapolated based on current trends and industry expectations.

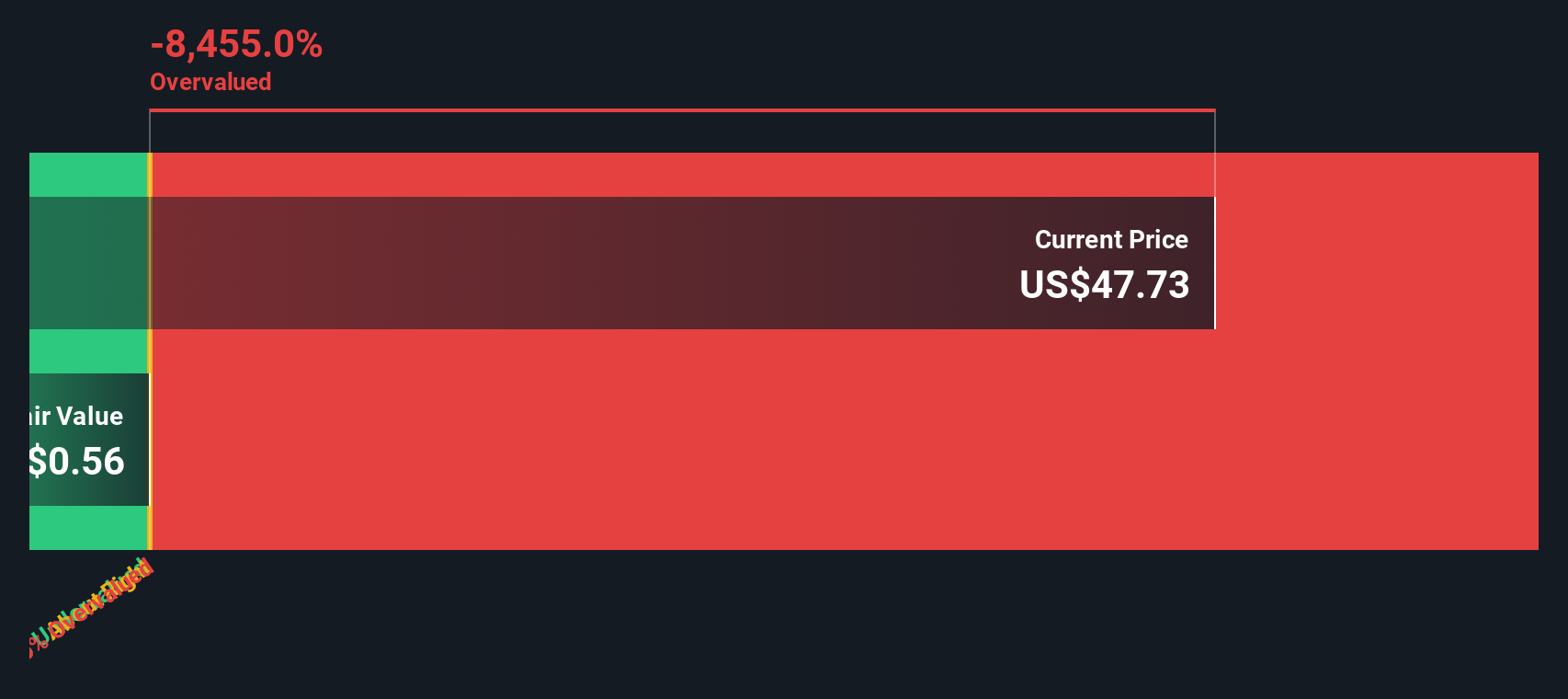

Using these cash flow estimates and a two-stage free cash flow to equity model, the DCF analysis yields a fair value of $0.53 per share. However, with the market pricing in significantly more optimism, the DCF calculation indicates that Bitmine shares are trading about 10,537.6 percent above their estimated intrinsic value. This suggests the stock is extremely overvalued by this metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bitmine Immersion Technologies may be overvalued by 10537.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Bitmine Immersion Technologies Price vs Book

When assessing the value of a profitable business like Bitmine Immersion Technologies, the Price-to-Book (PB) ratio is often a reliable starting point. This metric helps investors determine how much they are paying for each dollar of the company’s net assets, which can be particularly relevant for companies in capital-intensive or asset-heavy sectors.

Market optimism and expectations for rapid growth or reduced risk tend to justify higher PB ratios, whereas caution about the future will pull these multiples closer to or below industry norms. Understanding what baseline is considered “fair” matters, especially given the sector’s tendency for big swings in sentiment.

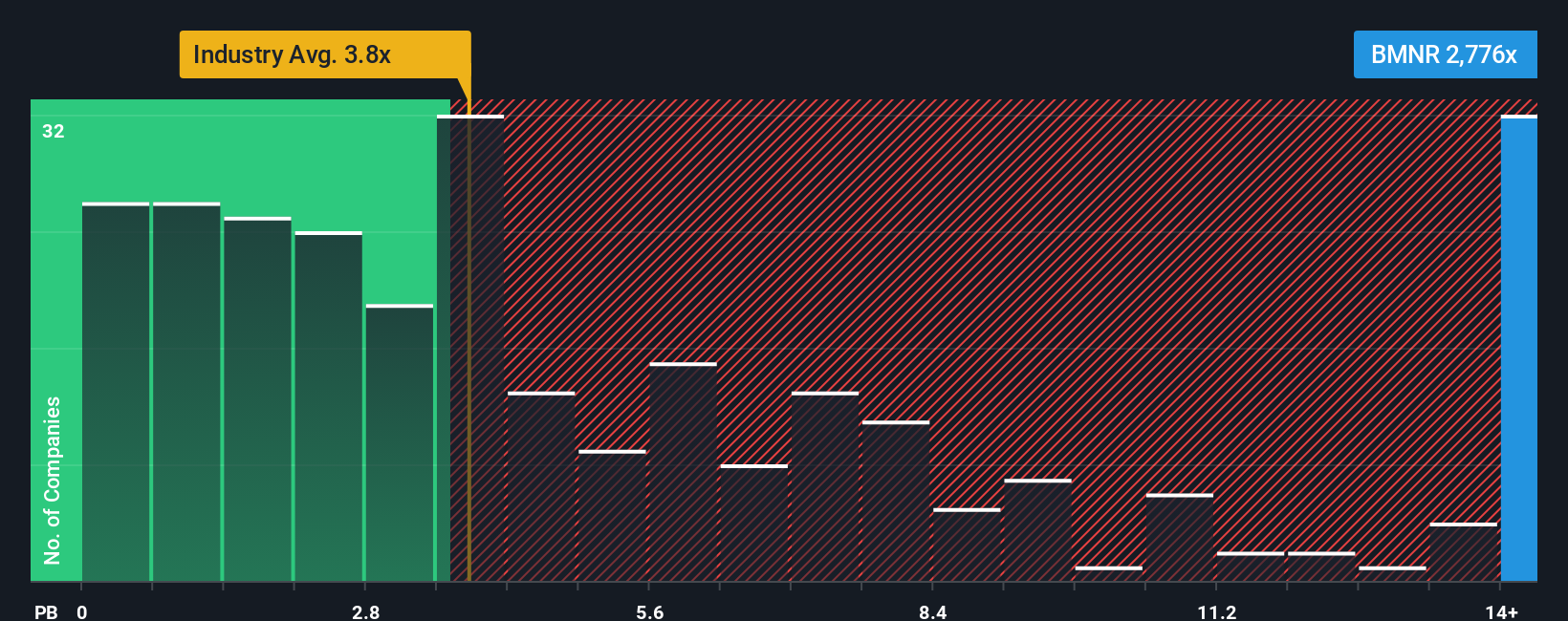

Currently, Bitmine trades at a PB multiple of 3,517.89x, a figure that dramatically outpaces both the industry average of 3.99x and the peer average of 11.55x. These eye-popping multiples raise immediate questions about whether the market’s exuberance is warranted based only on tangible book value.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. Unlike a basic peer or industry comparison, the Fair Ratio considers not just growth and risk levels, but also factors such as margins, size, and the company’s specific operating environment. By tailoring the expectation of a “normal” PB multiple to the full context, the Fair Ratio aims to spot situations where traditional benchmarks might miss the mark.

In this case, Bitmine’s actual PB ratio is vastly higher than what the Fair Ratio would justify, suggesting the shares are commanding a premium far in excess of their fundamental value.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bitmine Immersion Technologies Narrative

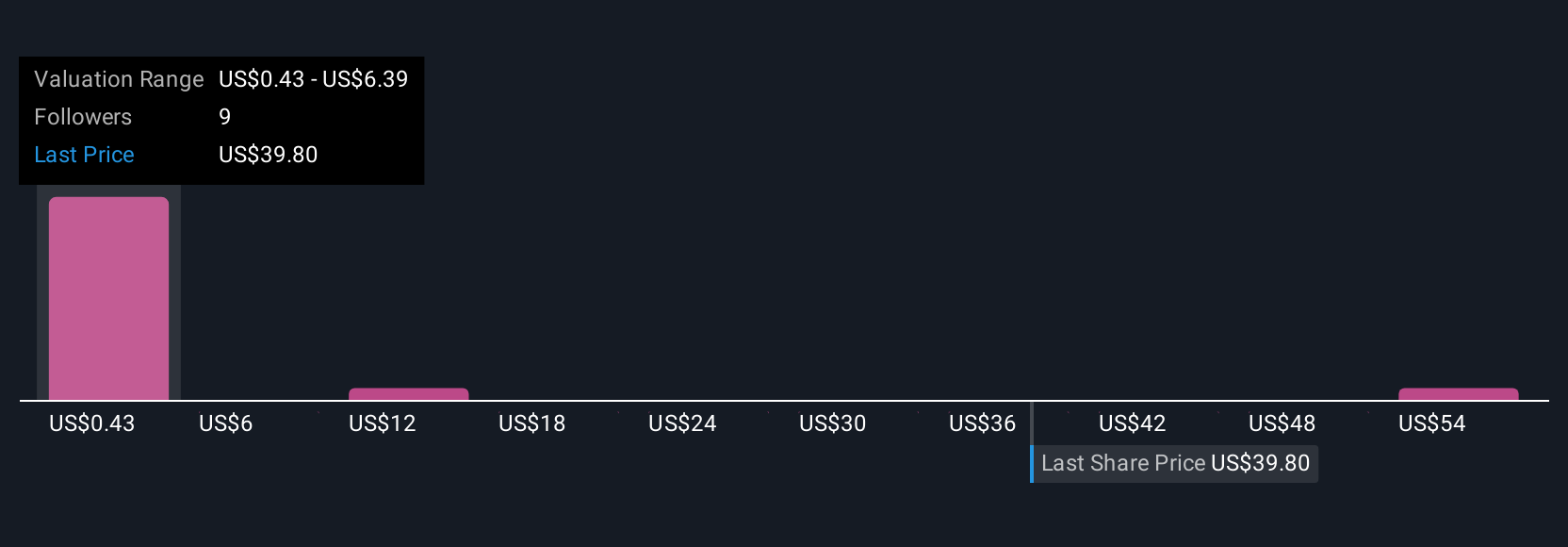

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, story-driven approach that lets you connect your perspective on a company with real numbers, such as your fair value estimate and assumptions for future revenue, profit margins, and more. Instead of only relying on ratios and past performance, Narratives empower you to tie Bitmine’s evolving story directly to a financial forecast and fair value. This makes your investment decisions more meaningful and personal.

Available right now on Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors. They help you decide when to buy or sell by instantly comparing your calculated fair value against the live share price. Narratives also keep you updated automatically when new data, news, or earnings are released, ensuring your outlook stays current. For Bitmine Immersion Technologies, you might see one investor’s bullish Narrative with aggressive growth assumptions and a high fair value, while another, more cautious Narrative projects a much lower price based on conservative estimates. Narratives bring your investment decisions to life, giving you clarity, flexibility, and control.

Do you think there's more to the story for Bitmine Immersion Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion