- United States

- /

- Software

- /

- NYSEAM:BMNR

Bitmine Immersion Technologies (BMNR): Evaluating Valuation After Recent Stock Dip and Lack of Major News

Reviewed by Simply Wall St

Bitmine Immersion Technologies (NYSEAM:BMNR) has seen shares slip quietly lower by nearly 10% in the latest trading session, continuing a stretch investors may have overlooked. While there was no clear event behind this move, such a drop on an otherwise calm news day tends to get attention. Is this simply the ebb and flow of a small-cap name, or could it be the first sign of something underlying that is worth a closer look?

Looking at a broader timeframe provides additional context. Over the past month, the stock rebounded more than 17%, nearly erasing losses from earlier this year, but its long-term trajectory has been much more muted. Despite a strong run over the past 3 months, longer-term returns have barely changed, making it tricky to categorize the current action as part of any clear trend. With no material company-specific news and no major shifts in fundamentals, recent price movements seem to reflect changes in sentiment rather than concrete new developments.

After this uneven year and a surprising rebound, the question remains whether Bitmine Immersion Technologies is undervalued or if the market has already accounted for any possible upside in the near future.

Price-to-Book of 1894.5x: Is it justified?

Bitmine Immersion Technologies currently trades at a price-to-book (P/B) ratio of 1894.5, which is far higher than the average P/B ratio of its peers at 10.1. This suggests that the stock appears significantly overvalued when compared to similar companies in the industry.

The price-to-book ratio measures a company's market value relative to its book value and is especially relevant for evaluating companies where tangible assets make up a large part of value. In the technology sector, this ratio can indicate whether investors are betting on future growth or if market sentiment is outpacing business fundamentals.

With such a dramatic premium to peers, markets may be anticipating substantial growth or unique assets that have not yet appeared in financial results. However, this discrepancy also suggests that expectations for Bitmine Immersion Technologies may exceed the company’s current performance by a considerable margin.

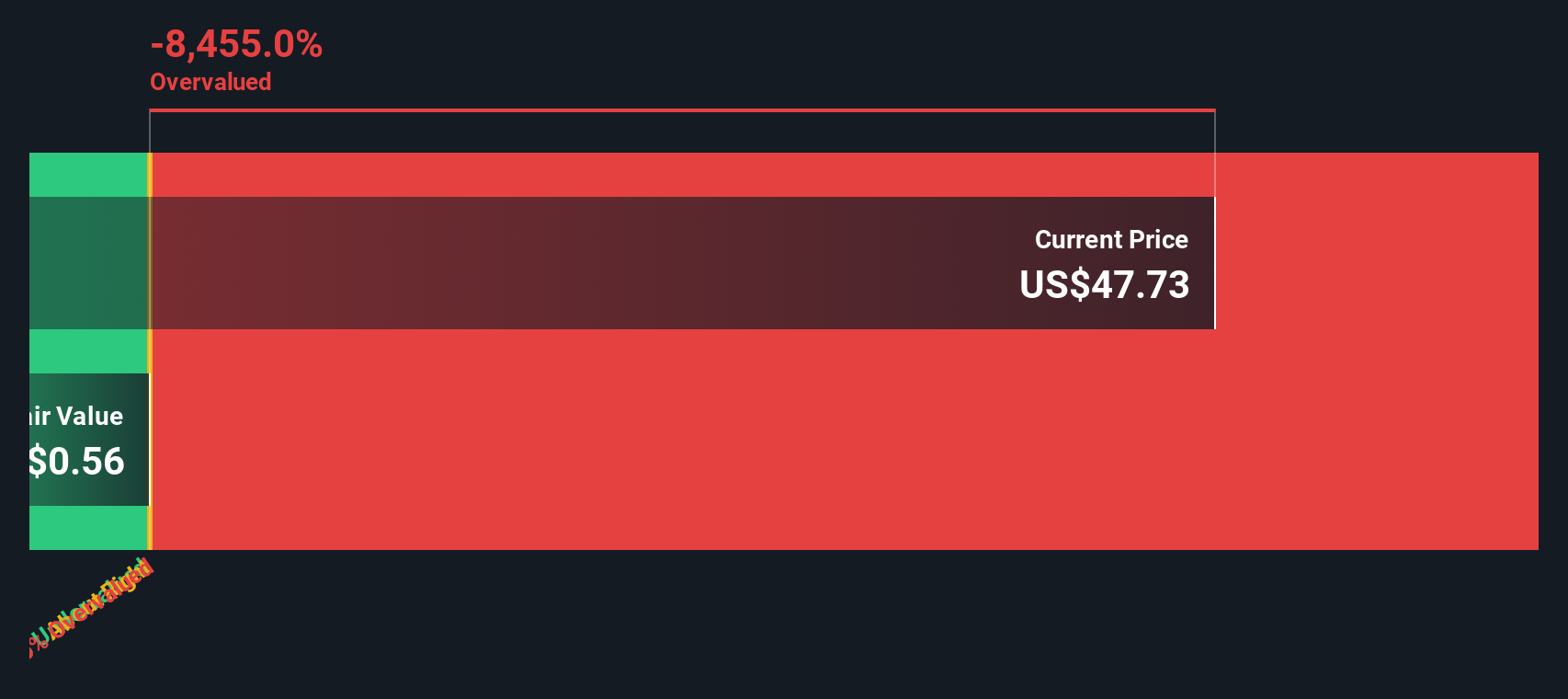

Result: Fair Value of $0.88 (OVERVALUED)

See our latest analysis for Bitmine Immersion Technologies. However, risks remain, such as a lack of revenue growth and ongoing net losses. These factors could challenge the market’s optimism surrounding Bitmine Immersion Technologies. Find out about the key risks to this Bitmine Immersion Technologies narrative.Another View: What Does Our DCF Model Say?

Taking a different approach, our DCF model also points to the stock being overvalued. This method examines expected future cash flows and, similar to the earlier measure, raises concerns. However, there is a question of whether the future might reveal something the numbers do not capture.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you see things differently, or want to dig deeper into the data yourself, it takes just a few minutes to develop your own perspective. do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep an eye out for fresh opportunities. Don’t let exciting prospects pass you by when so many niche sectors could offer promising returns. Use these tailored stock collections to enhance your research and help your portfolio stay ahead of the curve:

- Discover steady income potential by exploring dividend stocks with yields > 3%, where you’ll find companies with robust dividends above 3% for consistent cash flow.

- Benefit from new trends by using AI penny stocks to access up-and-coming AI-driven businesses that are reshaping industries today.

- Explore the next leap in technology by reviewing quantum computing stocks. Here you can find pioneers in quantum computing technologies who are influencing the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives