- United States

- /

- Software

- /

- NYSEAM:BMNR

Assessing Bitmine Immersion Technologies (BMNR) Valuation Following Recent Share Price Stability

Reviewed by Simply Wall St

If you are following Bitmine Immersion Technologies (BMNR) and wondering what is driving attention lately, you are not alone. Despite the absence of a clear news event, recent movement in the stock might have caught your eye. Sometimes, prices stir conversations not because of a dramatic announcement but simply because investors are looking for cues in a quiet market.

Bitmine Immersion Technologies has seen its share price climb over the past quarter, adding more than 5%. Gains since the start of the year echo a similar trend. Over the past year, however, its upward momentum has cooled, with returns settling below 3%. Other business or market developments have been relatively muted, allowing valuation questions to rise to the forefront.

With movement stabilizing after earlier growth, is Bitmine Immersion Technologies now trading at a bargain, or is the market simply betting on future improvement?

Price-to-Book of 2639.9x: Is it justified?

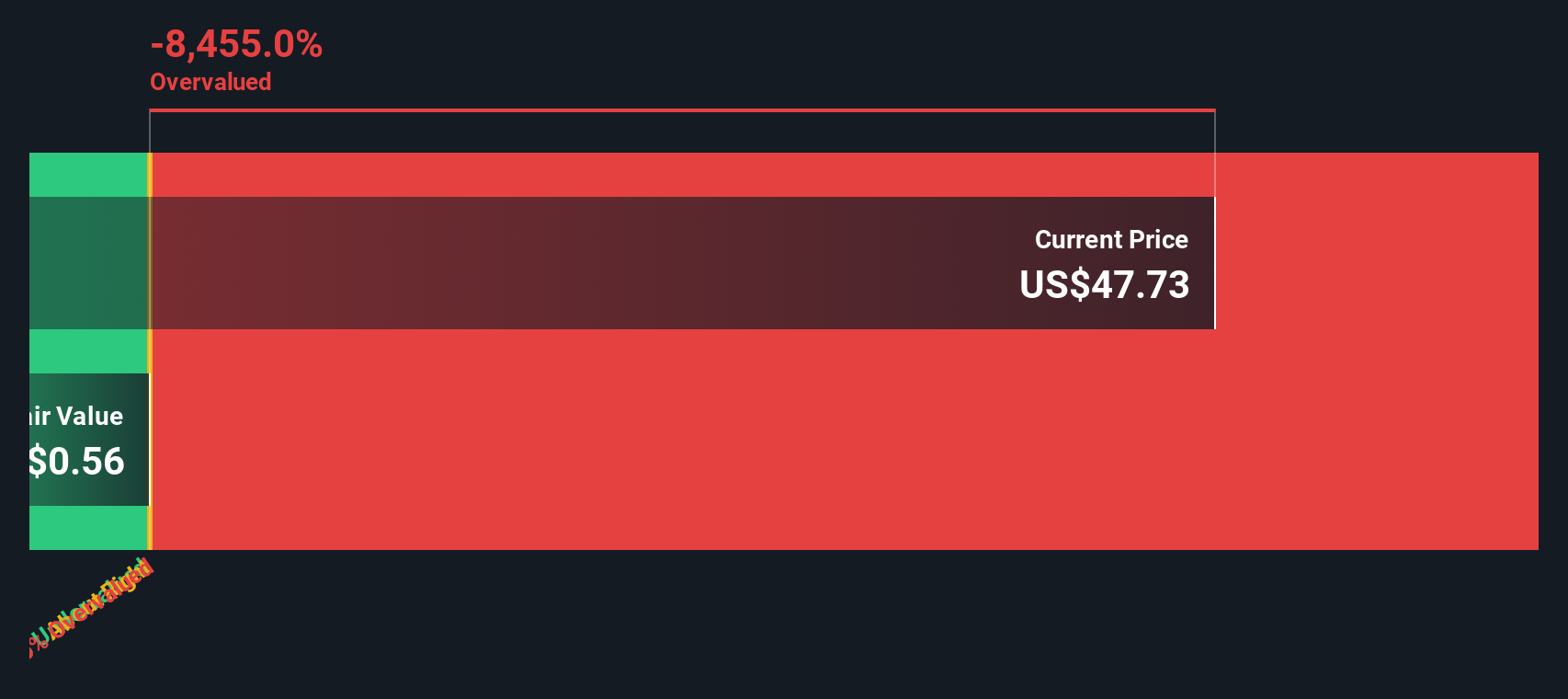

Based on the price-to-book ratio, Bitmine Immersion Technologies appears to be significantly overvalued compared to both the peer group and the wider industry. The valuation premium stands out sharply in the context of current market norms for U.S. software companies.

The price-to-book ratio compares a company's market value to its book value. This metric indicates how much investors are willing to pay for each dollar of net assets. In software, this multiple can run higher than in other sectors due to intangible assets and growth potential. However, extremely high ratios may point to disconnects with fundamentals.

With Bitmine Immersion Technologies sporting a price-to-book ratio of 2639.9x, while the peer average sits at just 11.3x and the broader software industry at 3.9x, the market is valuing assets well above historical or sector norms. Unless future earnings or asset growth expectations are exceptionally high, such a ratio is difficult to justify by standard valuation measures.

Result: Fair Value of $0.56 (OVERVALUED)

See our latest analysis for Bitmine Immersion Technologies.However, company fundamentals such as negative net income and limited revenue growth could quickly shift sentiment if market conditions deteriorate further.

Find out about the key risks to this Bitmine Immersion Technologies narrative.Another View: SWS DCF Model

Taking a step back from the price-to-book ratio, the SWS DCF model also points to Bitmine Immersion Technologies being overvalued. This approach digs into company cash flows and raises fresh questions about future returns. Could the true value lie somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bitmine Immersion Technologies Narrative

If the current perspective does not align with your view or you prefer diving into your own analysis, you can craft your own insights in just a few minutes. Do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the market by acting on promising investment trends. The right decisions today could put you on the path to smarter returns tomorrow. Don't miss out on these fresh opportunities.

- Jumpstart your search for hidden gems by scanning penny stocks with strong financials and uncover fast-growing companies with unexpectedly strong fundamentals.

- Maximize your income potential by tracking down top-yield picks with dividend stocks with yields > 3% and expand your portfolio with robust dividend payers delivering more than 3% annual yield.

- Get an edge in emerging tech by scouting companies at the forefront of healthcare and artificial intelligence through healthcare AI stocks, connecting you to future leaders reinventing the industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion