- United States

- /

- Software

- /

- NYSE:ZETA

Zeta Global Holdings (NYSE:ZETA) Sees 6% Stock Decline Despite US$15 Million Q4 Net Income

Reviewed by Simply Wall St

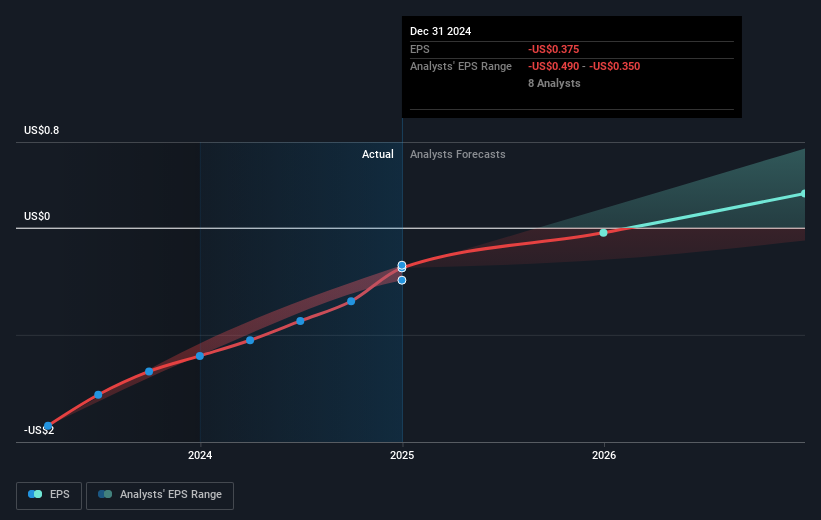

Zeta Global Holdings (NYSE:ZETA) has announced significant improvements in earnings for the fourth quarter and ambitious revenue guidance moving forward. However, over the last month, the company's stock price experienced a 6% decline. This was possibly influenced by the broader market downturn, with the tech-heavy Nasdaq Composite falling 4% amid concerns about the economy. Despite this, Zeta posted a net income of $15 million for Q4, a substantial improvement from the previous year's loss. Their strong earnings and EPS figures reflect operational progress, supported by an active share buyback program, yet these positive developments didn't shield the stock from the broader market sentiment. Economic concerns, including weak manufacturing data and tariff issues, likely weighed on investor sentiment for tech stocks, including NYSE:ZETA. While market dynamics remain influential, the company's strategic steps to boost shareholder value, like share buybacks, underscore their commitment to sustaining long-term growth despite a challenging environment.

Click here and access our complete analysis report to understand the dynamics of Zeta Global Holdings.

Over the past year, Zeta Global Holdings has achieved a total shareholder return of 66.93%, significantly outpacing the broader US Market and the US Software industry, which returned 15.3% and 4.4%, respectively. Key contributing factors include Zeta's revenue growth and improved financial performance. For instance, the company's full-year 2024 sales grew to US$1.01 billion from US$728.72 million the previous year, with a reduced net loss of US$69.77 million. Positive revisions in corporate guidance have also likely bolstered investor confidence.

In addition, Zeta's active share buyback program played a role in enhancing shareholder value. From October to December 2024, the company repurchased 751,016 shares for US$14.67 million, which may have supported its stock performance. Moreover, Zeta's valuation appears favorable, trading below the estimated fair value and at a good value compared to industry peers, highlighting a potential attraction for investors despite short-term fluctuations.

- Analyze Zeta Global Holdings' fair value against its market price in our detailed valuation report—access it here.

- Uncover the uncertainties that could impact Zeta Global Holdings' future growth—read our risk evaluation here.

- Shareholder in Zeta Global Holdings? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives