- United States

- /

- Airlines

- /

- NasdaqGS:ULCC

Top US Growth Stocks With High Insider Ownership In February 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a mix of earnings reports and geopolitical developments, major indices like the S&P 500 and Nasdaq Composite have experienced slight declines, reflecting investor caution amidst fluctuating corporate performances. In this environment, growth companies with high insider ownership can be appealing due to their potential alignment of interests between management and shareholders, offering a sense of stability and commitment even as broader market conditions remain volatile.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 33.8% |

| TeraWulf (NasdaqCM:WULF) | 14.8% | 49.4% |

| Similarweb (NYSE:SMWB) | 25.4% | 92.4% |

| RH (NYSE:RH) | 17% | 53.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Sportradar Group (NasdaqGS:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services for the sports betting and media industries across the United Kingdom, United States, Malta, Switzerland, and internationally; it has a market cap of approximately $6.35 billion.

Operations: Sportradar Group generates revenue from providing sports data services primarily to the sports betting and media industries across multiple regions, including the United Kingdom, United States, Malta, and Switzerland.

Insider Ownership: 31.9%

Revenue Growth Forecast: 11.5% p.a.

Sportradar Group's strong insider ownership aligns with its growth trajectory, as evidenced by a substantial increase in net income to €37.26 million for Q3 2024, up from €4.34 million the previous year. The company raised its revenue guidance to at least €1.09 billion for 2024 and is actively seeking M&A opportunities to enhance organic growth. Forecasts suggest earnings could grow significantly at 34.6% annually, outpacing the broader US market's expectations.

- Click to explore a detailed breakdown of our findings in Sportradar Group's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Sportradar Group shares in the market.

Frontier Group Holdings (NasdaqGS:ULCC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market cap of approximately $1.85 billion.

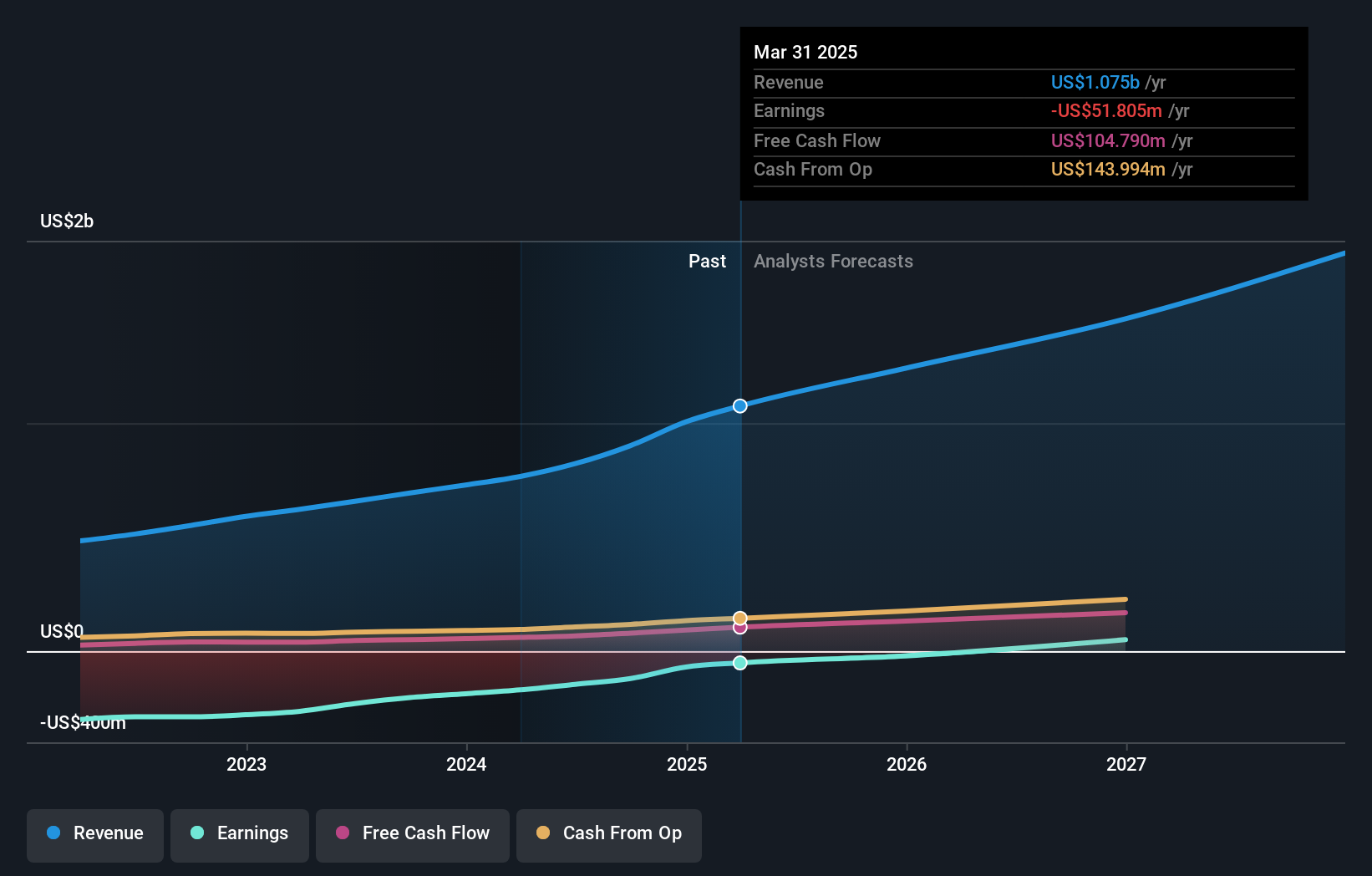

Operations: The company generates revenue of $3.66 billion from providing air transportation services for passengers.

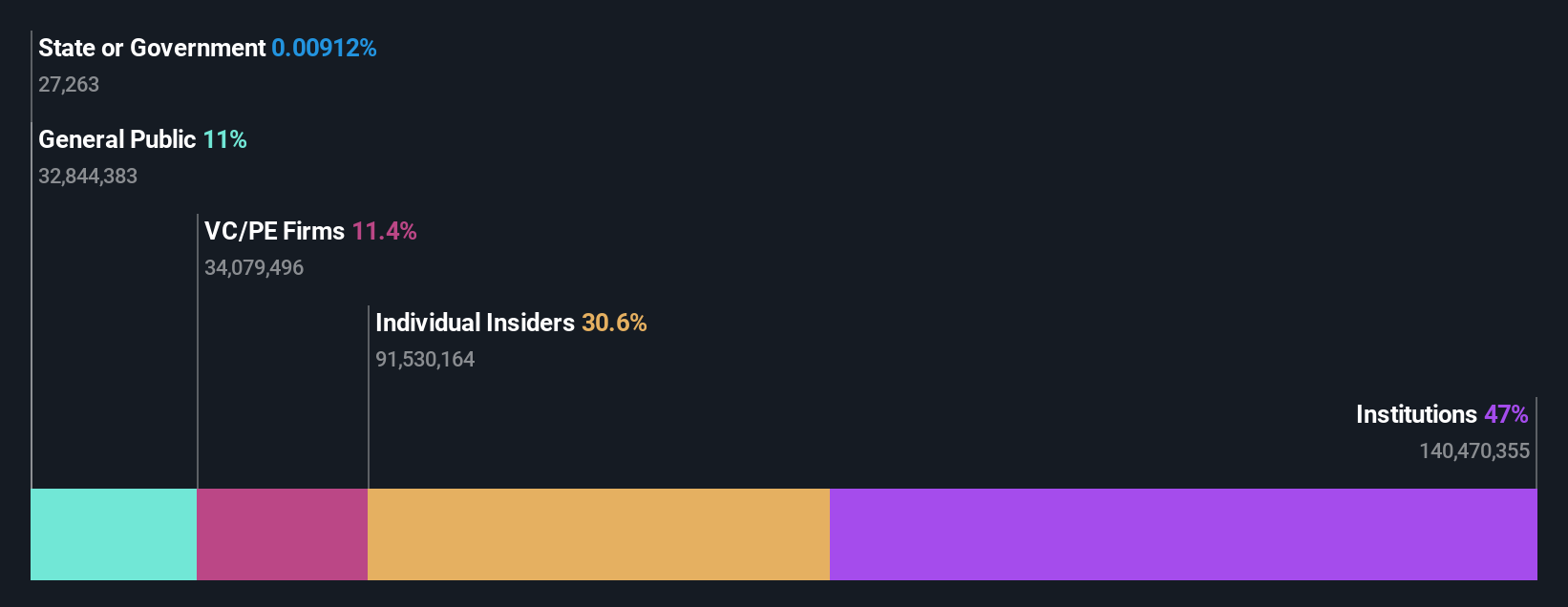

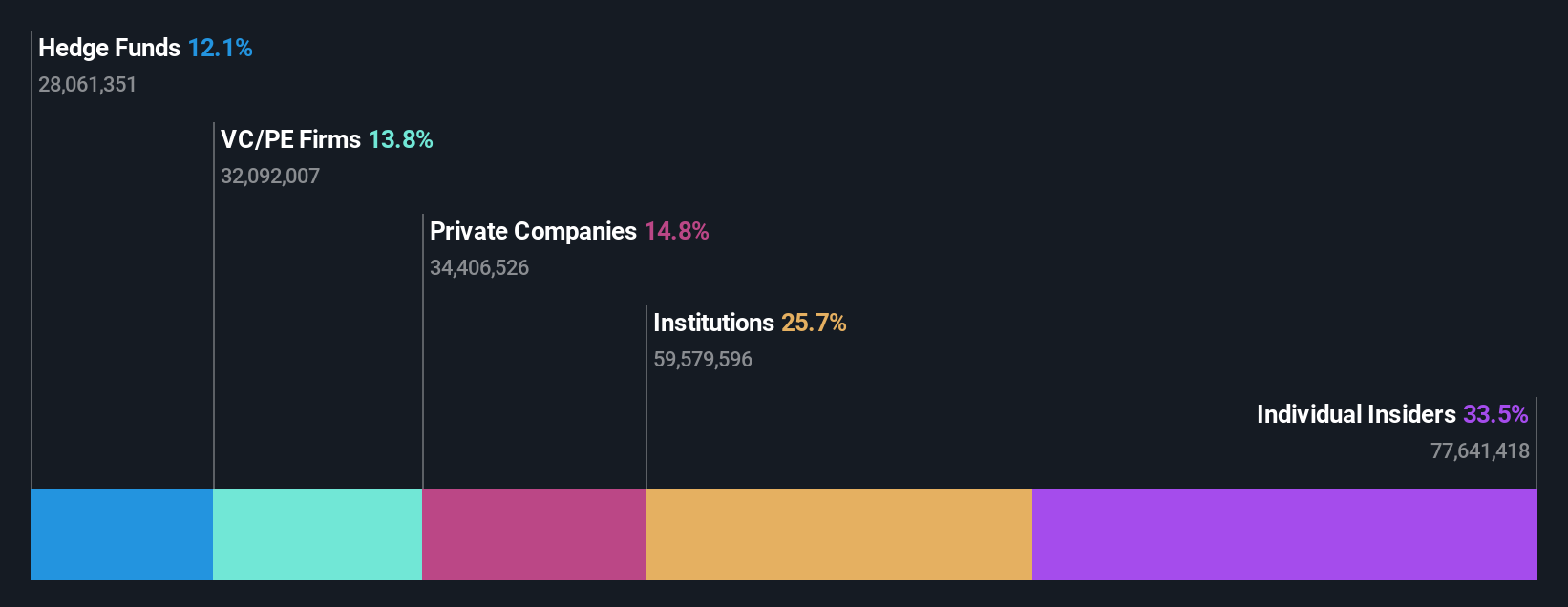

Insider Ownership: 34.1%

Revenue Growth Forecast: 13.4% p.a.

Frontier Group Holdings is experiencing significant insider buying, indicating confidence in its growth potential. The company is forecasted to achieve profitability within three years, with earnings expected to grow at 93% annually. Its revenue growth of 13.4% per year surpasses the US market average and it offers good relative value compared to peers. Recent inclusion in the S&P Transportation Select Industry Index and upcoming customer-focused enhancements underscore its strategic transformation efforts.

- Dive into the specifics of Frontier Group Holdings here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Frontier Group Holdings' share price might be too pessimistic.

Zeta Global Holdings (NYSE:ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $4.32 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated $901.40 million.

Insider Ownership: 18.8%

Revenue Growth Forecast: 15.8% p.a.

Zeta Global Holdings is experiencing substantial insider buying, reflecting confidence in its growth trajectory. The company is forecasted to achieve profitability within three years, with earnings projected to grow at 125.6% annually. Despite legal challenges related to data practices impacting stock volatility, Zeta's revenue growth of 15.8% per year outpaces the US market average and it trades below its estimated fair value. Recent executive appointments aim to enhance strategic growth initiatives in AI-driven marketing solutions.

- Navigate through the intricacies of Zeta Global Holdings with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Zeta Global Holdings' share price might be on the cheaper side.

Where To Now?

- Navigate through the entire inventory of 205 Fast Growing US Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULCC

Frontier Group Holdings

Provides low-fare passenger airline services to leisure travelers in the United States and Latin America.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives