- United States

- /

- Software

- /

- NYSE:ZETA

Is Athena by Zeta AI Innovation Altering the Investment Case for Zeta Global Holdings (ZETA)?

Reviewed by Sasha Jovanovic

- Earlier this week, Zeta Global unveiled Athena by Zeta™, an AI-powered superintelligent agent integrated into its marketing platform, designed to personalize digital workspaces, automate workflows, and provide instant insights for enterprise marketers.

- This launch underlines Zeta's effort to differentiate through proprietary technology and accelerate enterprise adoption of AI-driven marketing solutions.

- We'll examine how Athena's introduction and its advanced AI capabilities may reshape Zeta Global's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Zeta Global Holdings Investment Narrative Recap

To be a shareholder in Zeta Global today, you must believe the company’s proprietary AI capabilities like Athena can unlock sustained adoption and long-term revenue growth, while successfully defending its differentiation in a rapidly evolving martech market. The Athena launch amplifies Zeta’s short-term catalyst, rapid enterprise AI marketing adoption, yet does not remove core risks tied to ongoing net losses and increasing competition from larger platforms with their own integrated AI solutions.

Of Zeta’s recent moves, the introduction of Athena stands out as the most relevant for investors considering near-term catalysts. By integrating features such as automated workflows and conversational analytics directly into its marketing platform, Athena represents a meaningful product innovation aimed at deepening customer value and helping offset threats from commoditized AI competitors.

On the other hand, investors should be aware that persistent net losses and a need for…

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings is expected to reach $1.9 billion in revenue and $106.5 million in earnings by 2028. This projection requires an annual revenue growth rate of 18.3% and a $143.1 million increase in earnings from the current level of -$36.6 million.

Uncover how Zeta Global Holdings' forecasts yield a $26.50 fair value, a 44% upside to its current price.

Exploring Other Perspectives

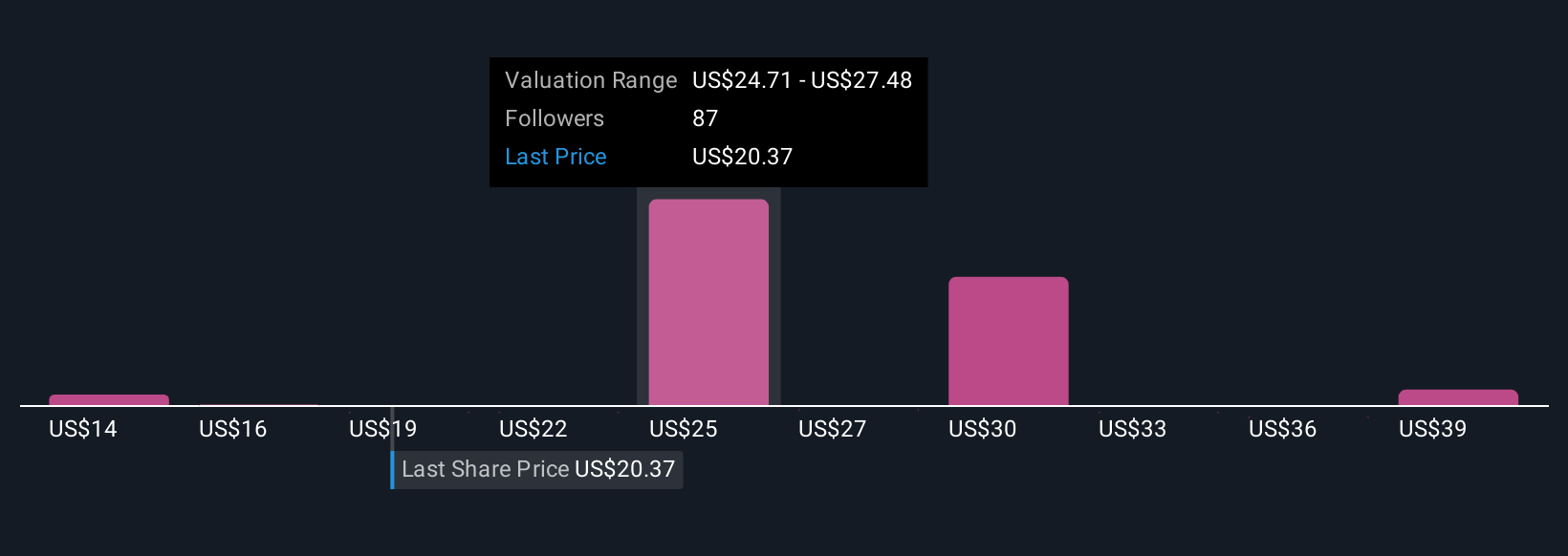

Twenty-nine members of the Simply Wall St Community estimate Zeta Global’s fair value ranging from US$13.63 to US$41.34 per share. While opinions are split, Zeta’s next phase depends heavily on whether its AI-powered innovations can command enduring client loyalty amid intensifying industry competition.

Explore 29 other fair value estimates on Zeta Global Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives