- United States

- /

- Software

- /

- NasdaqGS:AVPT

3 US Growth Companies With Up To 36% Insider Ownership

Reviewed by Simply Wall St

As U.S. markets experience fluctuations with investors closely analyzing inflation and jobs data, the focus remains on how economic indicators will influence Federal Reserve policies. In this environment, growth companies with substantial insider ownership can offer a unique perspective on potential resilience and confidence within the firm, as insiders may have deeper insights into their company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.4% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 41.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's take a closer look at a couple of our picks from the screened companies.

AvePoint (NasdaqGS:AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

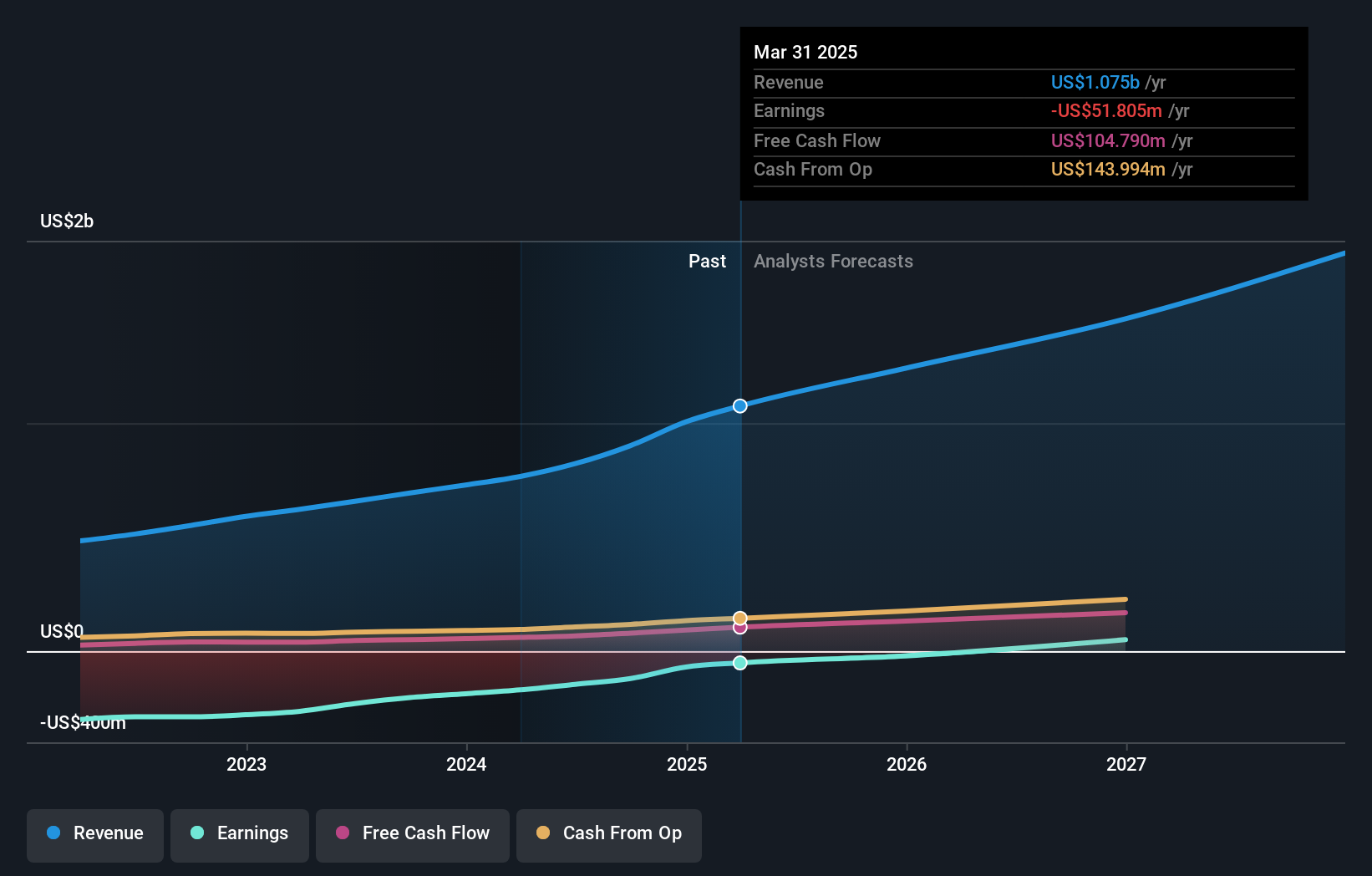

Overview: AvePoint, Inc. offers a cloud-native data management software platform across North America, Europe, the Middle East, Africa, and Asia Pacific with a market cap of approximately $2.30 billion.

Operations: The company's revenue segment includes Software & Programming, generating $299.88 million.

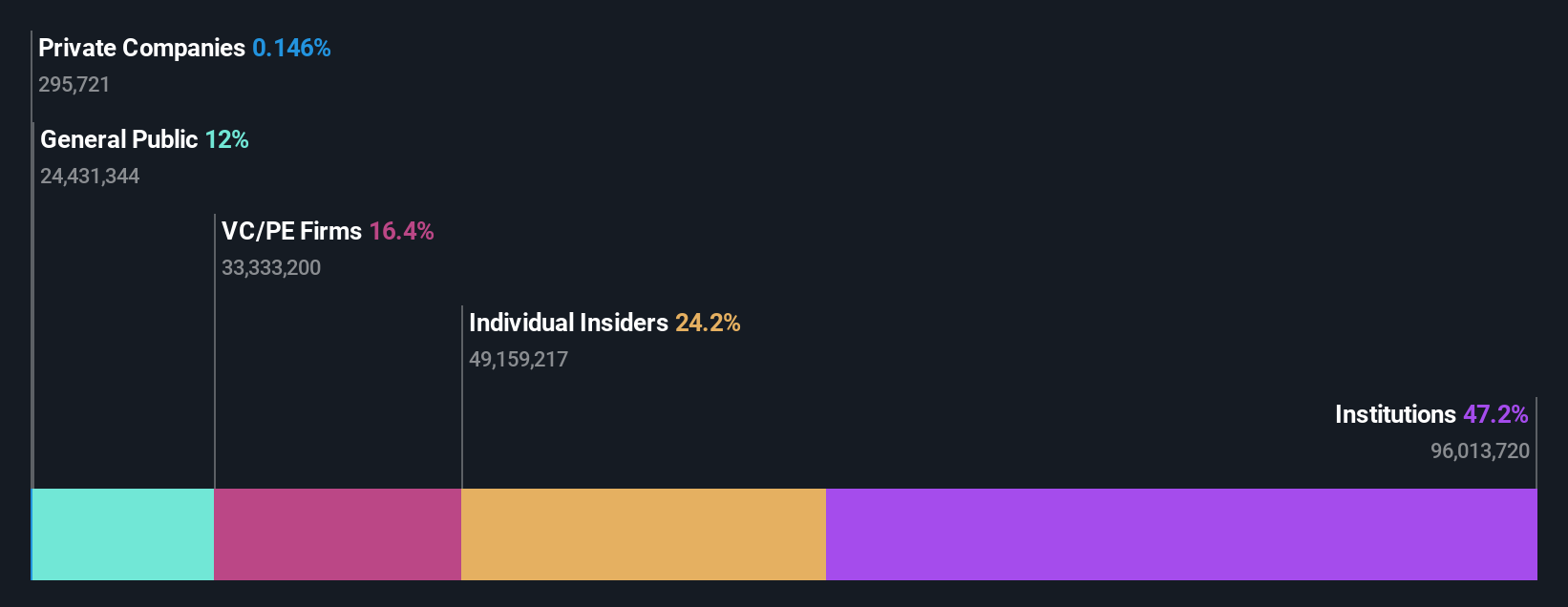

Insider Ownership: 36.8%

AvePoint exhibits significant growth potential with revenue expected to grow 17% annually, outpacing the broader US market. Despite recent insider selling, the company has a high level of insider ownership and is trading at a discount to its estimated fair value. Recent earnings reports show increased revenue but continued net losses. AvePoint's new product, Cloud Backup Express, enhances its data protection capabilities and positions it well in the multi-cloud security space.

- Click here and access our complete growth analysis report to understand the dynamics of AvePoint.

- In light of our recent valuation report, it seems possible that AvePoint is trading beyond its estimated value.

Simulations Plus (NasdaqGS:SLP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simulations Plus, Inc. develops drug discovery and development software using AI and machine learning for modeling, simulation, and molecular property prediction globally, with a market cap of $605.63 million.

Operations: The company's revenue is divided into two main segments: Services, generating $26.54 million, and Software, contributing $40.44 million.

Insider Ownership: 18.3%

Simulations Plus demonstrates growth potential with earnings projected to grow 22.31% annually, surpassing the US market average. Despite slower revenue growth at 18% per year, it remains above the market rate. The company is trading significantly below its estimated fair value and has high insider ownership, suggesting confidence in its prospects. Recent developments include a NIH research grant for innovative drug discovery methods and strategic leadership changes to support expansion following acquisitions.

- Click to explore a detailed breakdown of our findings in Simulations Plus' earnings growth report.

- Our expertly prepared valuation report Simulations Plus implies its share price may be lower than expected.

Zeta Global Holdings (NYSE:ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $7.63 billion.

Operations: The company generates revenue from its Internet Software & Services segment, amounting to $822.09 million.

Insider Ownership: 14.9%

Zeta Global Holdings is experiencing robust growth, with revenue expected to increase by 17.6% annually, outpacing the broader US market. The company anticipates profitability within three years and a high return on equity forecasted at 47%. Recent strategic moves include a $550 million refinancing to enhance liquidity and support acquisitions, as well as an expanded partnership with Yahoo for advanced marketing solutions. However, shareholder dilution occurred due to recent equity offerings totaling $310.2 million.

- Dive into the specifics of Zeta Global Holdings here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Zeta Global Holdings is priced higher than what may be justified by its financials.

Summing It All Up

- Click this link to deep-dive into the 182 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific.

Flawless balance sheet with reasonable growth potential.