- United States

- /

- IT

- /

- NasdaqGS:BCOV

US Penny Stocks To Watch: 3 Picks With Market Caps Under $500M

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with the Dow Jones Industrial Average reaching record highs and the S&P 500 extending its winning streak, investors are increasingly exploring diverse opportunities across various sectors. Penny stocks, a term that may seem outdated but remains significant in investment circles, offer a unique blend of affordability and potential growth. Typically representing smaller or newer companies, these stocks can be attractive for those looking to uncover value in less-established firms with strong financials and promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.79 | $6.1M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.83 | $2.29B | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2376 | $8.57M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.40 | $557.36M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8999 | $80.04M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $4.08 | $445.26M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

ProKidney (NasdaqCM:PROK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ProKidney Corp. is a clinical-stage biotechnology company focused on developing a proprietary cell therapy platform for treating chronic kidney diseases in the United States, with a market cap of $216.27 million.

Operations: ProKidney Corp. currently does not report any specific revenue segments.

Market Cap: $216.27M

ProKidney Corp., a clinical-stage biotechnology company, remains pre-revenue with less than US$1 million in revenue and faces ongoing financial challenges, evidenced by a net loss of US$17.91 million for Q3 2024. Despite this, the company has made strategic advancements in its Phase 3 trials for rilparencel, targeting advanced chronic kidney disease (CKD). The FDA's confirmation of an accelerated approval pathway offers potential regulatory advantages. ProKidney's cash reserves of US$430.2 million comfortably cover both short- and long-term liabilities and provide a runway into early 2027, although management and board experience are limited.

- Unlock comprehensive insights into our analysis of ProKidney stock in this financial health report.

- Examine ProKidney's earnings growth report to understand how analysts expect it to perform.

Brightcove (NasdaqGS:BCOV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brightcove Inc. offers cloud-based streaming services across multiple regions including the Americas, Europe, Asia Pacific, Japan, India, and the Middle East with a market cap of $143.98 million.

Operations: The company generates revenue from its Software & Programming segment, totaling $199.83 million.

Market Cap: $143.98M

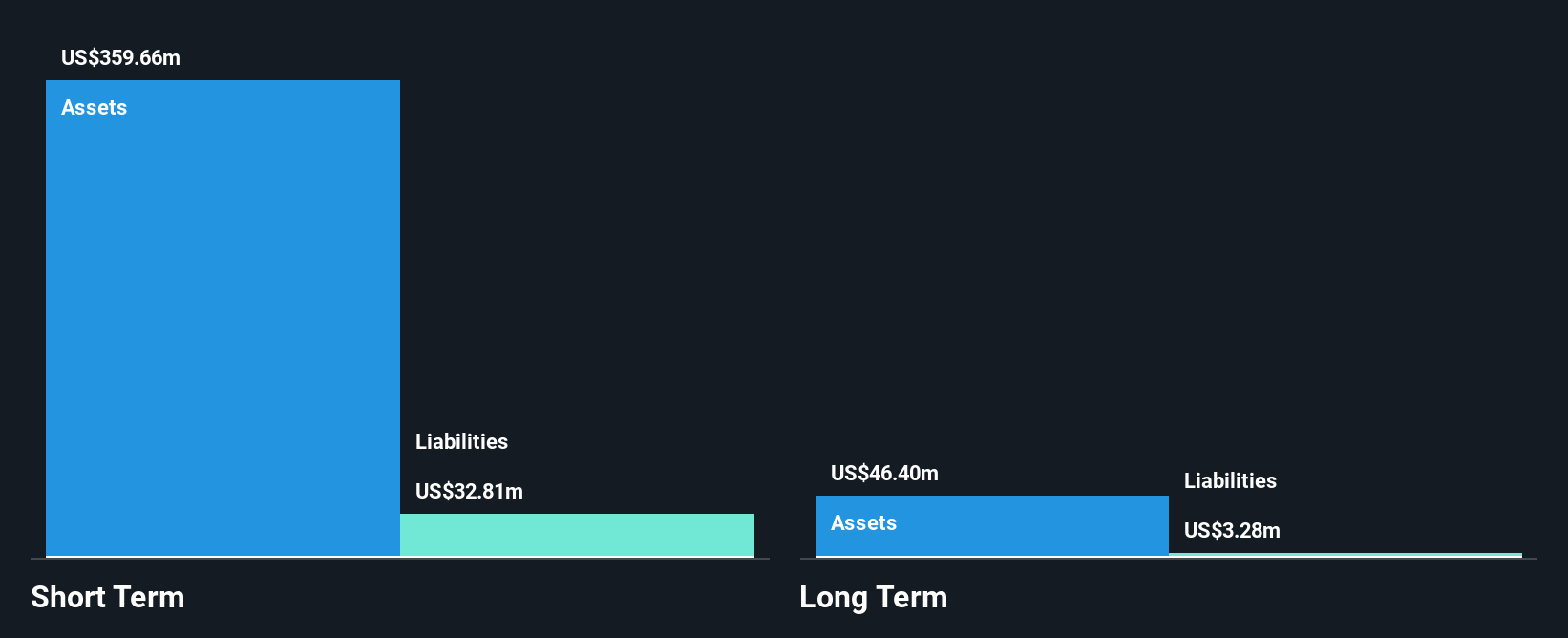

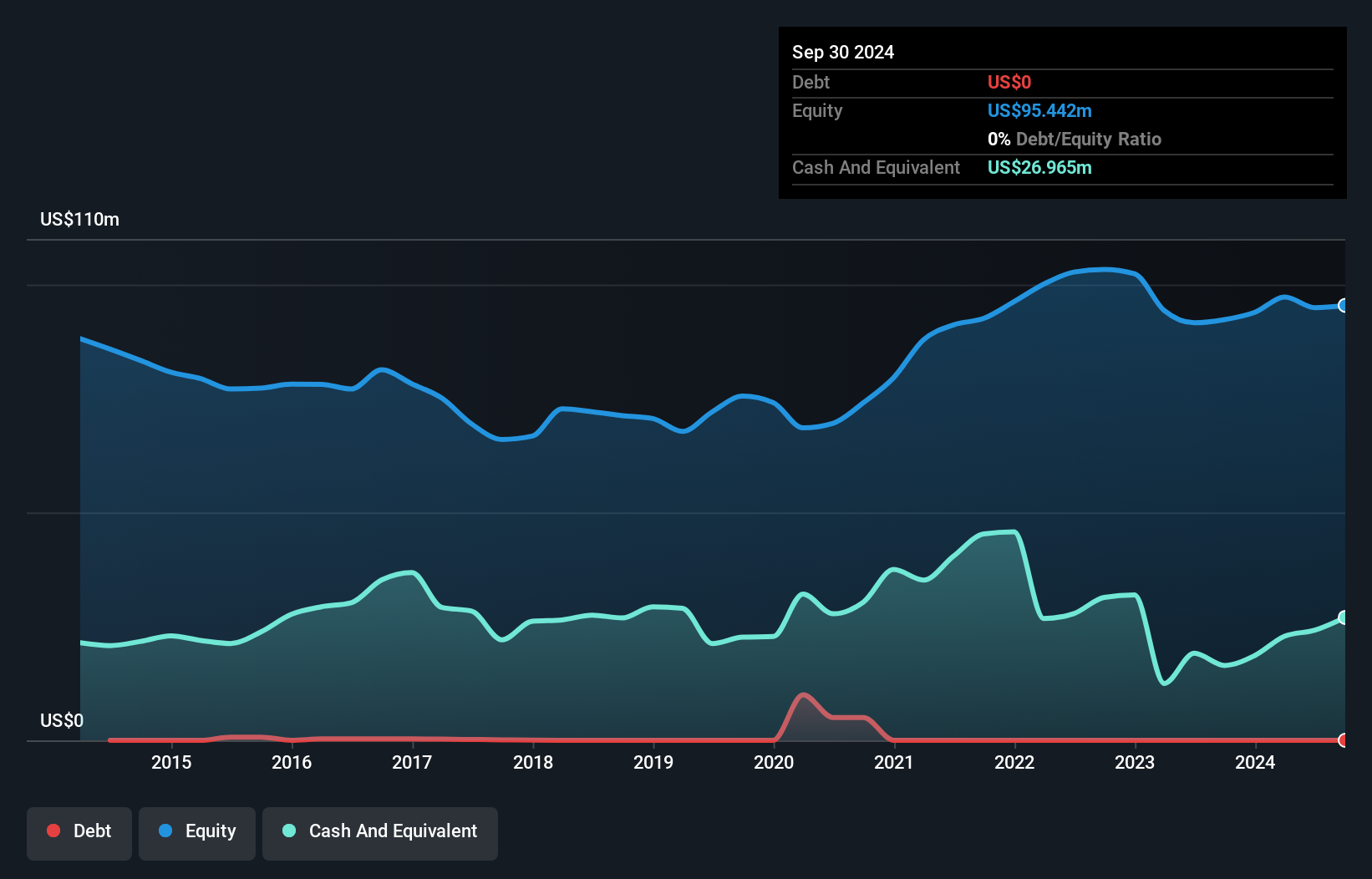

Brightcove Inc., with a market cap of US$143.98 million, operates in the cloud-based streaming sector, generating US$199.83 million in revenue from its Software & Programming segment. Despite being unprofitable and experiencing shareholder dilution, Brightcove is debt-free and maintains a cash runway exceeding three years. Recent developments include the launch of new video engagement solutions and an acquisition agreement by Bending Spoons S.p.A., valuing Brightcove at approximately US$230 million. This transaction, expected to close in early 2025, will transition Brightcove into a privately held entity, potentially impacting its future public market presence.

- Click to explore a detailed breakdown of our findings in Brightcove's financial health report.

- Review our growth performance report to gain insights into Brightcove's future.

Innovid (NYSE:CTV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Innovid Corp. operates an independent software platform offering ad serving, measurement, and creative services with a market cap of $453.11 million.

Operations: The company generates revenue of $151.56 million from its Advertising and Creative Services segment.

Market Cap: $453.11M

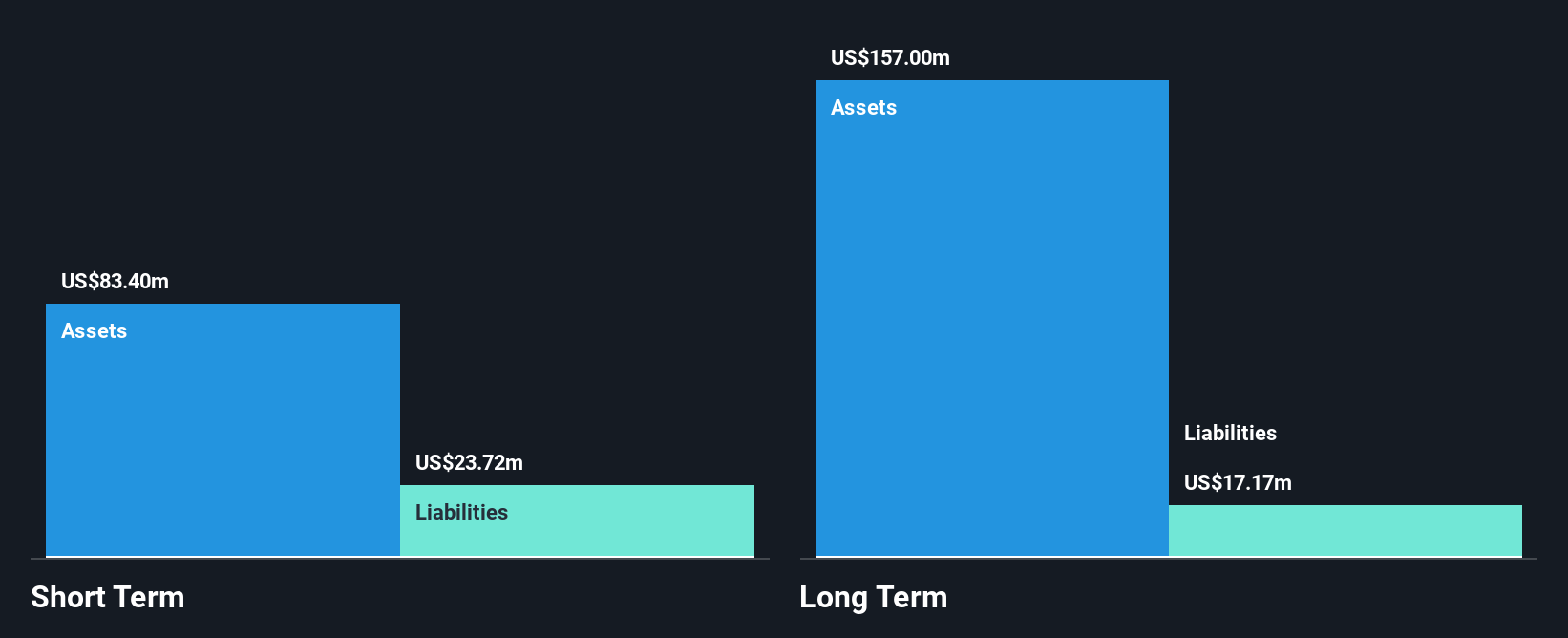

Innovid Corp., with a market cap of US$453.11 million, is experiencing significant developments in the ad tech sector. The company recently announced a merger agreement with Flashtalking, Inc., valued at approximately US$510 million, expected to close in early 2025. Despite past shareholder dilution and high share price volatility, Innovid has shown revenue growth, reporting US$38.25 million for Q3 2024 and projecting up to US$152.5 million for the year. While unprofitable, Innovid maintains a strong cash runway exceeding three years and plans a US$20 million share repurchase program amidst these strategic changes.

- Get an in-depth perspective on Innovid's performance by reading our balance sheet health report here.

- Gain insights into Innovid's future direction by reviewing our growth report.

Make It Happen

- Jump into our full catalog of 720 US Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brightcove might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BCOV

Brightcove

Provides cloud-based streaming services the Americas, Europe, the Asia Pacific, Japan, India, and the Middle East.

Excellent balance sheet and fair value.