- United States

- /

- Machinery

- /

- NasdaqCM:NNDM

Nano Dimension Leads 3 US Penny Stocks To Consider

Reviewed by Simply Wall St

As the Dow Jones and S&P 500 reach new highs, investors are increasingly looking for opportunities beyond the traditional large-cap stocks. Penny stocks, though often considered a relic of past trading days, still hold potential for those willing to explore smaller or newer companies with solid financial foundations. These stocks can offer a unique blend of affordability and growth potential, making them an intriguing option for investors seeking hidden value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.83945 | $6.1M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.80 | $2.29B | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.233 | $8.57M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.39 | $557.36M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.55 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8899 | $80.04M | ★★★★★☆ |

| VCI Global (NasdaqCM:VCIG) | $1.975 | $6.12M | ★★★★★☆ |

Click here to see the full list of 729 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Nano Dimension (NasdaqCM:NNDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nano Dimension Ltd. is a company that provides additive manufacturing solutions both in Israel and internationally, with a market cap of $462.59 million.

Operations: The company's revenue is generated from its Printers & Related Products segment, which amounts to $57.66 million.

Market Cap: $462.59M

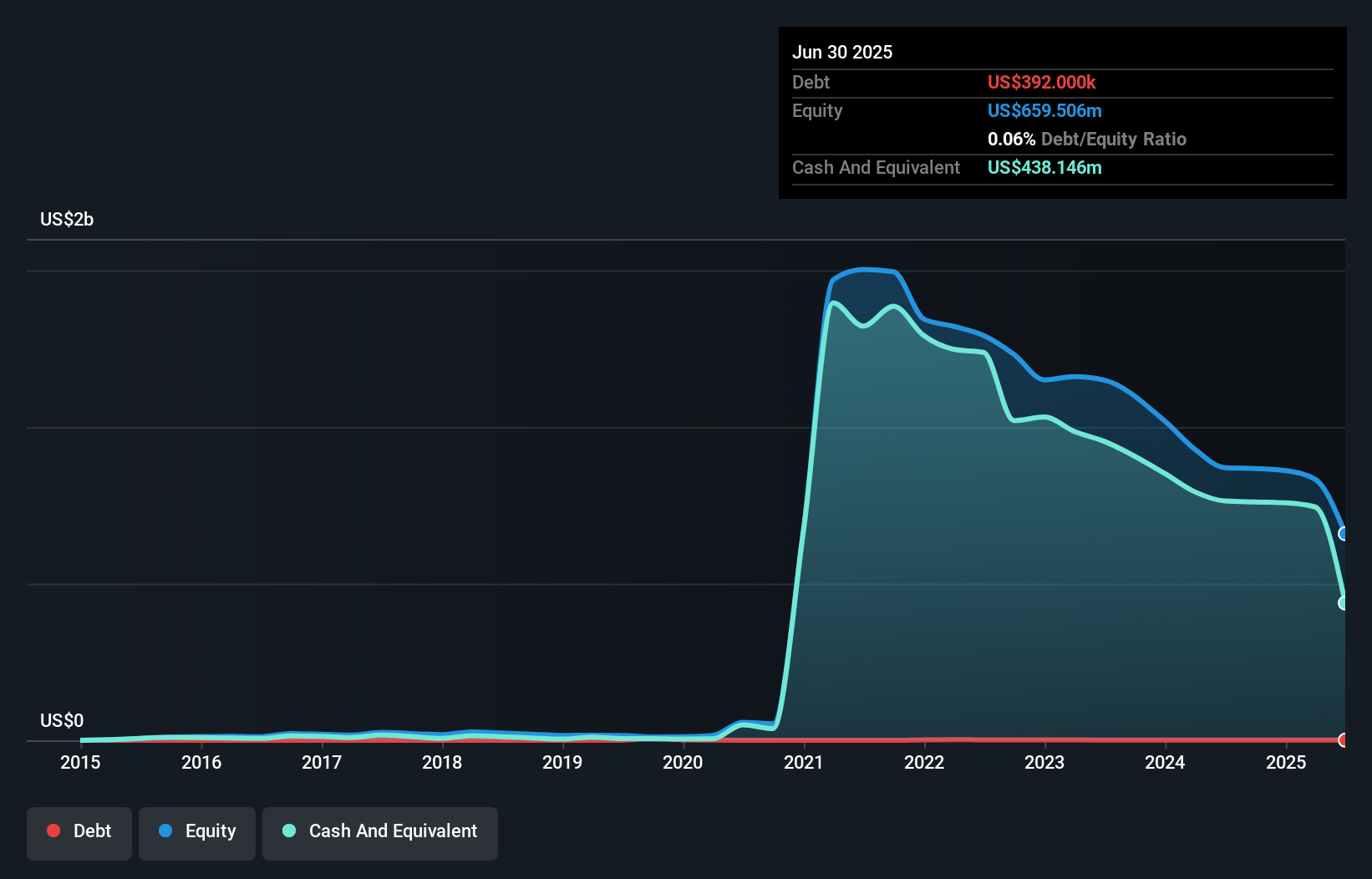

Nano Dimension Ltd., with a market cap of US$462.59 million, operates in the additive manufacturing sector and has recently been embroiled in significant investor activism. The company reported third-quarter 2024 sales of US$14.86 million, an improvement from the previous year, though it remains unprofitable with a net loss of US$8.35 million for the quarter. Despite its financial challenges, Nano Dimension holds more cash than debt and maintains sufficient cash to cover over three years of operations at current burn rates. Recent boardroom disputes highlight concerns about governance and strategic direction as shareholders prepare for a critical vote on December 6, 2024.

- Click here and access our complete financial health analysis report to understand the dynamics of Nano Dimension.

- Gain insights into Nano Dimension's historical outcomes by reviewing our past performance report.

Zentalis Pharmaceuticals (NasdaqGM:ZNTL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zentalis Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company dedicated to developing small molecule therapeutics for cancer treatment, with a market cap of $230.19 million.

Operations: Zentalis Pharmaceuticals, Inc. currently does not report any revenue segments.

Market Cap: $230.19M

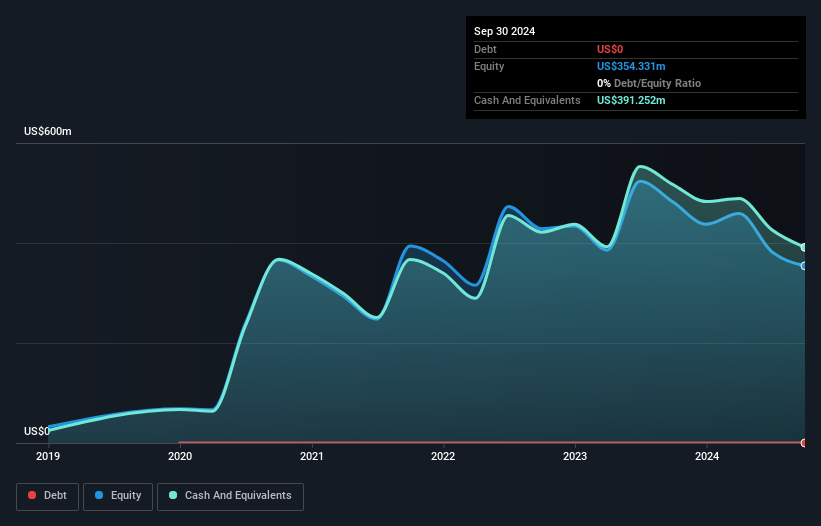

Zentalis Pharmaceuticals, Inc., with a market cap of US$230.19 million, is a pre-revenue biopharmaceutical company focused on cancer therapeutics. Recent executive changes include the appointment of Julie Eastland as CEO to steer the company through its clinical trials for azenosertib, following the FDA's lift of a partial clinical hold. Despite being unprofitable and experiencing volatile share prices, Zentalis has no debt and sufficient cash runway for nearly two years based on current free cash flow trends. The company's short-term assets significantly exceed its liabilities, providing some financial stability amidst ongoing development challenges.

- Click to explore a detailed breakdown of our findings in Zentalis Pharmaceuticals' financial health report.

- Explore Zentalis Pharmaceuticals' analyst forecasts in our growth report.

Sight Sciences (NasdaqGS:SGHT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sight Sciences, Inc. is an ophthalmic medical device company focused on developing and commercializing surgical and nonsurgical technologies for treating eye diseases, with a market cap of $203.53 million.

Operations: Sight Sciences generates revenue from two main segments: Dry Eye, which contributed $5.26 million, and Surgical Glaucoma, accounting for $74.28 million.

Market Cap: $203.53M

Sight Sciences, Inc., with a market cap of US$203.53 million, is navigating through executive transitions with the appointment of Dr. MK Raheja and Brenton Taylor to key leadership roles. Despite being unprofitable and having experienced significant insider selling recently, the company maintains a solid cash runway exceeding three years and has more cash than debt. Its revenue guidance for 2024 remains steady at US$81-83 million, driven by its Dry Eye and Surgical Glaucoma segments. While shareholders faced dilution last year, Sight Sciences trades at good value compared to peers and industry standards amidst stable volatility levels.

- Get an in-depth perspective on Sight Sciences' performance by reading our balance sheet health report here.

- Gain insights into Sight Sciences' future direction by reviewing our growth report.

Seize The Opportunity

- Click this link to deep-dive into the 729 companies within our US Penny Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nano Dimension might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NNDM

Nano Dimension

Engages in additive manufacturing solutions in Israel and internationally.

Flawless balance sheet minimal.