- United States

- /

- Software

- /

- NYSE:KVYO

3 Stocks With Estimated Discounts Up To 49.7% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market navigates through a mix of earnings reports and tariff news, investors are keenly analyzing opportunities amidst fluctuating indices. In this environment, identifying undervalued stocks becomes crucial, as these equities potentially offer significant discounts below their intrinsic value despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $13.41 | $26.38 | 49.2% |

| Similarweb (SMWB) | $7.57 | $14.92 | 49.2% |

| Rhythm Pharmaceuticals (RYTM) | $90.01 | $178.91 | 49.7% |

| Old National Bancorp (ONB) | $20.72 | $40.13 | 48.4% |

| Gogo (GOGO) | $15.31 | $30.29 | 49.5% |

| First Commonwealth Financial (FCF) | $16.54 | $32.97 | 49.8% |

| Duolingo (DUOL) | $343.61 | $677.05 | 49.2% |

| Berkshire Hills Bancorp (BHLB) | $24.23 | $46.67 | 48.1% |

| Atlantic Union Bankshares (AUB) | $31.69 | $62.54 | 49.3% |

| ACNB (ACNB) | $41.75 | $80.99 | 48.5% |

Let's review some notable picks from our screened stocks.

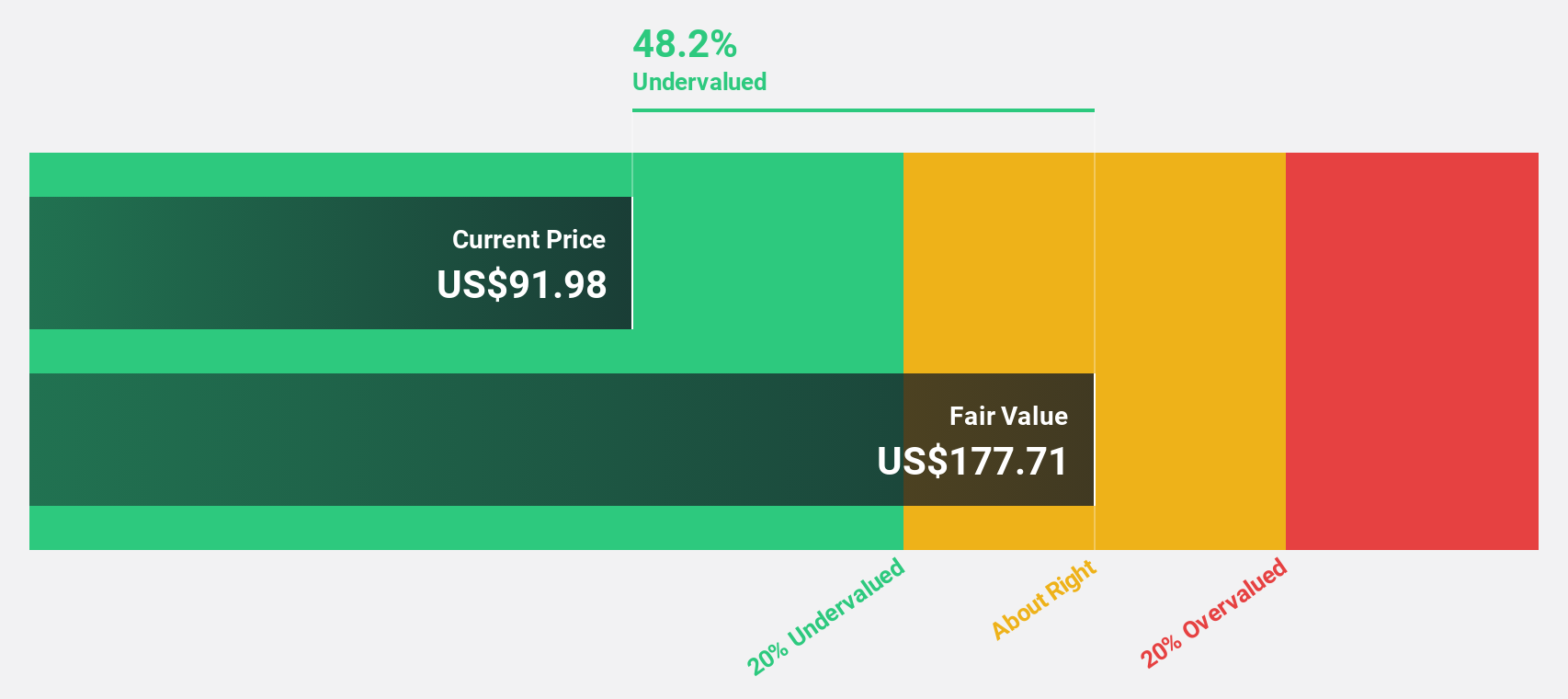

Rhythm Pharmaceuticals (RYTM)

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company specializing in treatments for rare neuroendocrine diseases, with a market cap of $5.84 billion.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, which generated $156.29 million.

Estimated Discount To Fair Value: 49.7%

Rhythm Pharmaceuticals is trading at US$90.01, significantly below its estimated fair value of US$178.91, suggesting it may be undervalued based on cash flows. Despite reporting a net loss of US$46.63 million in Q2 2025, the company's revenue grew to US$48.5 million from US$29.08 million year-over-year, highlighting strong growth potential. With revenue expected to grow 44.2% annually and profitability anticipated within three years, Rhythm's valuation appears attractive despite recent share price volatility and ongoing losses.

- The growth report we've compiled suggests that Rhythm Pharmaceuticals' future prospects could be on the up.

- Navigate through the intricacies of Rhythm Pharmaceuticals with our comprehensive financial health report here.

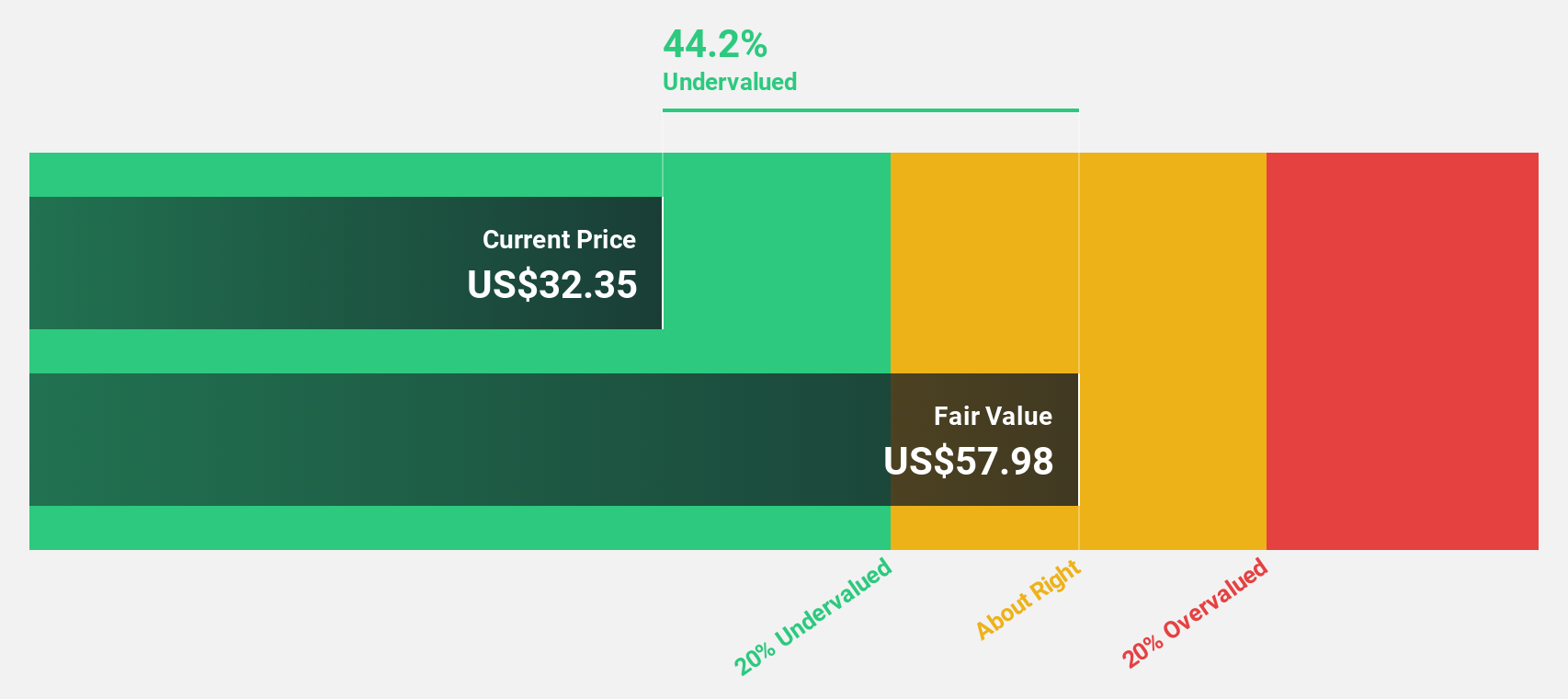

Klaviyo (KVYO)

Overview: Klaviyo, Inc. is a technology company offering a software-as-a-service platform across multiple regions including the Americas, Asia-Pacific, Europe, the Middle East, and Africa with a market cap of $8.47 billion.

Operations: Klaviyo generates revenue primarily from its Internet Software segment, amounting to $1.01 billion.

Estimated Discount To Fair Value: 39.6%

Klaviyo, Inc., trading at US$35.31, is valued below its estimated fair value of US$58.48, indicating potential undervaluation based on cash flows. The company's Q2 2025 sales rose to US$293.12 million from US$222.21 million year-over-year despite a net loss increase to US$24.28 million from US$4.94 million last year. Revenue is projected to grow faster than the market at 17.4% annually, with profitability expected within three years, enhancing its investment appeal amidst executive transitions and product innovations.

- The analysis detailed in our Klaviyo growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Klaviyo.

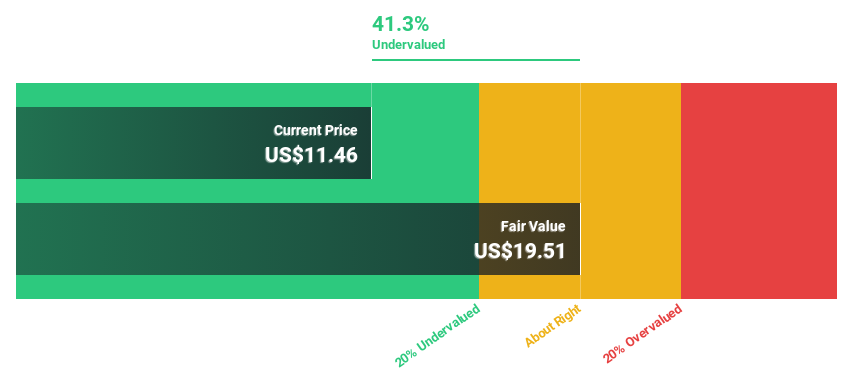

Zeta Global Holdings (ZETA)

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $3.74 billion.

Operations: Revenue segments for Zeta Global Holdings include its omnichannel data-driven cloud platform, which provides consumer intelligence and marketing automation software to enterprises both in the U.S. and internationally.

Estimated Discount To Fair Value: 10.1%

Zeta Global Holdings, trading at US$20.23, is slightly undervalued compared to its fair value of US$22.49. Recent Q2 results show sales increasing to US$308.44 million from US$227.84 million a year ago, with net losses narrowing significantly. The company raised its revenue guidance for 2025 and announced a share repurchase program worth up to $200 million, reflecting strong cash flow management despite high share price volatility and ongoing executive changes in AI leadership roles.

- In light of our recent growth report, it seems possible that Zeta Global Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Zeta Global Holdings' balance sheet health report.

Where To Now?

- Explore the 176 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives