- United States

- /

- Software

- /

- NYSE:ZEN

Zendesk, Inc. (NYSE:ZEN): Does The Earnings Decline Make It An Underperformer?

When Zendesk, Inc. (NYSE:ZEN) announced its most recent earnings (31 March 2020), I compared it against two factor: its historical earnings track record, and the performance of its industry peers on average. Being able to interpret how well Zendesk has done so far requires weighing its performance against a benchmark, rather than looking at a standalone number at a point in time. In this article, I've summarized the key takeaways on how I see ZEN has performed.

See our latest analysis for Zendesk

Was ZEN's recent earnings decline indicative of a tough track record?

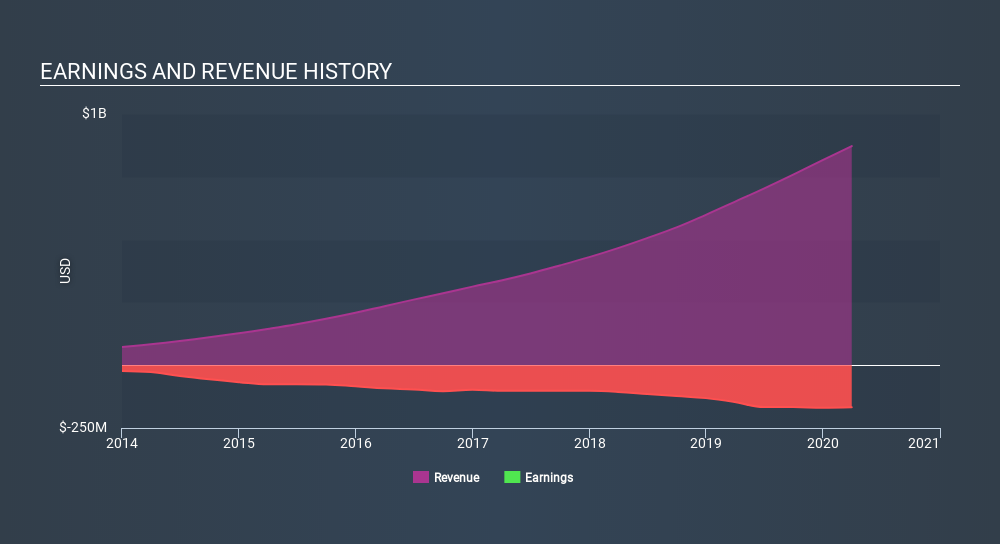

ZEN is loss-making, with the most recent trailing twelve-month earnings of -US$167.7m (from 31 March 2020), which compared to last year has become more negative. Furthermore, the company's loss seem to be growing over time, with the five-year earnings average of -US$100.8m. Each year, for the past five years ZEN has seen an annual increase in operating expense growth, outpacing revenue growth of 32%, on average. This adverse movement is a driver of the company's inability to reach breakeven.

Viewing growth from a sector-level, the US software industry has been growing its average earnings by double-digit 17% over the past twelve months, and 29% over the past five. This growth is a median of profitable companies of 25 Software companies in US including SolarWinds, salesforce.com and ZIM. This suggests that whatever uplift the industry is deriving benefit from, Zendesk has not been able to leverage it as much as its industry peers.

Given that Zendesk is currently unprofitable, with operating expenses (opex) growing year-on-year at 25%, it may need to raise more cash over the next year. It currently has US$468m in cash and short-term investments, however, opex (SG&A and one-year R&D) reachedUS$785m in the latest twelve months. Although this is a relatively simplistic calculation, and Zendesk may reduce its costs or open a new line of credit instead of issuing new equity shares, the analysis still gives us an idea of the company’s timeline and when things will have to start changing, since its current operation is unsustainable.

What does this mean?

Zendesk's track record can be a valuable insight into its earnings performance, but it certainly doesn't tell the whole story. Companies that incur net loss is always hard to forecast what will happen in the future and when. The most valuable step is to assess company-specific issues Zendesk may be facing and whether management guidance has dependably been met in the past. I suggest you continue to research Zendesk to get a more holistic view of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for ZEN’s future growth? Take a look at our free research report of analyst consensus for ZEN’s outlook.

- Financial Health: Are ZEN’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 March 2020. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ZEN

Zendesk

Zendesk, Inc., a software development company, provides software as a service solutions for organizations in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives