- United States

- /

- Software

- /

- NYSE:ZEN

Did The Underlying Business Drive Zendesk's (NYSE:ZEN) Lovely 391% Share Price Gain?

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Zendesk, Inc. (NYSE:ZEN) shares for the last five years, while they gained 391%. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 44% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

See our latest analysis for Zendesk

Zendesk isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Zendesk saw its revenue grow at 31% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 37% per year in that time. Despite the strong run, top performers like Zendesk have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

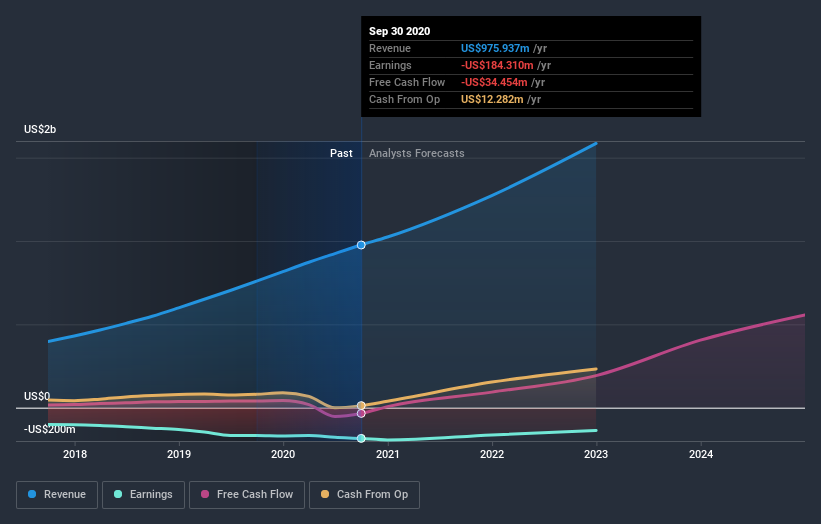

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Zendesk stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Zendesk shareholders have received a total shareholder return of 63% over one year. That's better than the annualised return of 37% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Zendesk better, we need to consider many other factors. Even so, be aware that Zendesk is showing 4 warning signs in our investment analysis , you should know about...

Of course Zendesk may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Zendesk, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zendesk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:ZEN

Zendesk

Zendesk, Inc., a software development company, provides software as a service solutions for organizations in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives