- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (YOU): Valuation in Focus as Airport Expansions and Tech Partnerships Accelerate Growth Prospects

Reviewed by Kshitija Bhandaru

Clear Secure (YOU) is making headlines again, this time with a pair of announcements that could make investors sit up and take notice. The company has just unveiled its identity verification technology at John Wayne Airport in Orange County, bringing its footprint to 60 airports nationwide. In addition, a recent expansion at San Diego International highlights that Clear Secure is moving fast to keep up with the evolving demands of travel and digital security. These developments follow ambitious plans to roll out new biometric eGates, which aim to streamline airport experiences as the industry prepares for major events such as the 2026 FIFA World Cup.

These business moves come at a time when investor interest in Clear Secure has been building, fueled by a steady climb in the share price over the past three months. The stock has risen 33% in that period and is up 15% over the past year, reinforcing a sense of momentum not just from news headlines but from actual market performance. Beyond airports, Clear Secure is finding new relevance. The partnership with Docusign, for example, points to growing demand for secure digital identity solutions outside the travel sector.

All these expansions and partnerships invite the question: with the stock already rallying this year, is Clear Secure a buy at current levels, or is the market already pricing in these growth prospects?

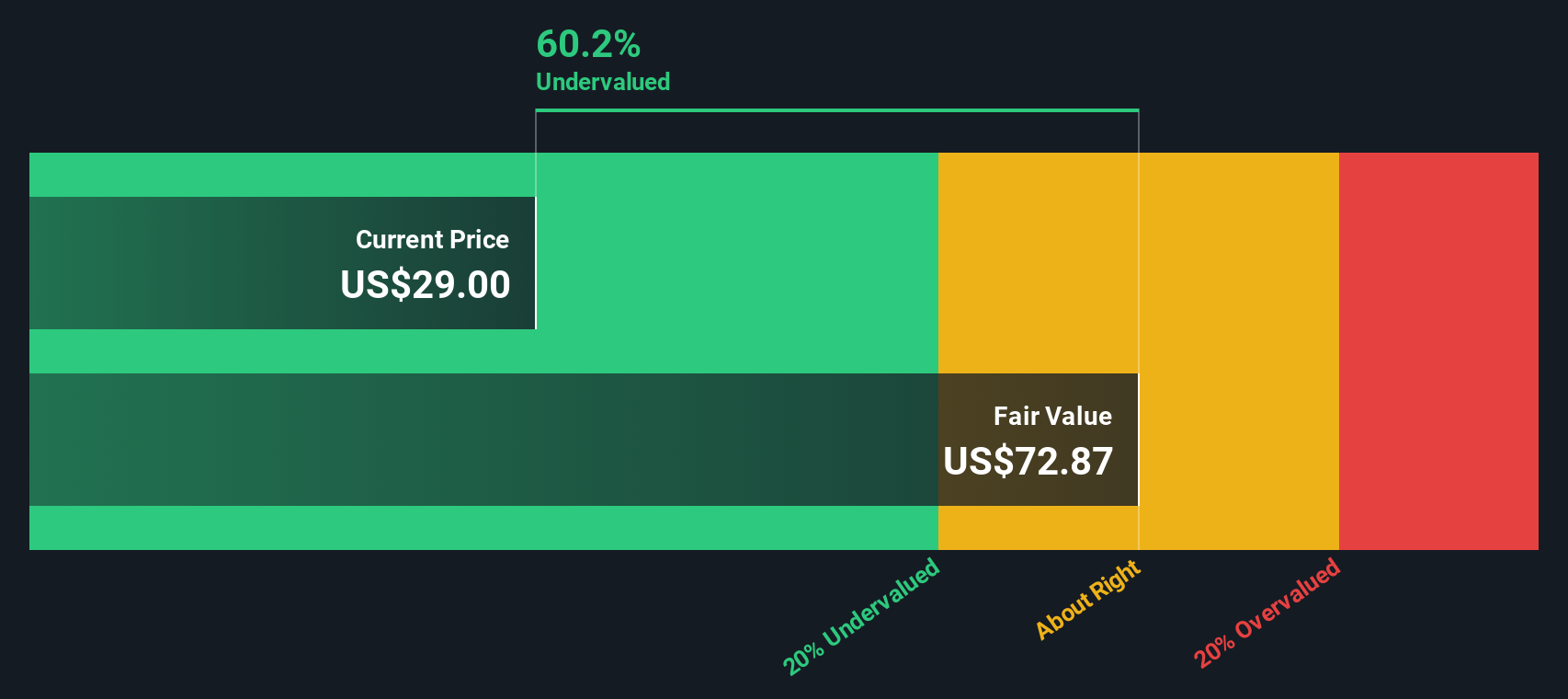

Most Popular Narrative: 21.5% Undervalued

The current market narrative suggests Clear Secure is trading well below its calculated fair value. Expansion and partnerships are powering upbeat projections for growth and profitability in the years ahead.

"Revenue is expected to grow from $735M today to approximately $1.5B by 2030, representing an annual growth rate of ~12.58%. Profit margins are expected to improve from current levels to reach 16% by 2030, driven by operational efficiencies from EnVe technology deployment and economies of scale."

Curious about what could drive such a high fair value? The story hinges on aggressive assumptions for user enrollment, profit margins, and the impact of new technology. Which numbers make this growth outlook so ambitious? Find out which surprising metrics fuel this narrative's bold target.

Result: Fair Value of $46.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated subscription costs and increasing airport fees could dampen user growth, serving as real-world checks on this optimistic upside narrative.

Find out about the key risks to this Clear Secure narrative.Another View: Discounted Cash Flow Perspective

Looking from another angle, the SWS DCF model also points to Clear Secure being priced below its underlying value. This method weighs future cash flows and offers a reality check for growth expectations. Is this the truest measure?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clear Secure Narrative

If you see things differently or want to dig deeper into the numbers, it's easy to run your own analysis and build a personalized scenario. Do it your way.

A great starting point for your Clear Secure research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by searching for untapped opportunities across new sectors. If you want to uncover the strongest trends and breakthroughs, don’t miss these tailored stock ideas, all just a click away:

- Tap into profit potential by finding companies with undervalued stocks based on cash flows, and seize opportunities before they hit the mainstream.

- Capitalize on fast-moving healthcare innovation by checking out healthcare AI stocks, set to transform medicine and patient care with intelligent technology.

- Boost your income with shares offering dividend stocks with yields > 3%, ideal for building a reliable stream of returns while staying ahead of rising markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives