- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (NYSE:YOU) Enhances Growth with Selfii Partnership and Dividend Increase

Reviewed by Simply Wall St

Clear Secure (NYSE:YOU) continues to demonstrate impressive financial health, with a notable increase in sales and net income in the second quarter, reflecting effective cost management and strategic market expansion. Recent developments, including a partnership with Selfii to enhance patient data access and inclusion in multiple S&P indices, highlight the company's commitment to innovation and market recognition. However, operational challenges and economic pressures pose risks, necessitating careful navigation to sustain growth and capitalize on undervaluation opportunities.

Take a closer look at Clear Secure's potential here.

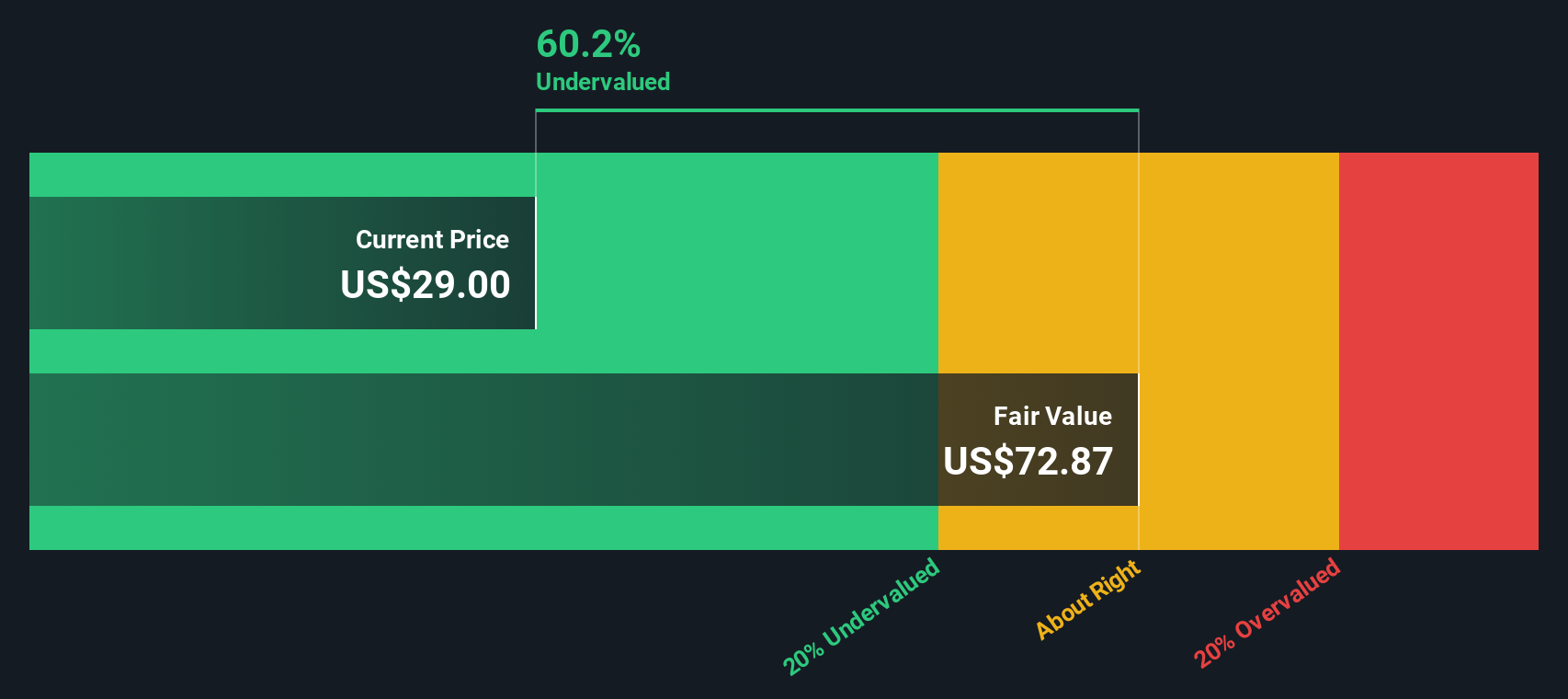

Core Advantages Driving Sustained Success for Clear Secure

Clear Secure's financial performance is evident from its impressive second-quarter results, showcasing a significant increase in sales to $186.75 million from $149.87 million the previous year. This growth, coupled with a net income surge to $24.12 million, highlights the company's effective cost management and strategic initiatives. The leadership's focus on market expansion, particularly in underserved areas like smaller airports, is a strategic move to enhance customer relationships and broaden its footprint. Additionally, the company's commitment to innovation, as emphasized by its new product lines, is set to drive future revenue growth and customer loyalty. Notably, Clear Secure is trading at $34.77, significantly below its estimated fair value of $79.19, suggesting potential undervaluation based on discounted cash flow analysis.

To dive deeper into how Clear Secure's valuation metrics are shaping its market position, check out our detailed analysis of Clear Secure's Valuation.Critical Issues Affecting the Performance of Clear Secure and Areas for Growth

Operational challenges remain a concern, with the company facing difficulties in scaling operations to meet growing demand, potentially impacting service quality. Rising costs due to inflationary pressures also pose a risk to margins, necessitating careful cost management. Furthermore, the high Price-To-Earnings Ratio of 44.8x compared to the industry average of 39x raises questions about valuation. The recent initiation of dividend payments, while a positive step, introduces uncertainty regarding their stability and reliability.

Learn about Clear Secure's dividend strategy and how it impacts shareholder returns and financial stability.Areas for Expansion and Innovation for Clear Secure

The partnership with Selfii to enhance patient access to health records represents a strategic alliance that aligns with healthcare regulations and expands Clear Secure's market presence. This collaboration not only simplifies patient data access but also strengthens the company's position in the healthcare sector. Additionally, the company's inclusion in multiple S&P indices, such as the S&P 1000 and S&P 600, underscores its growing market recognition and potential for significant earnings growth over the next three years.

To gain deeper insights into Clear Secure's historical performance, explore our detailed analysis of past performance.Regulatory Challenges Facing Clear Secure

Economic headwinds and regulatory hurdles present ongoing challenges. The management's proactive stance in monitoring macroeconomic indicators and preparing for regulatory changes reflects a strategic approach to mitigating risks. Supply chain vulnerabilities also require attention, with efforts to diversify suppliers being crucial to maintaining operational efficiency and product availability.

See what the latest analyst reports say about Clear Secure's future prospects and potential market movements.Conclusion

Clear Secure's impressive financial performance, highlighted by a notable increase in sales and net income, underscores its effective cost management and strategic market expansion efforts. The company's focus on underserved areas and commitment to innovation through new product lines positions it well for sustained growth and enhanced customer loyalty. Operational challenges and inflationary pressures persist; however, Clear Secure's strategic partnerships and inclusion in key S&P indices signal strong future earnings potential. Trading at $34.77, significantly below its estimated fair value of $79.19, suggests a promising opportunity for investors, given the company's proactive approach to managing regulatory risks and supply chain vulnerabilities.

Turning Ideas Into Actions

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion