- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (NYSE:YOU) Announces Quarterly Dividend of US$0.13 Per Share

Reviewed by Simply Wall St

Clear Secure (NYSE:YOU) recently declared a regular quarterly dividend of $0.125 per share, an announcement that coincided with a 7% rise in its share price over the past quarter. This increase may reflect positive investor sentiment around its consistent dividend payments, including a special cash dividend of $0.27 declared earlier in the year. The price move aligns with the broader market trends, which have seen general gains, possibly bolstered by Clear Secure's successful expansion efforts and strong financial results reported in February. Though the company's share buyback and changes in executive roles were notable, they likely supported broader investor confidence rather than driving price changes.

Every company has risks, and we've spotted 1 warning sign for Clear Secure you should know about.

The recent declaration of Clear Secure's quarterly dividend and the accompanying share price rise suggest a positive investor outlook, particularly in the wake of consistent dividend payments and a special dividend earlier this year. Over the past year, the company achieved a total return, including dividends, of 44.60%. This robust performance outstripped the broader US software industry's 14.5% return and the US market's 8.2% gain over the same period, highlighting Clear Secure's significant outperformance.

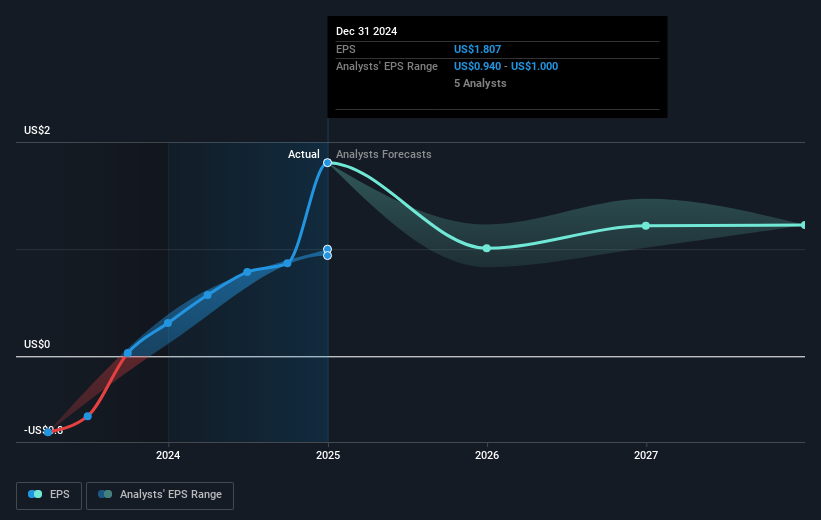

The company's recent share price movements and dividends may positively affect revenue and earnings expectations by boosting investor confidence. The increase could reflect optimism around Clear Secure's ongoing platform expansion and potential revenue gains from new initiatives. These developments might align with the analysts' expectations for earnings to decline by an average of 5% annually over the next three years, despite anticipated revenue growth. By trading at $25.31, the share price remains below the consensus analyst price target of $30.38, suggesting room for appreciation if Clear Secure can overcome challenges linked to leadership changes and pricing strategies.

Understand Clear Secure's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives