- United States

- /

- Software

- /

- NYSE:YEXT

Yext (YEXT): Exploring Current Valuation as Shares Gain Over 30% Year-to-Date

Reviewed by Kshitija Bhandaru

See our latest analysis for Yext.

Yext’s share price is up over 30% year-to-date, reflecting renewed optimism after a stretch of more muted performance. While the past month was a bit softer, longer-term total shareholder return tells a story of powerful momentum, with nearly doubling in three years even after factoring in a tough five-year run.

If you’re curious about where else positive momentum is building, why not broaden your horizons and discover fast growing stocks with high insider ownership

But with Yext’s shares vaulting higher this year, the big debate now is whether there is still value left for new investors or if the market has already fully priced in the company’s future growth potential.

Most Popular Narrative: 9.8% Undervalued

The most widely followed narrative suggests Yext’s intrinsic value sits noticeably above its latest closing price of $8.51, hinting at room for further upside. As expectations build around the company’s technology and customer base, major drivers come into focus.

Launch and strong early reception of Yext Scout, with a mix of new and existing customers and a waitlist of 2,000+, demonstrates product-market fit for new AI-driven offerings that address evolving brand discovery needs. This is likely to accelerate upsell, customer retention, and ARR growth.

Want a glimpse at what could really shift Yext’s future? The fair value rests on high-stakes margin expansion, faster earnings, and game-changing revenue moves. The most ambitious numbers are hiding just beneath the surface. Uncover the bold assumptions powering this premium price tag and find out what could truly set Yext apart from the crowd.

Result: Fair Value of $9.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market competition and uncertainty about new product adoption could quickly undermine bullish expectations if revenue growth or retention stalls.

Find out about the key risks to this Yext narrative.

Another View: Multiples Tell a Different Story

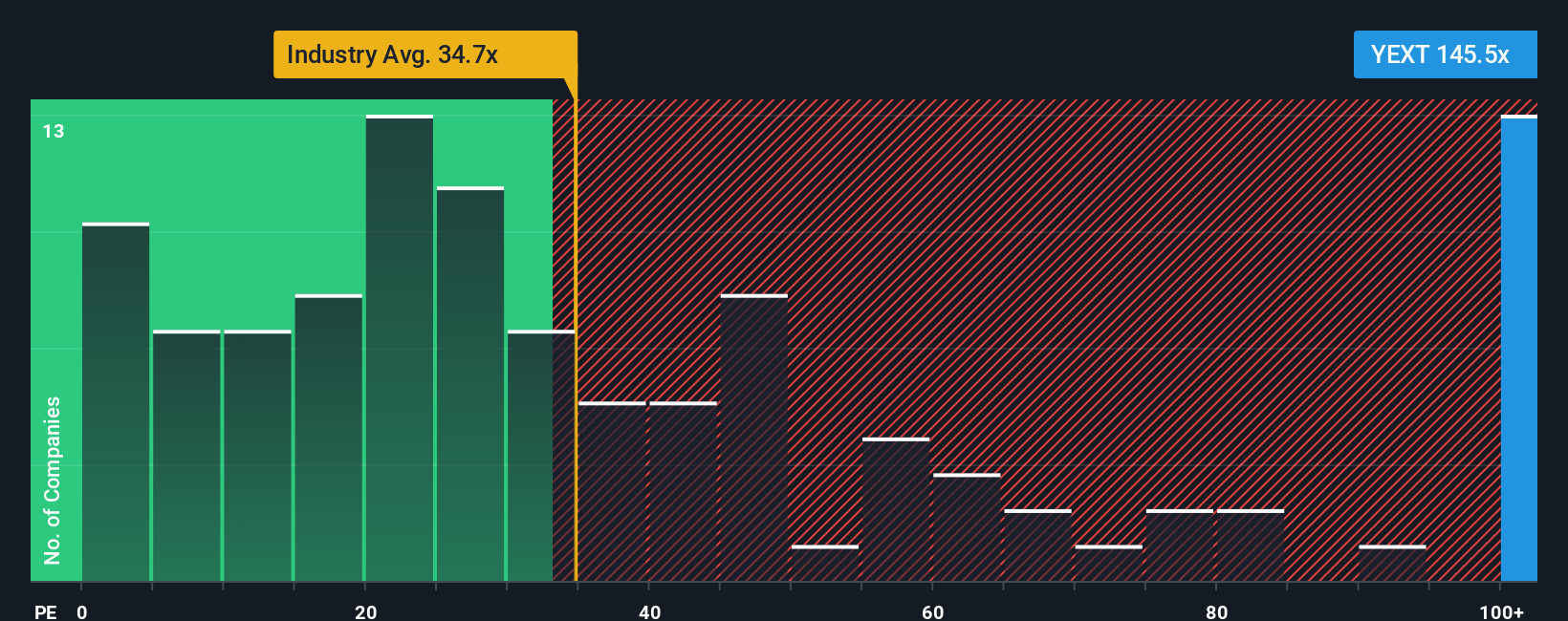

While some see Yext as undervalued, a closer look at its earnings ratio raises caution. Yext trades at 140.8 times its latest earnings, significantly higher than both the industry average of 35.6 and the peer average of 26.9. The fair ratio estimate is 41.4. This substantial gap suggests that investors expecting long-term growth are taking on notable valuation risk if those expectations are not met. Does this pricing strategy leave sufficient potential for reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yext Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

There are standout stocks in every corner of the market, and you’ll want to know where the real movers are before they hit the headlines. Instead of waiting for someone else to spot the next opportunity, get a head start on your next move with these smart screener ideas:

- Spot potential future tech leaders by checking out these 25 AI penny stocks that are shaking up industries with artificial intelligence innovation.

- Lock in steady cash flow by targeting these 18 dividend stocks with yields > 3% offering robust yields and proven track records that could help balance your portfolio.

- Boost your watchlist with these 887 undervalued stocks based on cash flows that might be trading below their worth based on their cash flows, giving you an edge others will miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)