- United States

- /

- Software

- /

- NYSE:YEXT

Yext (YEXT): Evaluating Value After a Year of Stock Gains

Reviewed by Simply Wall St

Yext (YEXT) has come across the radar of many investors lately, not because of a high-profile announcement or flashy headline, but simply due to recent movements in its share price. In a market where even small gains or losses tend to spark questions, Yext’s latest price moves could be enough to shift perceptions about where the company is headed next. Sometimes, it is these quieter pivots that catch more thoughtful investors making decisions about when or if to get involved.

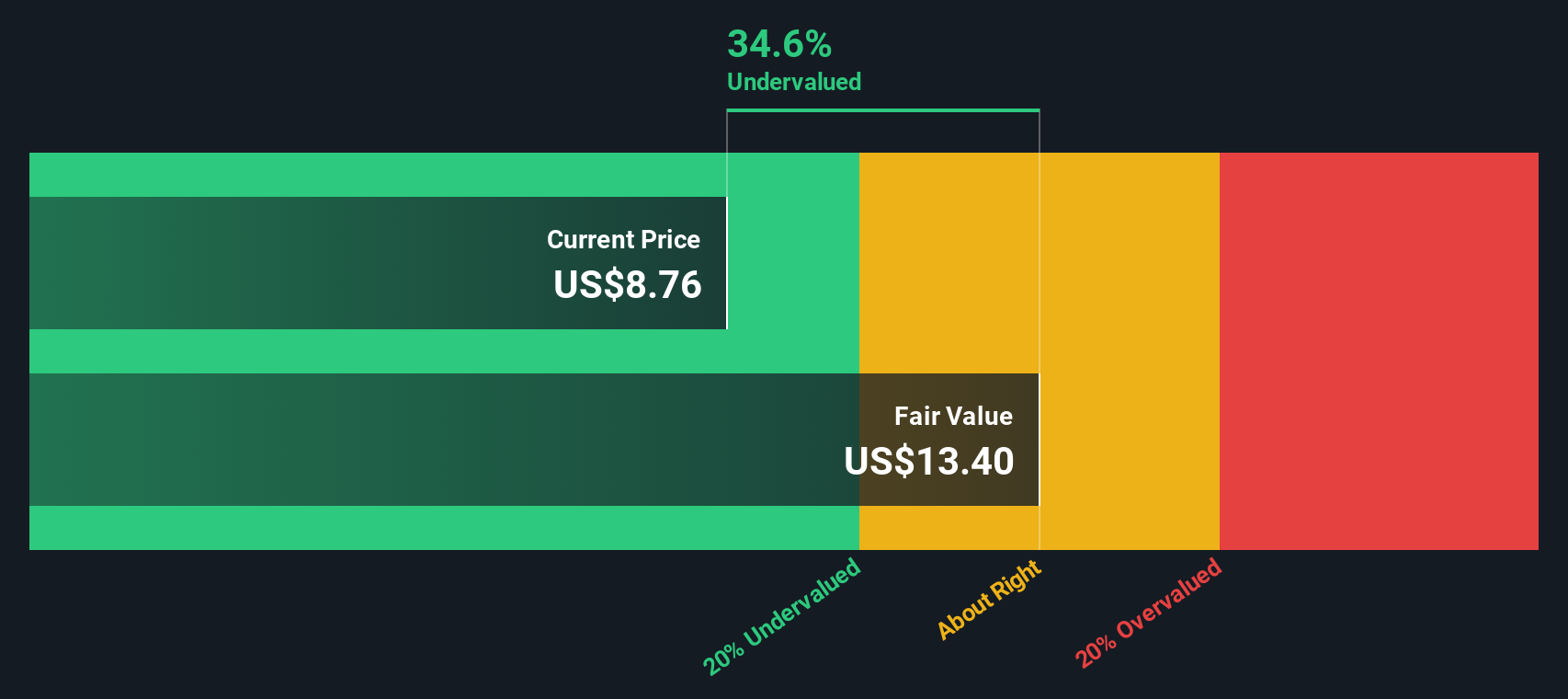

Looking at the bigger picture, Yext's stock has posted a gain of 38% over the past year, including a 12% bump this month despite some minor pullback in the past week. While longer horizons show mixed results, such as a substantial climb over three years but a drop across five, momentum over the past year has been building. The company’s annual revenue grew modestly, while net income saw a sharper improvement, hinting there is more happening beneath the surface than meets the eye.

So after a year of positive momentum, the question is clear: is Yext a buy at current levels, or has the market already priced in every ounce of future growth?

Most Popular Narrative: 6.8% Undervalued

According to the most widely followed narrative, Yext's shares are trading below fair value, reflecting optimism about future earnings and AI-fueled innovation.

“Rapid fragmentation of the consumer search market, driven by advances in AI-powered search and multi-channel engagement, is making digital visibility more complex. This trend increases demand for Yext's centralized digital presence and data management solutions, supporting higher future revenue growth.

Launch and strong early reception of Yext Scout, with a mix of new and existing customers and a waitlist of 2,000+, demonstrates product-market fit for new AI-driven offerings that address evolving brand discovery needs. This is likely to accelerate upsell, customer retention, and ARR growth.”

Want to know what’s really driving this bullish outlook? The narrative is built on a set of aggressive growth forecasts, margin expansion, and an earnings turnaround typically reserved for industry disrupters. Think Yext could actually deliver on these bold financial expectations? You’ll want to see which quantitative targets back up this fair value call.

Result: Fair Value of $9.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, market commoditization and uncertain new product impact could still disrupt Yext’s path and challenge recent bullish assumptions.

Find out about the key risks to this Yext narrative.Another View: Discounted Cash Flow Model

While analysts see fair value based on future earnings multiples, our SWS DCF model suggests Yext’s shares might be undervalued from a cash flow perspective. Does this deeper look change your opinion on the upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Yext Narrative

If you want to dig deeper or take a different approach, building your own narrative from the data takes just a few minutes. Do it your way.

A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for ordinary returns when unique opportunities await. Unlock your next investment move with screeners built to highlight companies with game-changing potential and strong fundamentals. See what you could be missing out on below.

- Pinpoint fast-growing innovators in artificial intelligence by analyzing market leaders using our AI penny stocks for a smarter tech portfolio.

- Capture untapped value in companies trading below their true worth by using this powerful undervalued stocks based on cash flows built for discerning investors.

- Supercharge your passive income strategy with hand-picked businesses offering consistent yields through the curated list of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)