- United States

- /

- Software

- /

- NYSE:YEXT

Is Yext’s (YEXT) AI Citation Study and Revenue Beat Shifting Its Digital Visibility Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Yext reported a strong quarter with revenues rising 14.1% year on year, surpassing analyst expectations, and released a comprehensive AI search study analyzing 6.8 million citations across platforms including ChatGPT, Gemini, and Perplexity.

- The company's research reveals that 86% of AI-generated citations come from sources brands already control, highlighting the pivotal role of managing structured, consistent data for digital visibility.

- We'll explore how Yext’s influential AI study could reshape its investment narrative by highlighting new value for marketers in digital presence.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Yext Investment Narrative Recap

Investing in Yext requires confidence that the rapid expansion of AI-powered search and digital presence management will increase demand for Yext's core offerings, driving sustained revenue and earnings growth even as the market faces pricing pressures and the risk of customer churn. The company’s recent AI search study reinforces Yext’s market differentiation but does not materially alter the most pressing near-term catalyst: successful upselling and renewal rates in the second half of the year. Execution risk, tied to scaling new products and monetizing recent innovation, remains the key threat.

Among recent announcements, Yext's Q2 2025 earnings showed solid revenue growth and a swing from a net loss to a net profit, highlighting improved profitability. While the strong quarter is encouraging, the ability to convert this performance into sustained ARR growth and improved retention is what investors will be watching most closely in light of ongoing macroeconomic caution and competitive threats.

On the other hand, investors should weigh the possibility that, if renewal activity or customer upsell falls short, the company’s improving momentum could give way to unexpected volatility in recurring revenue...

Read the full narrative on Yext (it's free!)

Yext's outlook anticipates $517.1 million in revenue and $62.1 million in earnings by 2028. Achieving this would require 6.0% annual revenue growth and an earnings increase of $85.5 million from current earnings of -$23.4 million.

Uncover how Yext's forecasts yield a $9.44 fair value, a 13% upside to its current price.

Exploring Other Perspectives

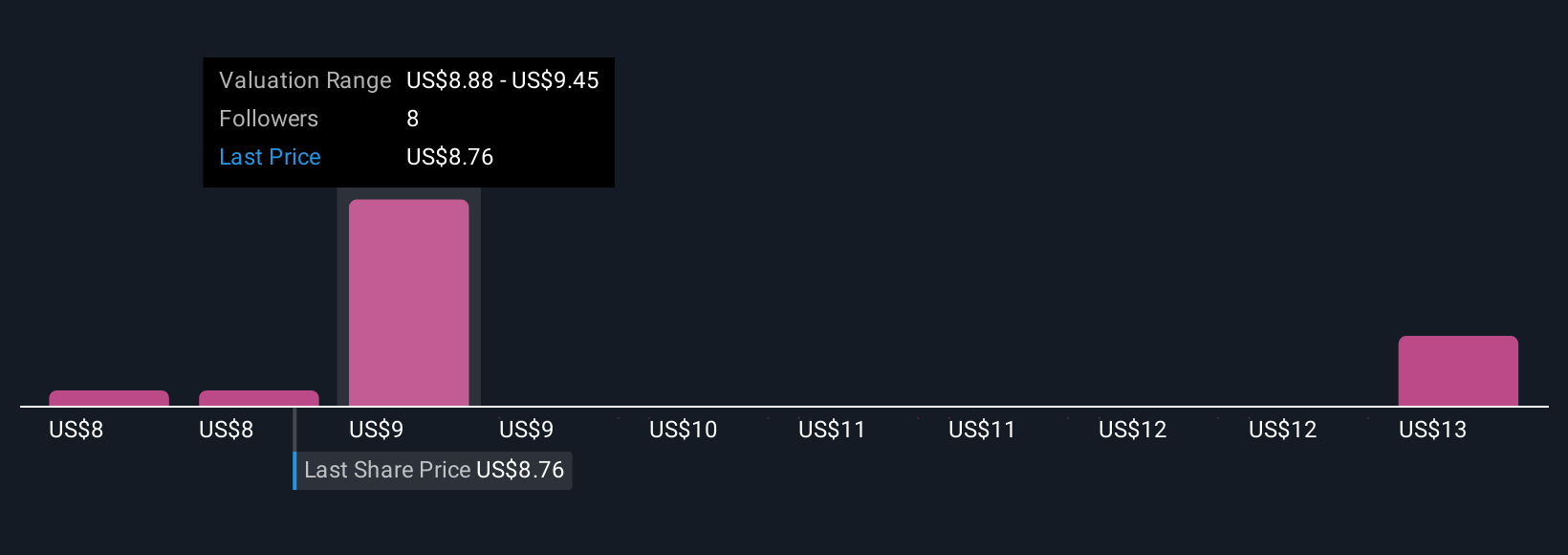

Four community estimates for Yext’s fair value range from US$7.75 to US$13.35, reflecting wide differences in growth expectations. While many see upside, the risk from intensified market competition and potential customer churn could influence future results, consider how your view aligns with these diverse perspectives.

Explore 4 other fair value estimates on Yext - why the stock might be worth 7% less than the current price!

Build Your Own Yext Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Yext research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yext's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives