- United States

- /

- Software

- /

- NYSE:WK

Swelling losses haven't held back gains for Workiva (NYSE:WK) shareholders since they're up 43% over 5 years

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. But Workiva Inc. (NYSE:WK) has fallen short of that second goal, with a share price rise of 43% over five years, which is below the market return. Zooming in, the stock is actually down 16% in the last year.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Workiva

Workiva isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Workiva saw its revenue grow at 19% per year. That's well above most pre-profit companies. While long-term shareholders have made money, the 7% per year gain over five years fall short of the market return. That's surprising given the strong revenue growth. Arguably this falls in a potential sweet spot - modest share price gains but good top line growth over the long term justifies investigation, in our book.

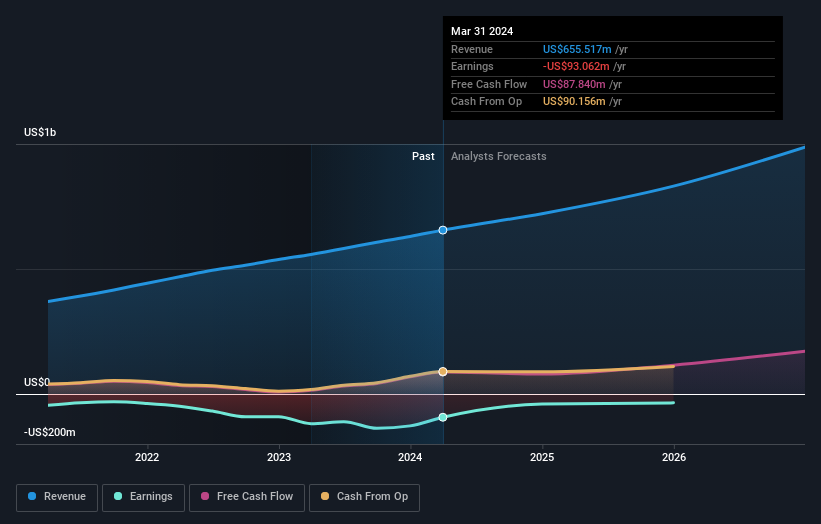

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Workiva is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Workiva stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market gained around 28% in the last year, Workiva shareholders lost 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 7%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Workiva has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

We will like Workiva better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.