- United States

- /

- Software

- /

- NYSE:WK

Shareholders have faith in loss-making Workiva (NYSE:WK) as stock climbs 4.5% in past week, taking five-year gain to 315%

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the Workiva Inc. (NYSE:WK) share price is up a whopping 315% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 15% over the last quarter.

Since the stock has added US$218m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Workiva

Workiva wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Workiva saw its revenue grow at 19% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 33%(per year) over the same period. It's never too late to start following a top notch stock like Workiva, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

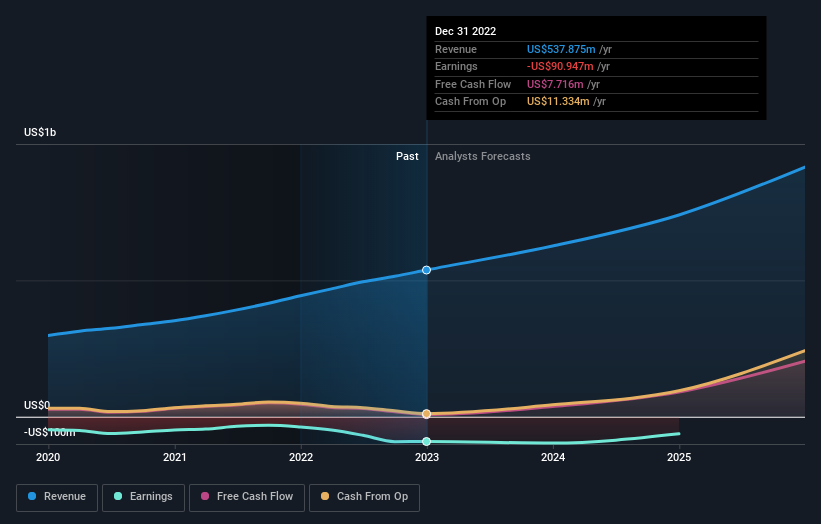

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Workiva is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Workiva stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market lost about 12% in the twelve months, Workiva shareholders did even worse, losing 13%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 33% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Workiva you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives