- United States

- /

- Consumer Services

- /

- NYSE:MH

3 Stocks That May Be Priced Below Their Estimated Worth In November 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates the aftermath of a historic government shutdown, with major indices experiencing fluctuations and tech shares leading declines, investors are keenly observing opportunities that may arise in this volatile environment. In such times, identifying stocks that are potentially undervalued can offer strategic entry points for those looking to capitalize on discrepancies between current prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ready Capital (RC) | $2.66 | $5.31 | 49.9% |

| Old National Bancorp (ONB) | $20.99 | $41.07 | 48.9% |

| Nicolet Bankshares (NIC) | $124.70 | $242.17 | 48.5% |

| Huntington Bancshares (HBAN) | $15.95 | $31.08 | 48.7% |

| First Busey (BUSE) | $23.15 | $45.34 | 48.9% |

| Fifth Third Bancorp (FITB) | $43.21 | $83.29 | 48.1% |

| Coeur Mining (CDE) | $15.63 | $30.65 | 49% |

| CNB Financial (CCNE) | $25.04 | $48.51 | 48.4% |

| Caris Life Sciences (CAI) | $24.77 | $47.82 | 48.2% |

| Byrna Technologies (BYRN) | $17.99 | $35.52 | 49.3% |

Let's uncover some gems from our specialized screener.

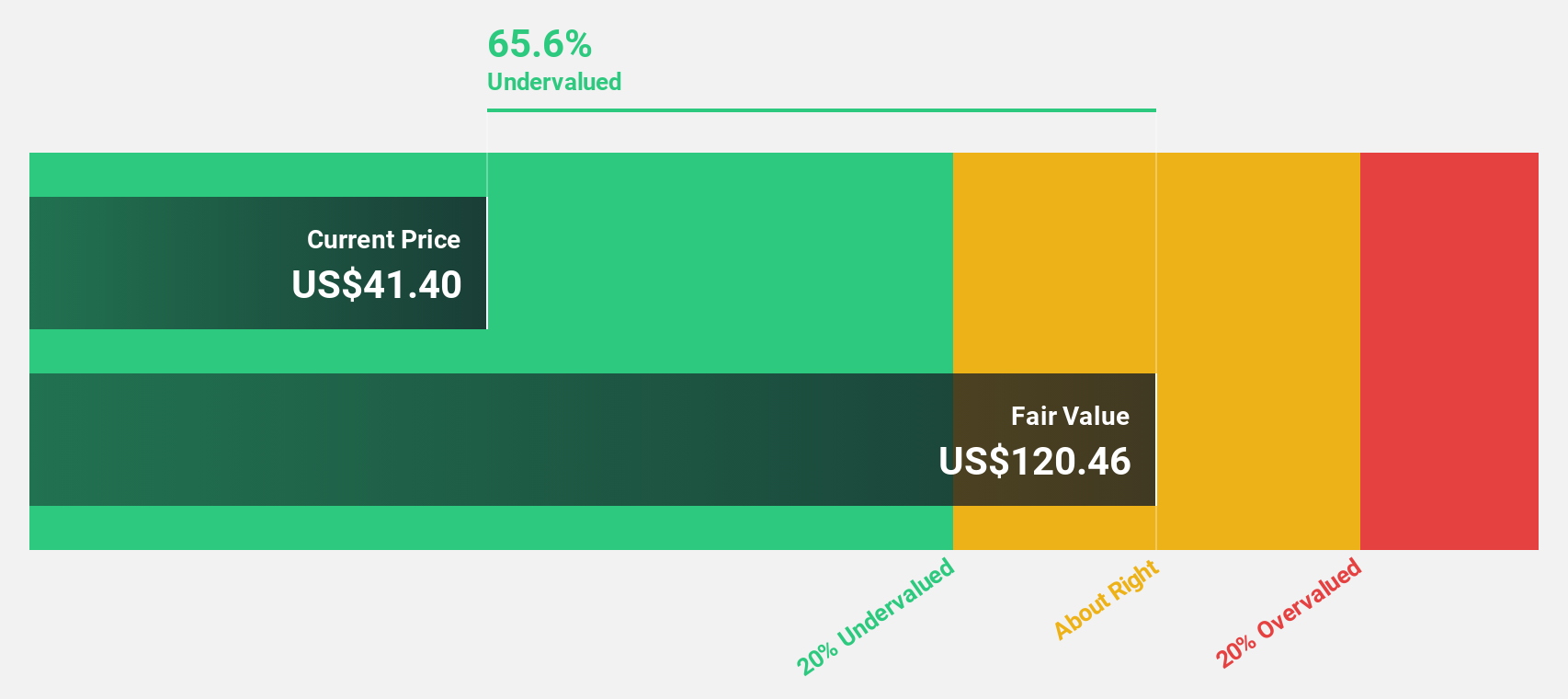

BILL Holdings (BILL)

Overview: BILL Holdings, Inc. offers a financial operations platform tailored for small and midsize businesses globally, with a market capitalization of approximately $4.66 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated approximately $1.50 billion.

Estimated Discount To Fair Value: 44.2%

BILL Holdings appears undervalued based on discounted cash flow analysis, trading at US$51.92 against an estimated fair value of US$92.98. Despite reporting a net loss in the recent quarter, earnings are forecast to grow significantly by 64.5% annually, outpacing the broader market's growth rate. The launch of BILL AI and strategic partnerships with firms like Acumatica and Oracle NetSuite enhance its offerings in accounts payable automation, potentially improving cash flow management for small to midsize businesses.

- Insights from our recent growth report point to a promising forecast for BILL Holdings' business outlook.

- Take a closer look at BILL Holdings' balance sheet health here in our report.

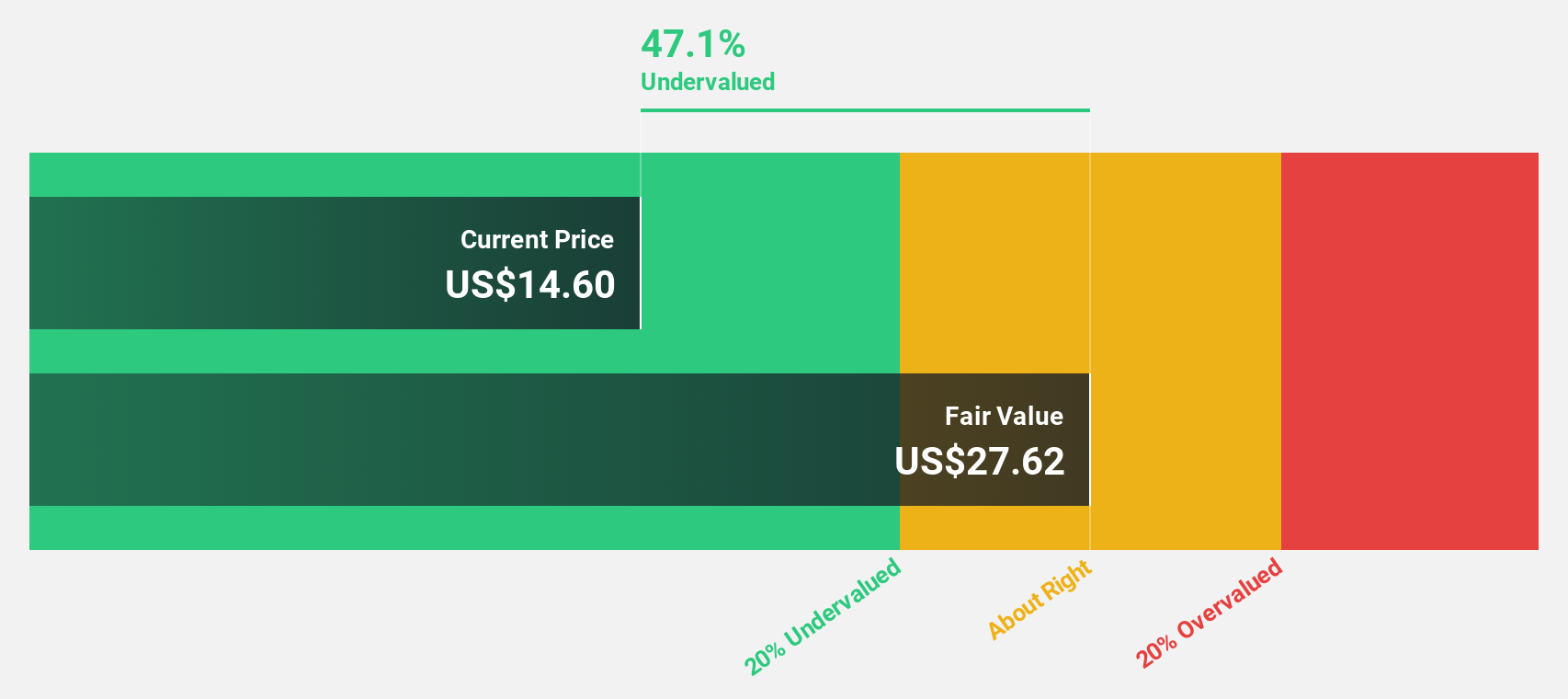

McGraw Hill (MH)

Overview: McGraw Hill, Inc. offers information solutions for K-12, higher education, and professional markets both in the United States and internationally, with a market capitalization of approximately $2.17 billion.

Operations: The company's revenue segments include $966.59 million from K-12, $805.14 million from higher education, $194.56 million from international markets, and $149.46 million from global professional services.

Estimated Discount To Fair Value: 43.3%

McGraw Hill trades at US$14.09, significantly below its estimated fair value of US$24.87, suggesting undervaluation based on cash flows. Despite revenue growth lagging the market, earnings are projected to rise 56.56% annually as profitability improves over three years. Recent strategic moves include enhanced AI capabilities in educational tools and a strengthened balance sheet with a US$150 million debt prepayment, positioning McGraw Hill for potential future growth despite current challenges in sales performance.

- The growth report we've compiled suggests that McGraw Hill's future prospects could be on the up.

- Click here to discover the nuances of McGraw Hill with our detailed financial health report.

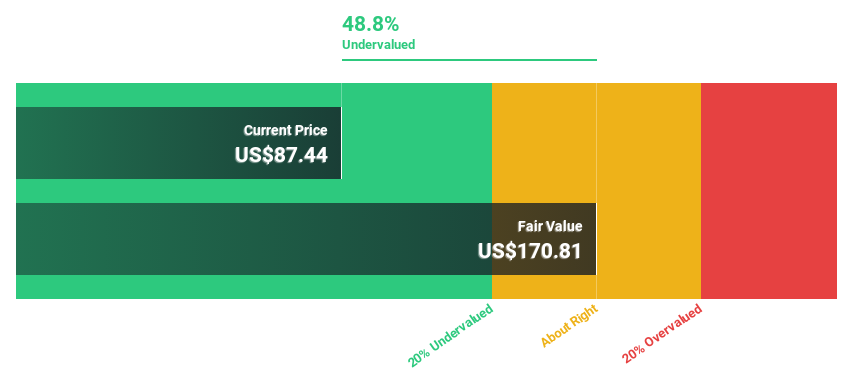

Workiva (WK)

Overview: Workiva Inc., along with its subsidiaries, offers cloud-based reporting solutions across the Americas and internationally, with a market cap of approximately $5.24 billion.

Operations: The company generates revenue from its cloud-based reporting solutions, with data processing contributing $845.52 million.

Estimated Discount To Fair Value: 35.1%

Workiva, trading at US$93.08, is significantly undervalued with an estimated fair value of US$143.50 based on cash flows. Recent earnings show a positive shift to net income from a previous loss, and revenue growth outpaces the market at 14.7% annually. The appointment of Michael Pinto as Chief Revenue Officer aims to drive further growth, while Irenic Capital's activist campaign highlights governance concerns and potential strategic changes amidst strong financial performance improvements.

- The analysis detailed in our Workiva growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Workiva.

Seize The Opportunity

- Explore the 190 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MH

McGraw Hill

McGraw Hill, Inc., doing business as McGraw Hill, provides information solutions for K-12, higher education, and professional markets in the United States and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives