- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

3 Top Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As major U.S. stock indexes recently ended lower amid ongoing earnings reports and renewed U.S.-China trade tensions, investors are keenly observing insider activities as potential indicators of confidence in growth companies. In such a volatile market environment, high insider ownership can be viewed as a positive signal, suggesting that those closest to the company's operations have faith in its future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.1% | 52.6% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

Let's explore several standout options from the results in the screener.

Bank First (BFC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bank First Corporation, with a market cap of $1.25 billion, operates as a holding company for Bank First, N.A.

Operations: The company's revenue segments are not specified in the provided text.

Insider Ownership: 10.2%

Revenue Growth Forecast: 23.6% p.a.

Bank First demonstrates strong growth potential with revenue and earnings forecasted to grow significantly above the US market average, at 23.6% and 24% annually, respectively. Recent insider activity shows more buying than selling, indicating confidence in the company's prospects. The addition of Todd A. Sprang to its Board is expected to enhance financial oversight and governance standards. Despite trading below fair value estimates, Bank First maintains a focus on transparency and risk management through strategic board appointments.

- Click here to discover the nuances of Bank First with our detailed analytical future growth report.

- The analysis detailed in our Bank First valuation report hints at an inflated share price compared to its estimated value.

Clover Health Investments (CLOV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.65 billion.

Operations: Clover Health generates revenue primarily through its Medicare Advantage insurance segment, which accounted for $1.61 billion.

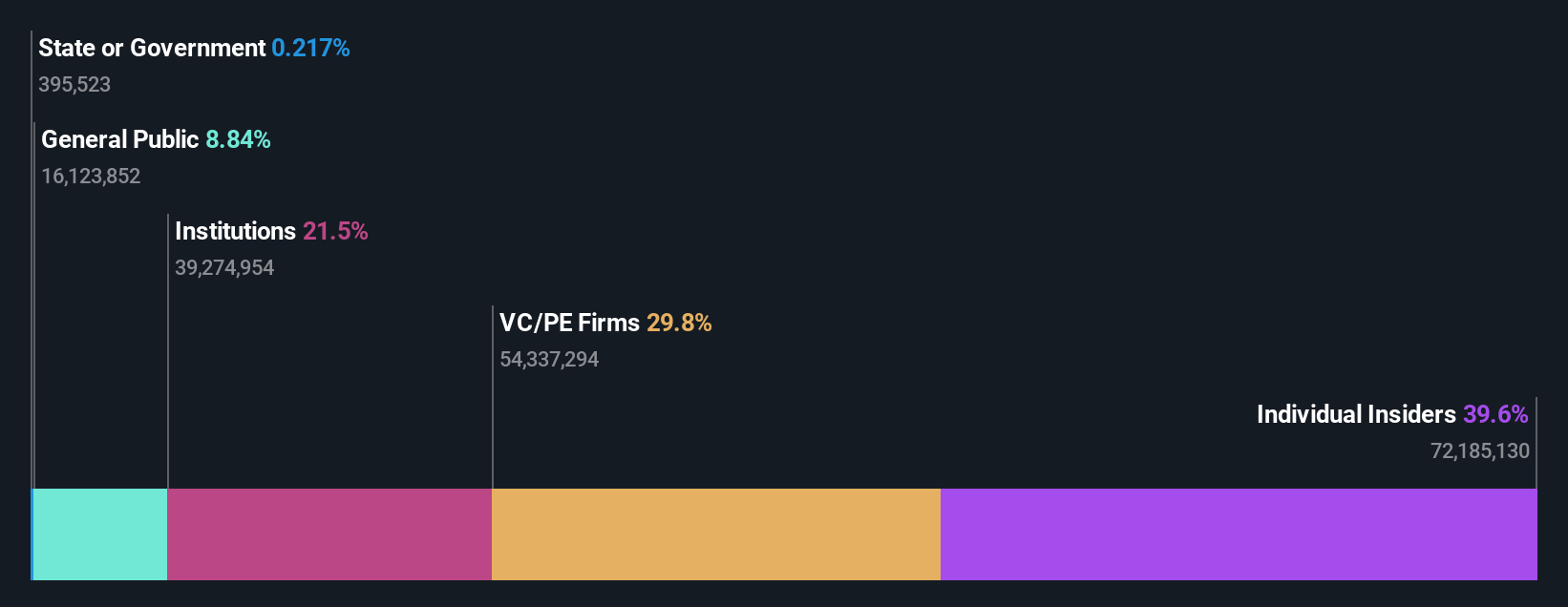

Insider Ownership: 21.6%

Revenue Growth Forecast: 16.9% p.a.

Clover Health Investments is positioned for growth with revenue expected to outpace the broader US market at 16.9% annually, while earnings are projected to rise by 62.65% per year. Recent insider activity shows more buying than selling, reflecting internal confidence. The company maintains its commitment to affordable healthcare through innovative Medicare Advantage offerings and operational enhancements via AI technology, despite recent financial losses and share price volatility.

- Get an in-depth perspective on Clover Health Investments' performance by reading our analyst estimates report here.

- Our valuation report here indicates Clover Health Investments may be undervalued.

VTEX (VTEX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $791.54 million.

Operations: VTEX generates revenue of $230.50 million from its Internet Software & Services segment, providing a digital commerce platform for enterprise brands and retailers.

Insider Ownership: 39.7%

Revenue Growth Forecast: 10.7% p.a.

VTEX is poised for significant growth, with earnings projected to increase by 38.2% annually, surpassing the US market's average. The company has recently expanded its enterprise capabilities, enhancing B2B solutions and AI-driven commerce tools. Despite a decline in net income from US$6.57 million to US$2.99 million year-over-year, its strategic initiatives aim to bolster long-term profitability. VTEX's share buyback program further underscores management's confidence in the company's future prospects and valuation stability.

- Click to explore a detailed breakdown of our findings in VTEX's earnings growth report.

- Our valuation report here indicates VTEX may be overvalued.

Where To Now?

- Investigate our full lineup of 202 Fast Growing US Companies With High Insider Ownership right here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives