Here is why Visa Inc. (NYSE:V) has Great Value on Key Fundamental Metrics

While Visa Inc. (NYSE:V) has fallen 8.5% this week, it's worth focusing on the longer term and seeing if the stock has underlying fundamentals that make it appealing for investors. We will focus on the bottom line quality, the long-term outlook, value, as well as a general comparison with peers.

The recent full-year report posted positive results, with improved earnings, revenues and profit margins:

- Revenue: US$24.1b (up 10% from FY 2020)

- Net income: US$12.3b (up 18% from FY 2020)

- Profit margin: 51% (up from 48% in FY 2020)

Over half a decade, Visa managed to grow its earnings per share at 18% a year. This EPS growth is reasonably close to the 21% average annual increase in the share price. Therefore, one could conclude that sentiment towards the shares hasn't morphed very much. Rather, the share price has approximately tracked EPS growth.

The company also has great return performance, which could be a great forward indicator for future growth. Visa's Return of Capital Employed (ROCE) is 23.5%, indicating that for every $1 of capital (debt + equity) invested in the business, Visa gains US0.23c in profit later on.

Check out our latest analysis for Visa

Competition

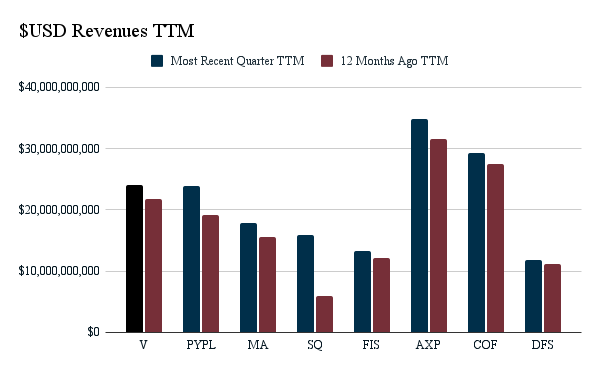

The high returns and margins give investors a sense of stability and growth for the business. As we will see in the chart below, Visa has also grown quite a bit relative to competitors.

The listed competitors in the graph above are (from left to right):

- Visa (NYSE:V), TTM revenue growth 10%

- PayPal (NASDAQ:PYPL), TTM revenue growth 24%

- Mastercard (NYSE:MA), TTM revenue growth 14%

- Square (NYSE:SQ), TTM revenue growth 170%

- Fidelity National Information Services (NASDAQ:FIS), TTM revenue growth 8.3%

- American Express (NYSE:AXP), TTM revenue growth 10.3%

- Capital One Financial (NYSE:COF), TTM revenue growth 6.5%

- Discover Financial Services (NYSE:DFS), TTM revenue growth 5.9%

The competitors are comprised of traditional and high growth financial service companies - keep in mind that the list is arbitrary and investors may consider other companies to be better representations of competitors.

We see that Visa is around the middle regarding revenues and growth, which makes it a stable and growing company. Additionally, the well-rounded position allows the company to protect and grow its market share.

Valuation

The stock seems fairly valued at the moment according to the Simply Wall St valuation model. It’s trading around 15% below intrinsic value, which means if you buy Visa today, you’d be paying a reasonable price for it.

However, if you believe that the stock is really worth $245.54, then there isn’t much room for the share price grow beyond what it’s currently trading. In addition to this, Visa has a low beta, which suggests its share price is less volatile than the wider market.

Outlook

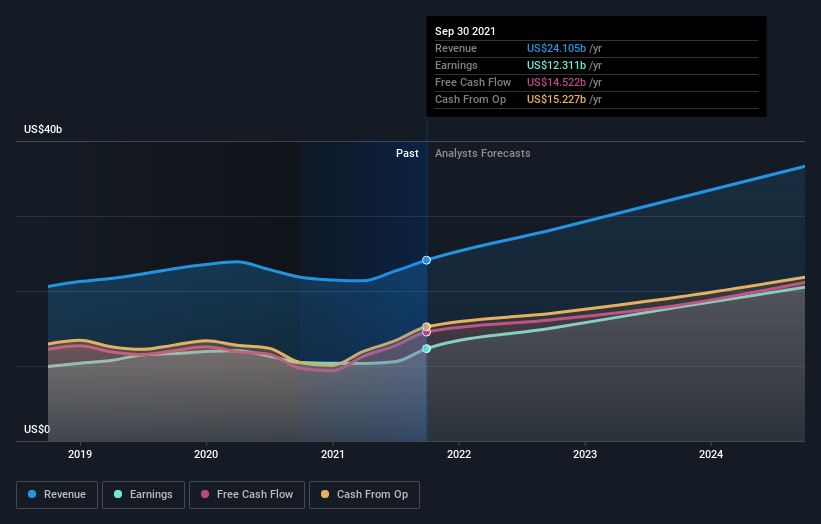

When thinking of the quality of company, the future counts much more than the short term. One way to gain some insight as to where Visa might be headed, it to aggregate the estimates of analysts following the company.

With profit expected to grow by 66% over the next couple of years, the future seems bright for Visa. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation. Revenues are also expected to grow by 13% annually.

The outlook is great, and it seems advances in FinTech will benefit the company even more in the future.

When analyzing the cash flows a bit more in detail, we can notice that in the past they have frequently been higher than net income. This means that Visa is quite effective at turning business operations into free cash flows, and the impact is captured by an accrual ratio. The accrual ratio can be a leading indicator to better future earnings growth, but is a bit counterintuitive, and a negative number is actually what we want to see.

For Visa, the accrual ratio is -0.06, which means that the company produces more cash for investors than what it reports as net income. This is a great indicator for quality financial performance!

Conclusion

As we examined multiple factors for Visa, we see that the company is a well-rounded stock, has high returns on capital, a positive outlook, produces high cash flows, is possibly undervalued, and positioned well among competitors. It seems that for the investor that is interested in the long-term, Visa is a stable and growing prospect.

If you are no longer interested in Visa, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion