- United States

- /

- Software

- /

- NYSE:U

Will Renewed Analyst Optimism and Outperform Ratings Change Unity Software's (U) Narrative?

Reviewed by Sasha Jovanovic

- In recent days, several brokerage firms have reiterated positive ratings on Unity Software, with Jefferies and BTIG highlighting continued optimism about the company’s outlook.

- This wave of upbeat analyst views, underpinned by a consensus “Outperform” stance, signals strengthening institutional confidence in Unity’s position within the technology sector.

- Building on this renewed analyst confidence, we’ll now examine how this shift in sentiment could influence Unity Software’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Unity Software Investment Narrative Recap

To own Unity, you need to believe its engine and monetization tools can translate heavy AI and platform investment into durable, diversified revenue while the company is still loss making. The recent wave of bullish analyst ratings signals stronger institutional confidence, but does not materially change the near term balance between the key catalyst of expanding non gaming use cases and the ongoing risk of high operating costs and delayed profitability.

The clearest link to this improved sentiment is Jefferies’ decision to maintain its Buy rating and lift its Unity price target to US$55.00, alongside other price target increases. This aligns with the existing catalyst around Unity’s push into new platforms such as Android XR and Nintendo Switch 2 support, where successful adoption could help justify higher valuation multiples despite current losses.

Yet while enthusiasm has risen, the risk that sustained AI and product investment keeps profitability out of reach longer than investors expect is something you should be aware of...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028.

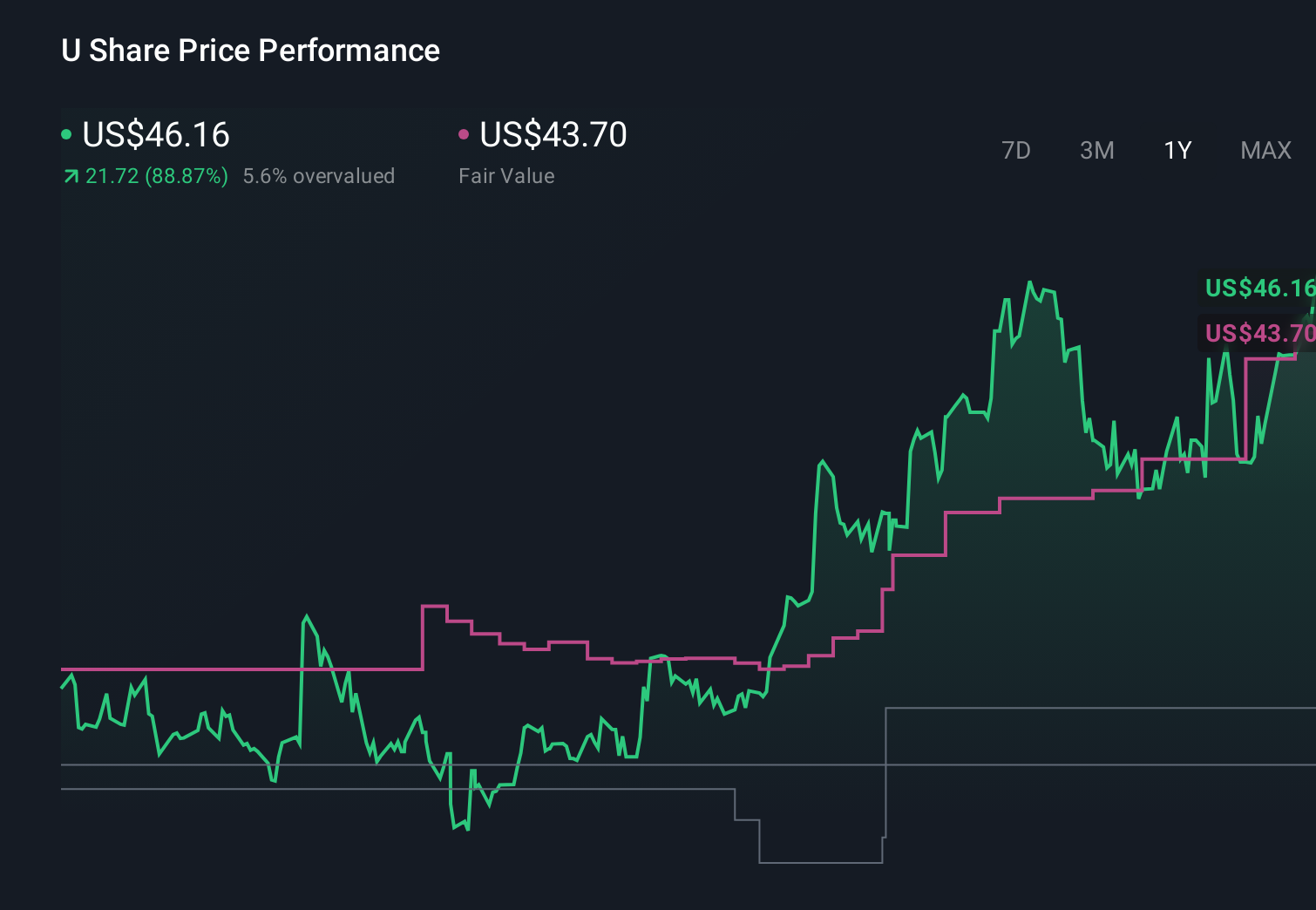

Uncover how Unity Software's forecasts yield a $45.63 fair value, in line with its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community value Unity between US$24.17 and US$56.76, highlighting very different expectations. Set against rising analyst optimism around Unity’s platform expansion, this spread underlines why it can help to compare several independent views before deciding how Unity’s execution risk fits your portfolio.

Explore 8 other fair value estimates on Unity Software - why the stock might be worth 47% less than the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale