- United States

- /

- Software

- /

- NYSE:U

Unity Software (U) Is Up 11.2% After Upward Earnings Revisions and Momentum Rating Boost – Has The Bull Case Changed?

- Recently, Unity Software received a top momentum rating and saw its earnings estimates revised upward by analysts, reflecting improved forecasts for its near-term performance.

- This strengthened outlook has encouraged increased investor confidence, pointing to a renewed focus on Unity’s operational execution and market opportunities.

- We'll explore how the boost in earnings outlook and momentum score could impact Unity Software’s evolving investment thesis.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Unity Software Investment Narrative Recap

Investors drawn to Unity Software often believe in the company’s ability to lead in real-time 3D creation and AI-powered innovation, with success resting on continued product adoption and improved margins. The recent momentum rating upgrade and higher earnings estimates could offer a short-term catalyst for sentiment, but do not fully resolve key challenges like Unity’s path to consistent profitability and long-term operating expense discipline; the impact of these positive signals, while encouraging, may prove limited unless Unity can demonstrate sustained financial improvement.

Among recent news, Unity’s new partnership with Globant stands out for its direct relevance to Unity’s push into non-gaming sectors such as automotive and healthcare. This collaboration comes as Unity seeks to make its platforms indispensable beyond gaming, an initiative closely tied to the short-term optimism reflected in the upward earnings revisions, but which also raises questions about the complexity and execution risks involved in expanding into unfamiliar territory.

Yet, despite rising optimism, investors should also consider the contrast between Unity’s positive momentum and the persistent risk that high R&D spending could...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million earnings increase from -$433.9 million today.

Uncover how Unity Software's forecasts yield a $34.75 fair value, a 21% downside to its current price.

Exploring Other Perspectives

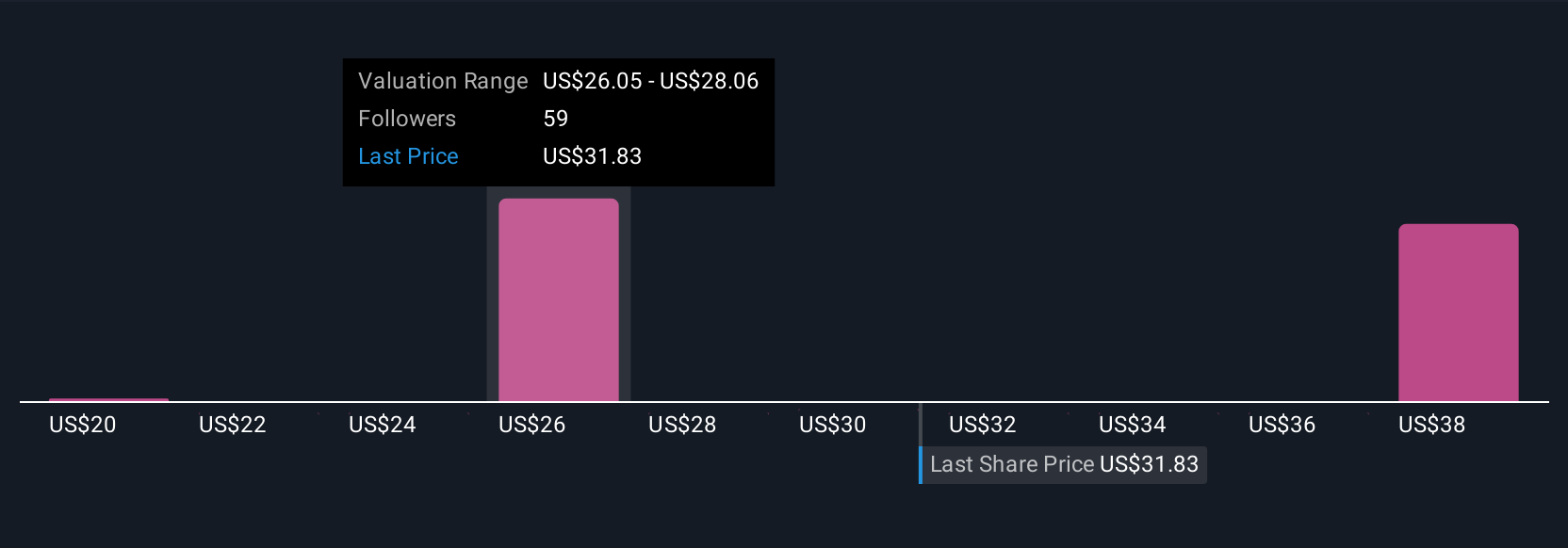

Fair value estimates from 7 members of the Simply Wall St Community span US$20.31 to US$44, underscoring sharply differing views. Against this backdrop, Unity’s focus on scaling AI-driven innovation could shape future expectations and rewards, so it is worth reviewing what drives such varied opinions.

Explore 7 other fair value estimates on Unity Software - why the stock might be worth as much as $44.00!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health - Valuation

TAV Havalimanlari Holding will soar with €2.5 billion investments fueling future growth

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.

NVDA+AEVA Agreement is a game changer for the AEVA stock even though it is just a partnership and does not have a roll out until 2028 (which means receivables as early as 2027, I would imagine) This agreement effectively moves the goal posts of profitability for AEVA much closer since this is in addition to the recent Forterra agreement, as well as the (just announced) European carmaker agreement (which is believed to be Mercedes-Benz). Underneath all of this, AEVA has a pre-existing agreement with Daimler truck. So business seems to be booming, especially with really big name brands…which tends to bring in even more brand names (and thus more agreements/contracts/announcements, etc). This dynamic often creates more coverage from analysts (often with upside stock initial coverage) that I believe will be occurring over the next 3 to 6 months (as professional traders/analysts often research for 2 to 3 months before initiating coverage of a new issue). Anyway, this all just one opinion , so please do your own due diligence. Disclaimer: I/We DO trade in this stock from time to time and I/we may (or may not have) a position currently, so again, please do your own due diligence.