- United States

- /

- Software

- /

- NYSE:U

Unity Software (NYSE:U): Evaluating Valuation After Strategic Push Into AI-Powered Advertising and Programmatic Expansion

Reviewed by Kshitija Bhandaru

Unity Software (NYSE:U) is drawing fresh attention after naming Chris Feo as Senior Vice President to lead its programmatic advertising business. This move fits squarely within Unity’s recent push to regain growth momentum and modernize its ad technology.

See our latest analysis for Unity Software.

Unity’s story has been anything but boring this year. While the latest share price stands at $35.24, down 22.67% over the past month, the company has still returned an impressive 59.4% in total shareholder return over the past year. Recent leadership changes and a renewed focus on programmatic ad tech are sparking optimism that momentum, though choppy, is starting to rebuild.

If Unity’s transformation has piqued your interest, now could be a perfect moment to broaden your search and discover See the full list for free.

With shares rebounding but recent volatility still fresh in investors' minds, they are left to wonder whether Unity’s transformation story is undervalued or if the market is already factoring in the company’s renewed growth outlook.

Most Popular Narrative: 8.4% Undervalued

According to Andreas_Eliades, the narrative assigns Unity Software a fair value of $38.48, notably above the recent close at $35.24. That gap underscores bullish confidence in Unity’s transformation efforts and its evolving business model.

Unity’s increasingly diversified revenue streams in non-gaming sectors decrease its riskiness and bolster its long-term growth potential. Significant restructuring progress with the new management addressing past missteps is evident by the rollback of the controversial runtime fee.

What is the foundation for this optimistic view? The narrative hints at ambitious growth projections and margin improvements well beyond Unity’s recent history. But which new markets or financial levers drive this upgrade? Peel back the curtain to see which assumptions powered that fair value. One factor alone might surprise most investors wondering if Unity is building for a much bigger future.

Result: Fair Value of $38.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition in advertising and gaming, along with Unity’s pace of implementing its strategy, could challenge even the most optimistic forecasts.

Find out about the key risks to this Unity Software narrative.

Another View: Multiples Raise Caution

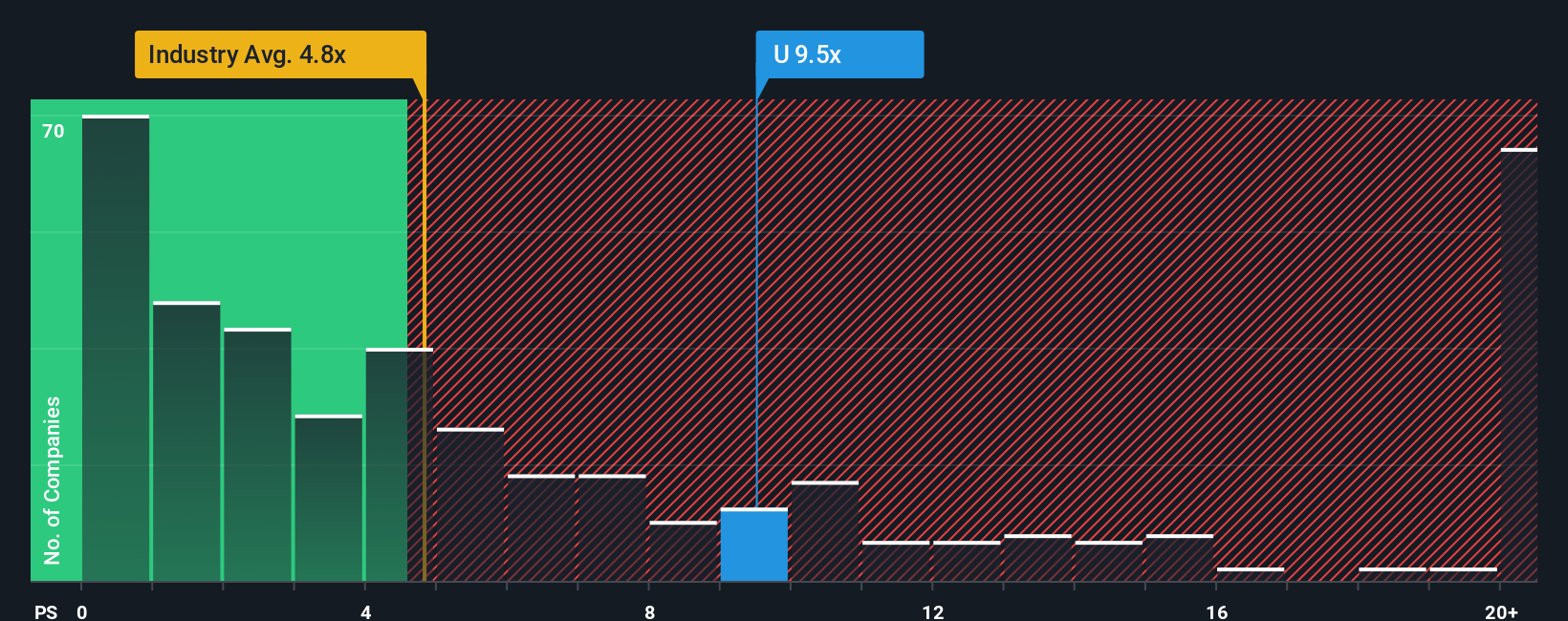

While some find Unity's share price attractively below fair value, a closer look at its price-to-sales ratio offers a reality check. Unity trades at 8.4 times sales, which is higher than the US Software industry average of 5 and a peer group average of 7.8. In fact, it is even above its own fair ratio of 7.7. This premium could signal investors are taking on additional risk in hope of a bigger turnaround. Will Unity deliver growth to justify the lofty multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unity Software Narrative

Of course, if this perspective does not match your own or you would rather dive into the numbers yourself, it takes less than three minutes to build your own view. Do it your way.

A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means looking beyond the obvious. Give your portfolio an edge by seizing fresh opportunities you may not have considered yet.

- Jump into the wave of tech disruption by targeting companies at the forefront of artificial intelligence advancements with these 24 AI penny stocks.

- Capture stable income and compounded growth when you tap into these 18 dividend stocks with yields > 3%, which offers yields above market averages.

- Stay ahead as quantum breakthroughs reshape industries and get an exclusive look at leaders in the space through these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026