- United States

- /

- Software

- /

- NYSE:U

Loss-making Unity Software (NYSE:U) sheds a further US$1.9b, taking total shareholder losses to 20% over 1 year

Over the last month the Unity Software Inc. (NYSE:U) has been much stronger than before, rebounding by 36%. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 20% in one year, under-performing the market.

If the past week is anything to go by, investor sentiment for Unity Software isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Unity Software

SWOT Analysis for Unity Software

- Debt is well covered by earnings.

- Expensive based on P/S ratio and estimated fair value.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Debt is not well covered by operating cash flow.

- Not expected to become profitable over the next 3 years.

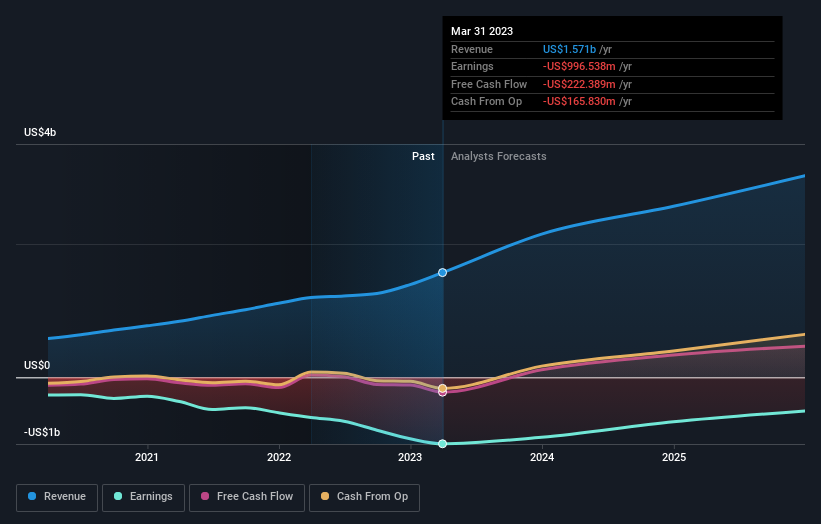

Because Unity Software made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last twelve months, Unity Software increased its revenue by 31%. We think that is pretty nice growth. Meanwhile, the share price is down 20% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Unity Software is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Unity Software stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While Unity Software shareholders are down 20% for the year, the market itself is up 10%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 33% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Unity Software you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives