- United States

- /

- Software

- /

- NYSE:U

How Will Heavy Insider Selling Shape Unity Software's (U) Investment Outlook?

Reviewed by Simply Wall St

- Over the past year, Unity Software insiders, including Co-Founder and Independent Director David Helgason, have sold a significant amount of company stock, with no insider purchases reported and Helgason alone selling US$6.8 million worth of shares.

- This level of insider selling, particularly without any offsetting purchases, can sometimes be interpreted as insiders viewing shares as fully valued or potentially foreseeing challenges ahead.

- To assess how this insider selling trend may affect Unity's investment outlook, we'll explore its implications for investor confidence and future growth expectations.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Unity Software Investment Narrative Recap

To be a shareholder in Unity Software, you need to believe in its ability to drive future revenue and earnings growth through advances in real-time 3D tools, expansion into new non-gaming verticals, and the integration of AI-driven technologies. The recent spate of insider selling, notably with no reported purchases, does little to materially change the biggest short-term catalyst, adoption of Unity’s AI-powered platforms and enterprise solutions, or the main risk, which is sustained unprofitability due to high R&D spend and execution uncertainty in new segments.

Unity’s recent partnership with Globant is especially relevant in the context of this insider selling, as it exemplifies the company’s efforts to grow its enterprise presence with initiatives in sectors like healthcare and digital twins. This move ties directly to Unity’s key catalysts but also underscores execution risks as the company manages complexity and marketplaces outside its traditional game development base.

However, despite optimism surrounding product launches, investors should be mindful that high costs and delayed profitability remain an ongoing concern as Unity diversifies...

Read the full narrative on Unity Software (it's free!)

Unity Software's narrative projects $2.3 billion revenue and $313.8 million earnings by 2028. This requires 9.3% yearly revenue growth and a $747.7 million increase in earnings from -$433.9 million.

Uncover how Unity Software's forecasts yield a $34.75 fair value, a 24% downside to its current price.

Exploring Other Perspectives

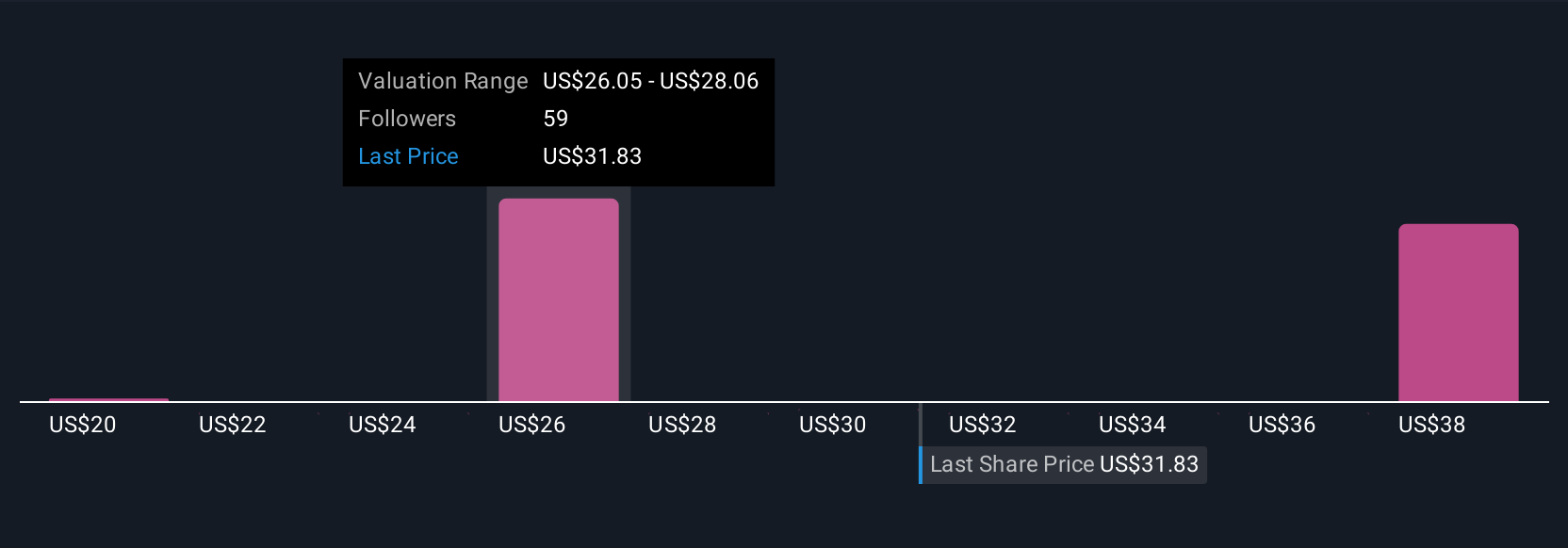

Nine Simply Wall St Community fair value estimates for Unity range from US$20.31 to US$44 per share, reflecting sharply contrasting views on potential. As some see promise in Unity’s AI and enterprise bets, others focus on high costs and uncertain profitability, giving you a spectrum of perspectives to explore.

Explore 9 other fair value estimates on Unity Software - why the stock might be worth less than half the current price!

Build Your Own Unity Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Unity Software research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Unity Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Unity Software's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:U

Unity Software

Operates a platform to create and grow games and interactive experiences for mobile phones, PCs, consoles, and extended reality devices in the United States, China, Hong Kong, Taiwan, Europe, the Middle East, Africa, the Asia Pacific, Canada, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion