- United States

- /

- Software

- /

- NYSE:TYL

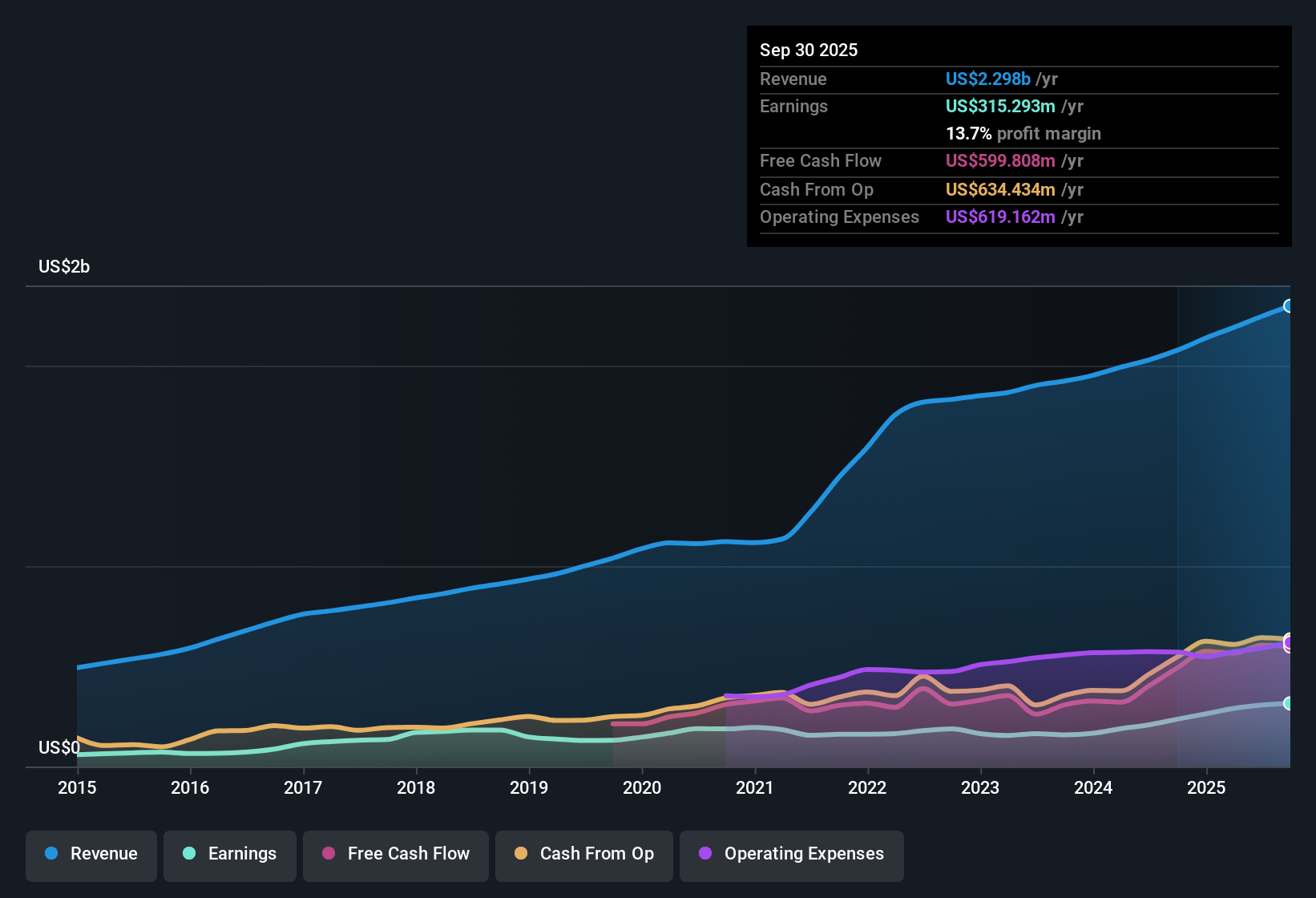

Tyler Technologies (TYL): Profit Margins Rise to 13.7%, Supporting Bullish Growth Narrative

Reviewed by Simply Wall St

Tyler Technologies (TYL) reported net profit margins of 13.7%, up from 11.4% a year ago, reflecting notable improvement in profitability. Over the past five years, annual earnings have grown by 11.9%, with the most recent year posting a standout 33.2% increase in earnings. The company now forecasts earnings growth of 14.5% per year, with revenue expected to expand at 8.6% annually. Both figures lag the broader US market’s outlook. With profitability on the rise and no flagged risk factors, investors are watching its premium valuation closely in light of consistent growth and a sustained track record of rewards.

See our full analysis for Tyler Technologies.Next, we’ll put the latest numbers side by side with the most widely discussed stories on Tyler Technologies to see which market narratives stand up to scrutiny.

See what the community is saying about Tyler Technologies

Cloud Solutions Fueling Recurring Revenue Momentum

- Analysts expect “cloud flips,” or migrations to Tyler’s cloud-based software, to increase by 25% each year. This is cited as a key driver behind ongoing double-digit gains in recurring revenue and higher average contract values.

- According to the analysts' consensus view, rapid digital transformation and new cybersecurity regulations are pushing state and local governments to modernize. This is bolstering demand for Tyler’s secure cloud offerings and reinforcing its market leadership.

- Regulatory tailwinds such as new NERIS emergency standards are encouraging agencies to adopt secure, compliant solutions. This is translating into wider SaaS adoption.

- This surge in demand supports the consensus expectation of sustained double-digit revenue growth and expanding profit margins from 13.7% to 16.3% within three years.

- Strong demand for cloud-based, secure, and integrated solutions is driving recurring revenue, market leadership, and higher contract values amid digital transformation and regulatory tailwinds. 📊 Read the full Tyler Technologies Consensus Narrative.

Premium Valuation Versus Industry Averages

- Tyler’s current price-to-earnings ratio is 65.6 times, which is far higher than the software industry average of 34.8 times and its own peer group at 57.1 times. The $478.08 share price sits above DCF fair value of $461.10, representing a notable premium.

- The consensus narrative notes that this premium is justified only if growth persists at current double-digit rates and margins expand as projected. However,

- Analysts calculate that by 2028, to reach the price target of 664.06, Tyler would need to trade at a PE ratio of 79.3 times, which is substantially above industry norms.

- This creates tension for value-focused investors, as the company would need to deliver on both revenue growth (from $2.9 billion) and expanding profit margins to sustain such a valuation.

Government Spending Remains a Double-Edged Sword

- The business remains highly exposed to changes in government spending at state and local levels, with unpredictable deal cycles and large bookings contributing to potential revenue volatility.

- The consensus narrative acknowledges that while recurring SaaS and transaction revenues provide stability, bears highlight risks from possible declines in professional services and maintenance fees, as well as new competition targeting governments’ preference for open architecture.

- Bears argue that if transaction revenue growth slows or new competitors win contracts from major governments, Tyler’s anticipated margin expansion and top-line growth could face pressure.

- Integration risks from acquisitions like Emergency Networking and evolving compliance standards further amplify these challenges for management and investors alike.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tyler Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest figures? Share your perspective in just a few minutes and bring your own narrative to life. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tyler Technologies.

Explore Alternatives

Despite robust revenue growth, Tyler Technologies' high valuation leaves little room for error if profit margins or earnings growth fall short of ambitious targets.

Want confidence your investments are trading at fair prices? Shift your focus with our these 848 undervalued stocks based on cash flows to discover companies that offer more attractive value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Provides integrated software and technology management solutions for the public sector.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)