- United States

- /

- Software

- /

- NYSE:TYL

Tyler Technologies (NYSE:TYL) Announces Leadership Transition With Retirement and Expanded Roles

Reviewed by Simply Wall St

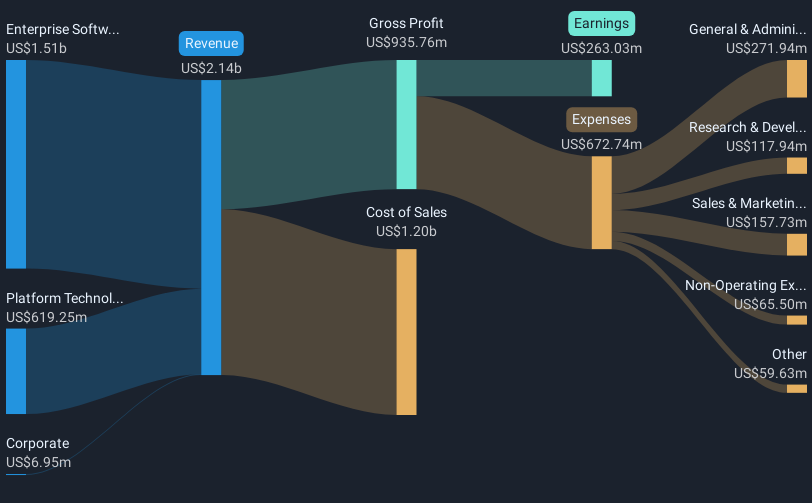

In recent developments, Tyler Technologies (NYSE:TYL) announced the retirement of Bret Dixon and the expanded role of Rusty Smith, highlighting a realignment in executive leadership. Over the past month, the company's share price increased by 1.5%. The market context during this time was mixed, with U.S. stock indices showing variability; the Dow rose amid tariff discussions while the Nasdaq and the S&P 500 faced downward pressure from tech sector volatility. Despite these mixed signals, TYL's positive earnings release on February 12, reporting a significant increase in both quarterly and annual income, likely provided a supportive backdrop for its share performance. Additionally, the signing of a client agreement with the Iowa Department of Public Safety might have strengthened investor confidence. Overall, TYL's recent earnings and strategic client wins appear to have contributed to its resilience against broader market fluctuations, which saw an overall 3.6% decline.

Navigate through the intricacies of Tyler Technologies with our comprehensive report here.

Over the last five years, Tyler Technologies’ total shareholder return has been a substantial 83.16%. This remarkable growth can be attributed to various strategic initiatives and financial performances. The company's regular earnings announcements, such as its Q4 2024 results, highlighted significant increases in revenue and net income, underscoring strong operational performance. Additionally, the company's expanding contract wins, like the agreement with the Iowa Department of Public Safety, have reinforced its growth footprint in public sector technology. These elements combine to reflect the company’s resilience and capacity to outperform broader market dynamics.

Despite being considered expensive based on its high Price-To-Earnings Ratio relative to the industry average, Tyler Technologies' aggressive earnings growth year over year has surpassed both industry and market averages. The company's return over the past year exceeded the US software industry and the overall US market, underscoring its strong positioning in the sector. With continuous corporate developments, including executive appointments, Tyler Technologies has maintained investor confidence and solidified its market stance.

- See whether Tyler Technologies' current market price aligns with its intrinsic value in our detailed report

- Discover the key vulnerabilities in Tyler Technologies' business with our detailed risk assessment.

- Already own Tyler Technologies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyler Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TYL

Tyler Technologies

Engages in the provision of integrated software and technology management solutions for the public sector.

Solid track record with excellent balance sheet.