- United States

- /

- IT

- /

- NYSE:TWLO

Twilio (TWLO): Reassessing Valuation as Slower Billings Growth and Thin Margins Test the Turnaround Narrative

Reviewed by Simply Wall St

Twilio (TWLO) is back in focus after management headed to the UBS Global Technology and AI Conference, just as investors are digesting slower billings growth and persistently thinner margins than many software peers.

See our latest analysis for Twilio.

Despite management doing the rounds at events like the UBS Global Technology and AI Conference, the share price has quietly rebuilt some momentum, with a roughly mid teens year to date share price return and a far stronger three year total shareholder return, even as the five year total shareholder return remains deeply negative.

If Twilio has you rethinking where growth and risk are headed in software, this is a good moment to explore high growth tech and AI stocks that might fit your strategy even better.

With revenue growth slowing, margins still trailing higher quality software peers, and the stock trading only modestly below analyst targets, is this a misunderstood turnaround story or has the market already priced in Twilio’s next chapter?

Most Popular Narrative: 6.1% Undervalued

Based on the most widely followed narrative, Twilio's fair value of $138.04 sits modestly above the last close at $129.65, implying a measured upside path rather than a deep value dislocation.

The analysts have a consensus price target of $130.885 for Twilio based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $75.0.

Want to see what kind of earnings ramp and margin reset could justify that future valuation multiple? The narrative leans on ambitious profit scaling and a rich future pricing of those earnings. Curious how those assumptions stack up against a more mature software peer set, and what kind of growth runway they quietly build in?

Result: Fair Value of $138.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative hinges on Twilio easing margin pressure from low-margin messaging and avoiding AI-driven disintermediation by larger cloud and in-house platforms.

Find out about the key risks to this Twilio narrative.

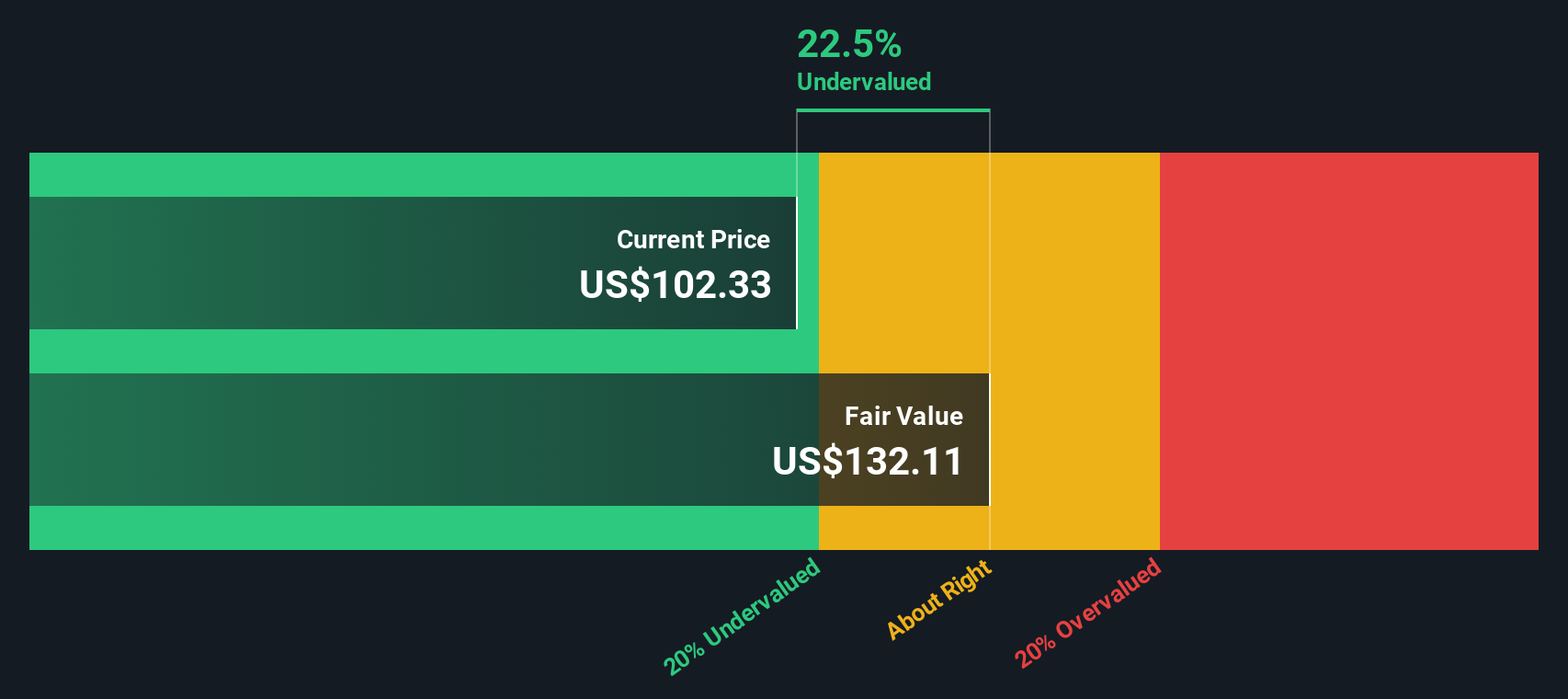

Another Take on Value

Our SWS DCF model points the other way, with a fair value of $119.56 versus the current $129.65, suggesting Twilio might be slightly overvalued rather than a clear bargain. If growth or margins wobble from here, how much patience will the market really have?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Twilio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Twilio Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a fresh view in minutes: Do it your way.

A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing move?

Do not stop at one stock. Use the Simply Wall St Screener to quickly uncover fresh ideas that match your goals before the market catches on.

- Capture potential multi baggers early by scanning these 3589 penny stocks with strong financials that pair tiny market caps with real balance sheet strength and improving fundamentals.

- Ride the next wave of intelligent automation by targeting these 27 AI penny stocks positioned at the heart of machine learning, data infrastructure, and software driven productivity.

- Lock in compelling entry points by focusing on these 903 undervalued stocks based on cash flows where current prices lag intrinsic value estimates based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026