- United States

- /

- IT

- /

- NYSE:TWLO

Except for Insider Selling, 3 Other Factors are Worrying about Twilio (NYSE: TWLO).

Although it beat the earnings, Twilio Inc. (NYSE: TWLO) likely didn't meet the guidance expectations as the stock dipped. Over the last 2 years, they beat the expectations every time, presumably, all the positivity has already been accounted for.

Dips on earning surprises have not been uncommon for the stock, although not to this tune, as the stock lost over 13% in after-hours trading.

Check out our latest analysis for Twilio

Earnings Results

- Non-GAAP EPS: US$0.01 (beat by US$0.15)

- GAAP EPS: - US$1.26 (beat by US$0.07)

- Revenue: US$740.2m (beat by US$56.1M)

Although the company beat expectations, it is worth mentioning that the dollar-based net expansion rate reduced from 137% to 131%. This metric measures active customers' increase in usage of the product.

Furthermore, although the revenue guidance is higher at US$760-770m vs. US$750.7m consensus, the company is cautious about a more considerable non-GAAP loss, with – US$0.23-0.26 expectations vs. consensus of -US$0.08.

This is concerning because it can mean higher costs eating into the revenue and reducing the earnings per share.

The Last 12 Months Of Insider Transactions At Twilio

In the last twelve months, the biggest single sale by an insider was when the Chief Operating Officer, George Hu, sold US$3.3m worth of shares at US$436 per share. While we don't usually like to see insider selling, it's more concerning if the sales occur at a lower price. It's of some comfort that this sale was conducted at a price well above the current share price, which is US$346. So it is hard to draw any firm conclusion from it.

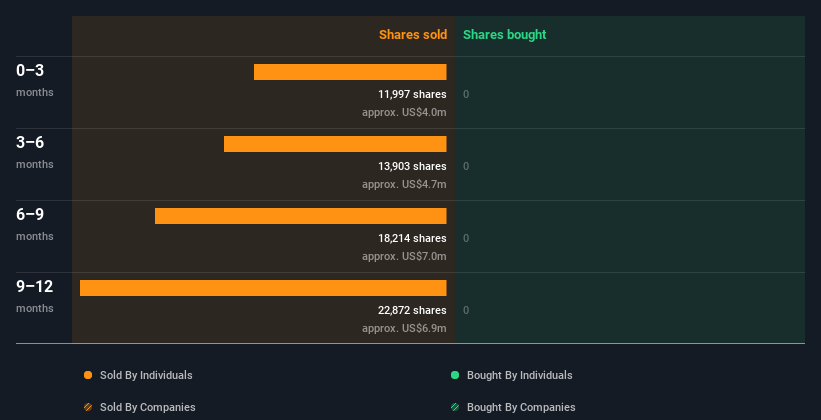

Twilio insiders didn't buy any shares over the last year. You can see a visual depiction of insider transactions (companies and individuals) over the last 12 months below. If you want to know precisely who sold, for how much, and when, click on the graph below!

Additionally, you will not want to miss this free list of growing companies that insiders are buying.

Twilio Insiders Are Selling The Stock

Over the last three months, we've seen significant insider selling at Twilio. Specifically, insiders ditched US$4.2m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this, it's hard to argue that all the insiders think that the shares are a bargain.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see pretty high levels of insider ownership. Twilio insiders own 4.5% of the company, currently worth about US$2.8b based on the recent share price. I like to see this level of insider ownership because it increases the chances that management is thinking about the best interests of shareholders.

Insider Selling and 3 Other Reasons

Insiders sold stock recently, but they haven't been buying. Looking at the last twelve months, our data doesn't show any insider buying. It is good to see high insider ownership, but insider selling leaves us cautious.

Furthermore, with a market cap of over US$60b, while remaining unprofitable, there is a lot of reasonable expectations baked into the company,

In particular, there are 3 reasons why we are reserved about the stock.

- Declining gross margins: Margins are falling and relatively low for a software company.

- Rising costs: From research & development, through selling and general expenses, costs are eating into the gross margin

- Risk of dilution: Share count has grown significantly over the last years, increasing 19.5% in the past year alone. If unprofitability persists, shareholders will likely be diluted again.

While it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to understand the risks that a particular company is facing. For instance, we've identified 4 warning signs for Twilio (1 shouldn't be ignored) you should be aware of.

But note: Twilio may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if Twilio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:TWLO

Twilio

Offers customer engagement platform solutions in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives