- United States

- /

- Software

- /

- NYSE:TUYA

Tuya (NYSE:TUYA) Valuation in Focus After Q2 Earnings Jump and Special Dividend Announcement

Reviewed by Simply Wall St

If you’re looking at Tuya (NYSE:TUYA) right now and wondering whether it’s time to make a move, you’re definitely not alone. The company just reported its second quarter results, with both sales and profits jumping compared to last year. On top of that, Tuya announced a special cash dividend, which is usually a sign that management feels good about where the business stands and wants to share some of that confidence with investors.

This upbeat news follows a year where Tuya’s share price has gained 92%, and momentum has accelerated in recent months. The strong earnings and special dividend appear to have reassured markets about Tuya’s financial footing, highlighting a story that’s been building since early this year. These announcements add to the sense that management is focusing on growth, efficiency, and a forward-looking AI strategy.

So with shares putting in a strong showing recently, is Tuya now trading at a bargain, or is all that growth already reflected in the price?

Most Popular Narrative: 22% Undervalued

According to the most widely followed narrative, Tuya is currently undervalued by 22% based on forecasted earnings and profit margin expansion over the next few years.

Accelerating integration of AI capabilities in nearly all shipped product categories along with robust developer engagement signal Tuya's ability to capitalize on the shift toward autonomous, intelligent IoT devices. This likely supports higher revenue growth, increased platform stickiness, and margin expansion as AI solutions become core to customer offerings.

Ready to uncover what’s really fueling this bullish view? The narrative hinges on ambitious forecasts for revenue growth and higher margins, all backed by bold future multiples. Want to understand the secret sauce behind that double-digit fair value gap? Take a closer look at the numbers and see what makes Tuya’s story stand apart from the crowd.

Result: Fair Value of $3.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent global trade uncertainties and growing competition could quickly change the outlook. This may make Tuya's path to sustained growth far less certain.

Find out about the key risks to this Tuya narrative.Another View: Multiples Tell a Different Story

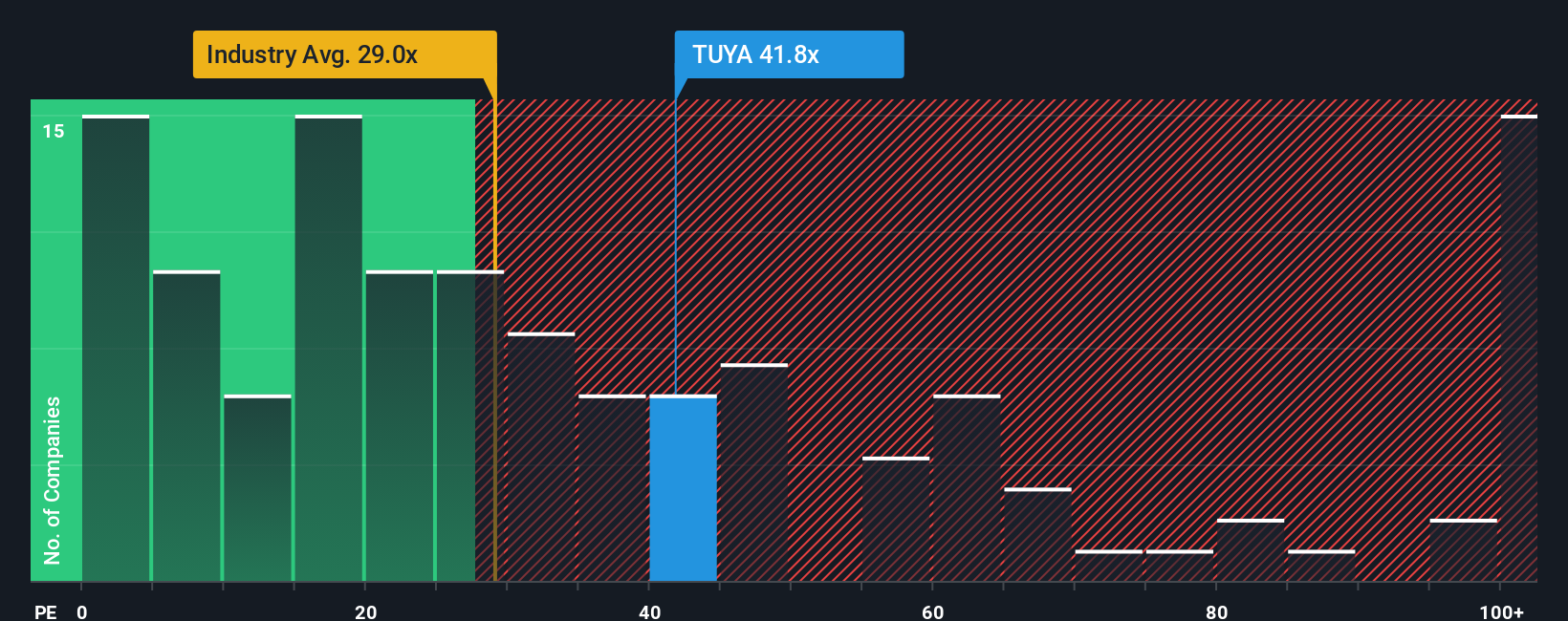

Looking at things from a different angle, the market’s favoured pricing ratio makes Tuya look pricier than most of its industry. This raises the question: is the growth outlook enough to justify paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Tuya to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Tuya Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build your own narrative from scratch in just a few minutes, and Do it your way.

A great starting point for your Tuya research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by tapping into high-potential opportunities across different themes and sectors. Give yourself an advantage with these unique investment angles. Each one is tailored to help you act before the crowd.

- Ignite your portfolio with emerging companies showing robust financial strength by jumping into the world of penny stocks with strong financials.

- Ride the unstoppable wave of AI innovation and access a selection of trailblazing technology leaders through AI penny stocks.

- Grow your passive income with stocks offering reliable yields above 3%, all waiting for you via dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)