- United States

- /

- Healthtech

- /

- NasdaqGM:LFMD

High Insider Ownership Growth Stocks To Watch In May 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of slight declines ahead of Nvidia's earnings report, investors are closely watching major indices like the Dow Jones and S&P 500, which have shown resilience despite recent volatility linked to trade policy shifts. In this environment, growth companies with high insider ownership can offer unique insights into potential long-term value, as insiders' stakes often signal confidence in their business models and future prospects amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 22.7% | 24% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.2% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.4% | 67.1% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.2% | 44.4% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 102.6% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.2% |

Here's a peek at a few of the choices from the screener.

LifeMD (NasdaqGM:LFMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LifeMD, Inc. is a direct-to-patient telehealth company that facilitates connections between consumers and healthcare professionals for medical care in the United States, with a market cap of $524.01 million.

Operations: The company's revenue is derived from its Telehealth segment, which generated $180.05 million, and its Worksimpli segment, which contributed $53.95 million.

Insider Ownership: 15.3%

LifeMD's growth trajectory is bolstered by its high insider ownership and strategic partnerships, such as the collaboration with Novo Nordisk to offer Wegovy at competitive prices. The company's revenue grew significantly to US$65.7 million in Q1 2025, marking a turnaround from previous losses with a net income of US$1.38 million. Despite volatile share prices and negative equity concerns, LifeMD's expected profitability within three years and innovative telehealth offerings position it well in the expanding weight management market.

- Unlock comprehensive insights into our analysis of LifeMD stock in this growth report.

- According our valuation report, there's an indication that LifeMD's share price might be on the cheaper side.

Frontier Group Holdings (NasdaqGS:ULCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market cap of approximately $835.90 million.

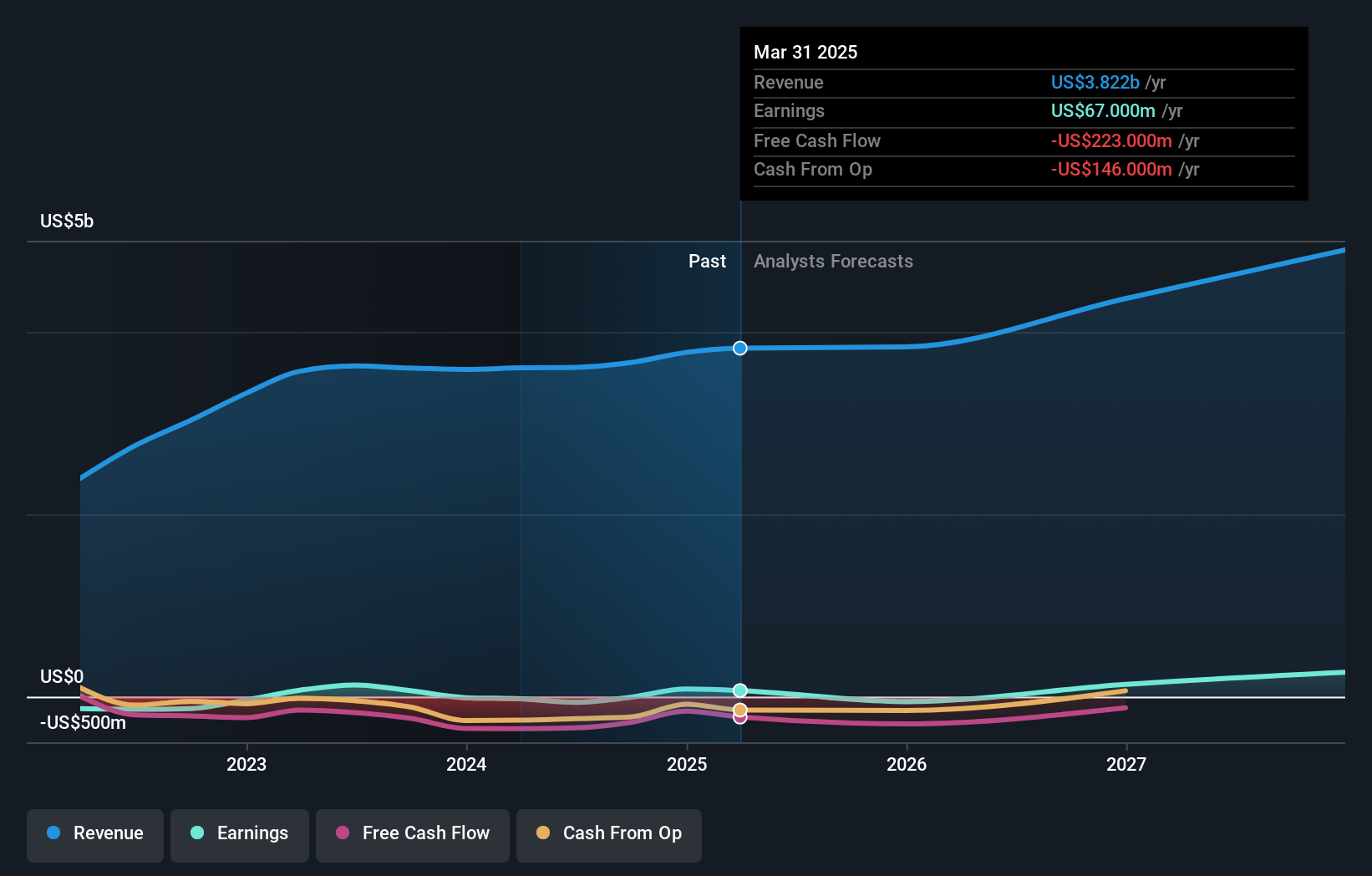

Operations: The company generates revenue of $3.82 billion from providing air transportation services for passengers.

Insider Ownership: 33.5%

Frontier Group Holdings' growth potential is highlighted by its forecasted earnings increase of 61.7% annually, outpacing the US market's average. However, recent insider activity shows significant selling over the past three months, raising concerns about confidence in future performance. Despite a volatile share price and a first-quarter net loss of US$43 million, Frontier's revenue is expected to grow at 9.3% per year, slightly above the market average but below high-growth benchmarks.

- Dive into the specifics of Frontier Group Holdings here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Frontier Group Holdings is priced higher than what may be justified by its financials.

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. operates in the Internet of Things (IoT) sector, providing related products and services both in China and internationally, with a market cap of approximately $1.45 billion.

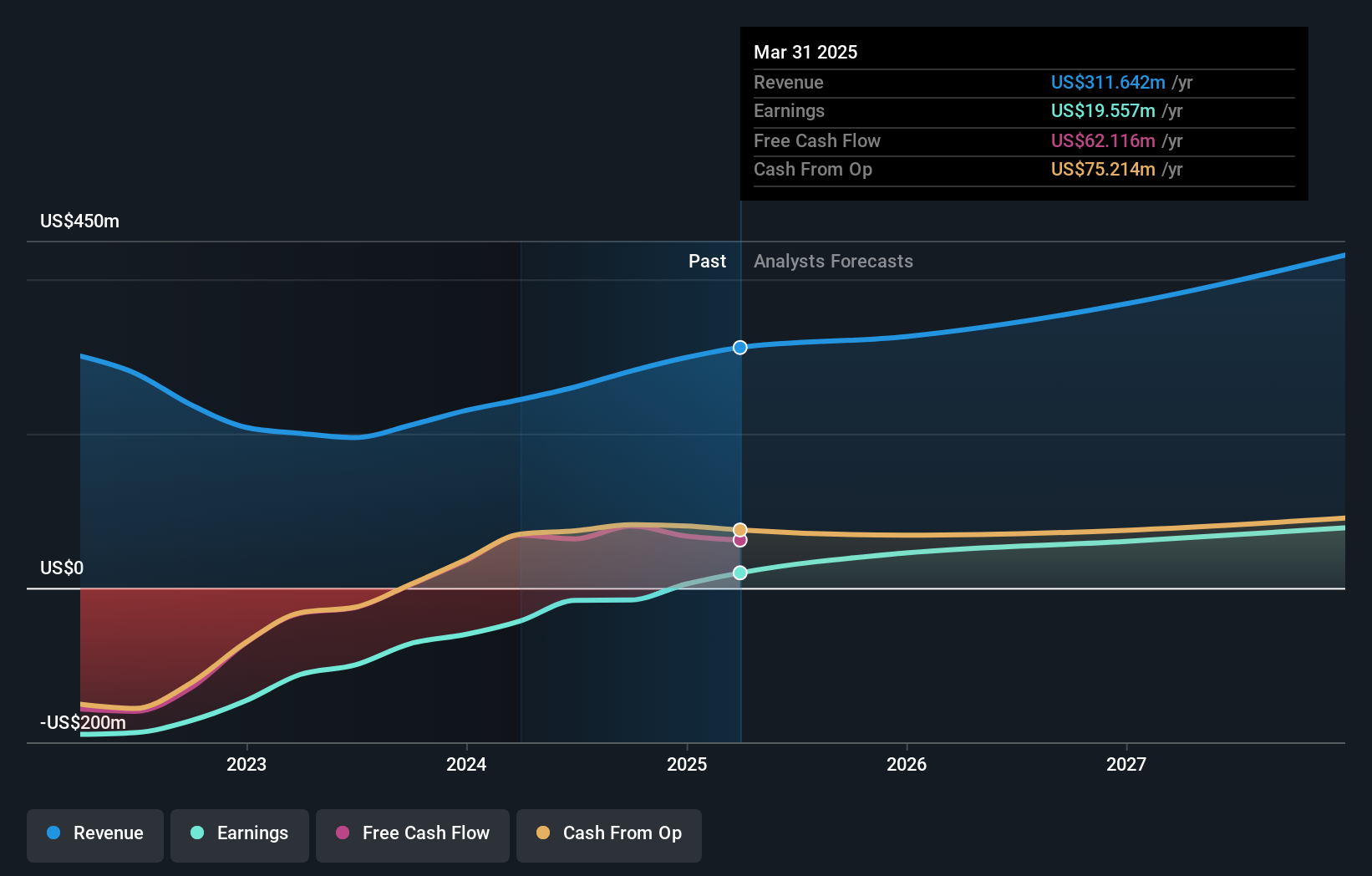

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, amounting to $311.64 million.

Insider Ownership: 29.7%

Tuya's recent earnings report highlights its transition to profitability, with a net income of US$11.02 million for Q1 2025, contrasting with a loss the previous year. The company's insider ownership aligns with its strategic initiatives in AIoT and smart energy management, showcased at the 2025 Global Developer Summit. Despite volatile share prices, Tuya's earnings are projected to grow significantly faster than the market average, although revenue growth is expected to be moderate at 15% annually.

- Get an in-depth perspective on Tuya's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Tuya implies its share price may be too high.

Make It Happen

- Access the full spectrum of 192 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LFMD

LifeMD

Operates as a direct-to-patient telehealth company that connects consumers to healthcare professionals for medical care in the United States.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives