- United States

- /

- Entertainment

- /

- NYSE:TKO

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 4.0%, but it remains up by 24% over the past year with earnings expected to grow by 15% annually in the coming years. In this dynamic environment, identifying high growth tech stocks involves looking at companies with strong innovation potential and robust financial health that can capitalize on anticipated earnings growth.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.95% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Grindr (NYSE:GRND)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grindr Inc. operates a social networking and dating application catering to the LGBTQ communities globally, with a market capitalization of approximately $2.97 billion.

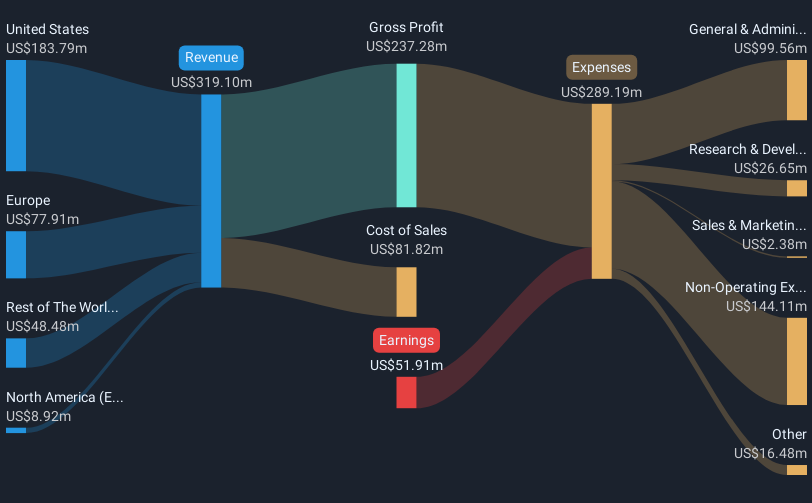

Operations: The company's primary revenue stream is derived from its internet information provider services, generating approximately $319.10 million. The business focuses on offering a social networking and dating platform specifically for LGBTQ communities worldwide.

Grindr's recent financial performance underscores its resilience and potential in the high-growth tech sector. In Q3 2024, the company reported a significant revenue increase to $89.33 million from $70.26 million year-over-year, with net income swinging to $24.68 million from a loss of $0.437 million, reflecting robust operational improvements and market acceptance. Additionally, Grindr has raised its full-year revenue guidance by 29%, signaling confidence in sustained growth amidst competitive pressures in the interactive media and services industry where it has outpaced average US market growth forecasts of 9.1% with an 18.9% increase expected annually. Recent strategic moves including a new Chief Accounting Officer appointment and a shelf registration filing for $42.25 million suggest Grindr is gearing up for further expansion or investment opportunities which could enhance shareholder value over time despite current unprofitability issues and insider selling concerns noted over the past quarter; these elements combined point towards an intriguing phase of transition aiming at profitability within three years as forecasted by analysts expecting annual earnings growth of 56%.

- Click here and access our complete health analysis report to understand the dynamics of Grindr.

Gain insights into Grindr's historical performance by reviewing our past performance report.

TKO Group Holdings (NYSE:TKO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TKO Group Holdings, Inc. is a sports and entertainment company with a market capitalization of $25.15 billion.

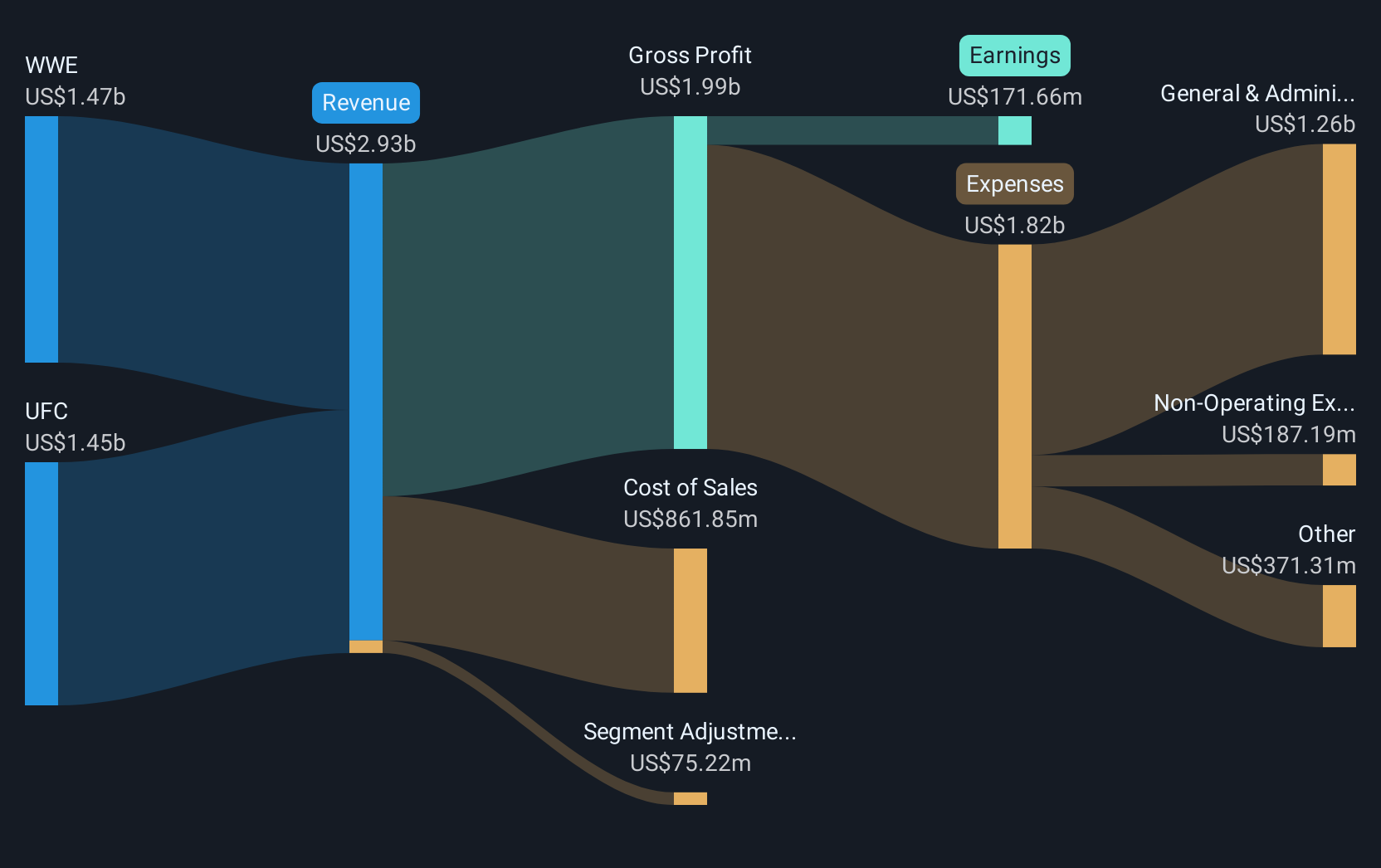

Operations: TKO Group Holdings generates revenue primarily from its UFC and WWE segments, with UFC contributing $1.35 billion and WWE generating $1.43 billion.

TKO Group Holdings has demonstrated a notable trajectory in the tech sector, with a recent uptick in revenue to $681.27 million for Q3 2024, marking a significant rise from the previous year. This growth is underpinned by an aggressive R&D strategy, where expenses have been meticulously managed to fuel innovations that keep TKO at the forefront of market dynamics. The firm's commitment to research has not only propelled its product offerings but also strategically positioned it for upcoming industry shifts. Moreover, TKO's recent shelf registration and enhanced full-year revenue guidance suggest an optimistic outlook, reinforcing its potential amidst evolving tech landscapes.

- Delve into the full analysis health report here for a deeper understanding of TKO Group Holdings.

Gain insights into TKO Group Holdings' past trends and performance with our Past report.

Tuya (NYSE:TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tuya Inc. provides a specialized Internet of Things (IoT) cloud development platform both in China and globally, with a market cap of $1.02 billion.

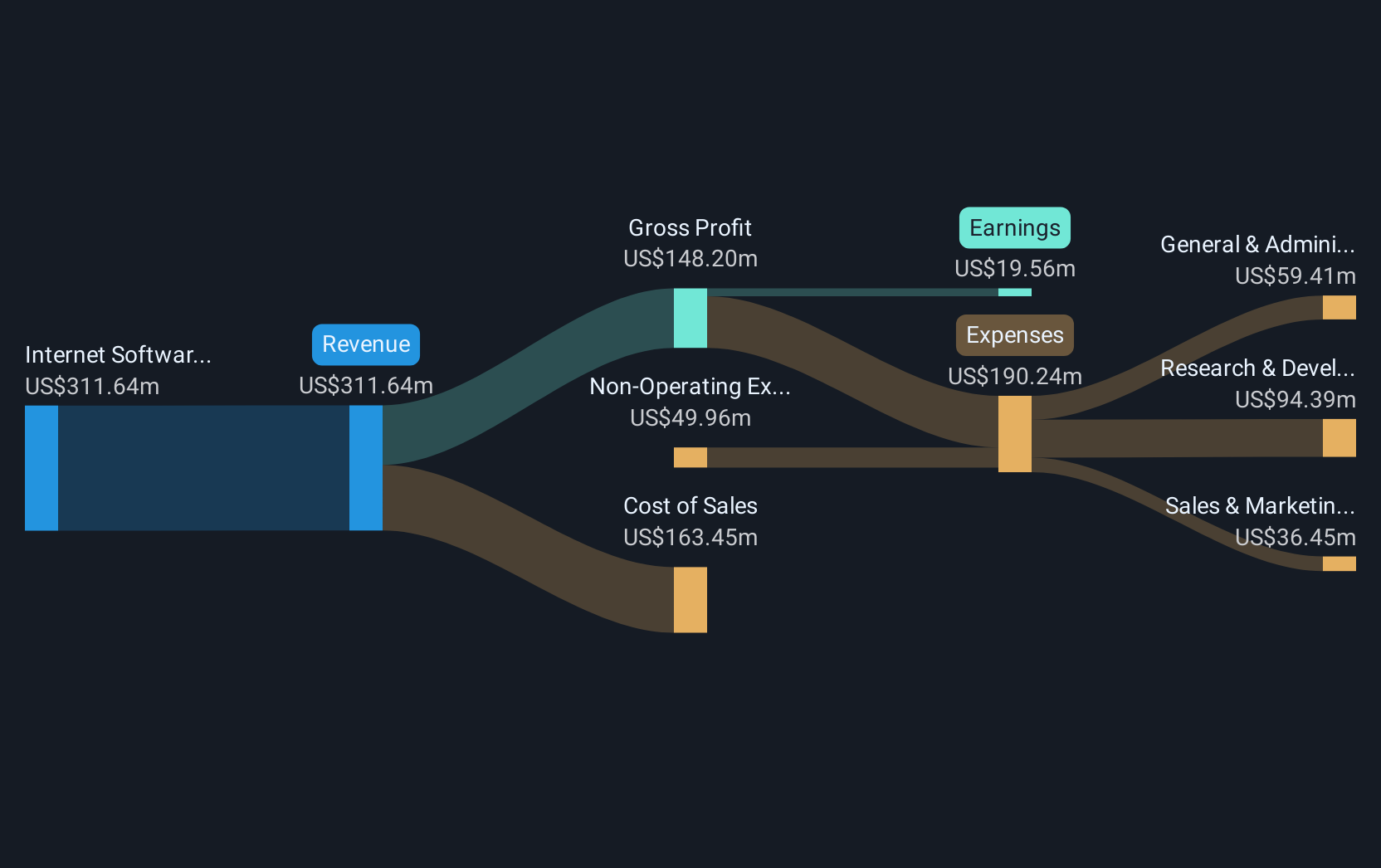

Operations: Tuya Inc. generates revenue primarily through its Internet Software & Services segment, amounting to $280.97 million. The company operates within the IoT sector, offering a cloud development platform that supports various applications and services internationally.

Tuya's recent expansion of its European headquarters aligns with its strategic focus on the burgeoning smart technology market, reflecting a robust commitment to international growth and innovation. This move, coupled with a significant 33% increase in quarterly sales to $81.62 million, underscores Tuya's adaptability and forward-thinking approach in the competitive tech landscape. Despite facing challenges with a net loss reduction to $4.37 million from $4.91 million year-over-year, Tuya's ongoing investments in R&D and strategic partnerships, like those with leading European brands and MLG for smart city projects in the Middle East, position it as an active participant shaping global smart technology trends. These efforts are pivotal as Tuya navigates through fluctuating market conditions while fostering sustainable growth avenues across diverse geographies.

Taking Advantage

- Get an in-depth perspective on all 235 US High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with adequate balance sheet.